By: Jose Torres, Interactive Brokers’ Senior Economist

With investors still assessing the impact of inflation’s U.S. resurgence, new data shows that price increases are also rebounding in France and Spain. U.S. home price data released today, however, show that the sector is far from recovering, especially as we navigate this new “higher for longer” regime. Home prices have declined for six consecutive months with no relief in sight. Amidst the sea of discouraging news, U.S. consumer confidence data released this morning was ice cold, favorable for fighting inflation, but at a significant implied cost—declining consumer spending which represents approximately 70% of the country’s GDP. As the U.S. Federal Reserve’s monetary tightening continues to raise fears that the country is likely to slip into a recession, Canada’s recent GDP release of 0%, shows the Great White North may be heading for an economic freeze.

U.S. home price data released today, however, show that the sector is far from recovering, especially as we navigate this new “higher for longer” regime. Home prices have declined for six consecutive months with no relief in sight.

Markets are looking to enter the new month directionless for the most part. The S&P 500 index is virtually unchanged, with gains from tech offsetting some weakness in the industrials. The Nasdaq is up 0.2% while the Dow is down 0.3%. Yields bounced notably earlier this morning in response to hot Euro inflation data but cool U.S. consumer confidence subdued yields back to unchanged levels. Adding to the snooze fest is the dollar index, skipping from gains to losses and then settling at an unchanged level. Crude oil is moving strongly this morning, however, as incoming economic data from China is expected to show a strong economic recovery. Chinese momentum offset concerns of a U.S. economic slowdown, as traders drove prices 2.4% higher to $77.50 per barrel.

Recent data include the following:

- Last week ended on a sobering note with both the headline Personal Expenditures Price Index (PCE) and the Core PCE climbing 0.6% month over month, implying that the U.S. inflation is creeping upward. The U.S. isn’t alone in maintaining this dubious distinction. In France, inflation climbed 7.2% year over year (y/y) as of February due to higher food and services costs and exceeding analysts’ expected 7% rate. Analysts also expected disinflation in Spain, but inflation there advanced 6%. The higher-than-anticipated price increases within the euro zone countries imply that the European Central Bank won’t back off its planned 50 basis points (BPS) hike in March and that policy makers are likely to remain hawkish in the coming months.

- U.S. PCE data isn’t the only troubling inflation indicator. After two consecutive months of declines in durable goods orders, the Commerce Department reported yesterday that core capital goods orders in January increased 5.3% y/y, dramatically exceeding the Reuters analyst consensus expectation of 0.1%. It was the biggest increase in five months. Shipments of manufactured goods also increased. Durable goods orders are a strong indication of business sentiment, in part because the orders can take months to fulfill. Additionally, financing is used for purchasing durable goods, so the stronger-than-anticipated data implies that interest rates may not be high enough to stifle demand.

- Even though businesses are anticipating growing demand for durable goods, consumers appear ready to tighten their spending, with today’s Conference Board Consumer Confidence Index dropping from 106 in January to 102.9 in February while analysts expected the number to climb to 108.5, according to the Refinitiv consensus estimate. In the U.S., consumer spending represents approximately 70% of GDP so while weakening sentiment among consumers implies that overall demand weakness may help tame inflation, it also implies that the economy is heading for a possible contraction.

- In Canada, consumers haven’t buckled under the strain of higher interest rates, but the country’s fourth quarter GDP was still flat. For the quarter, household income increased at a 2% annualized rate, disposable income climbed 12.4% and the household savings rate increased from 5% to 6%. Business investment, however, declined by an annualized rate of 5.5% and excess inventories weighed on growth. January appears stronger, with GDP estimated to have grown 0.3% due to increased oil and gas extraction and wholesale trade.

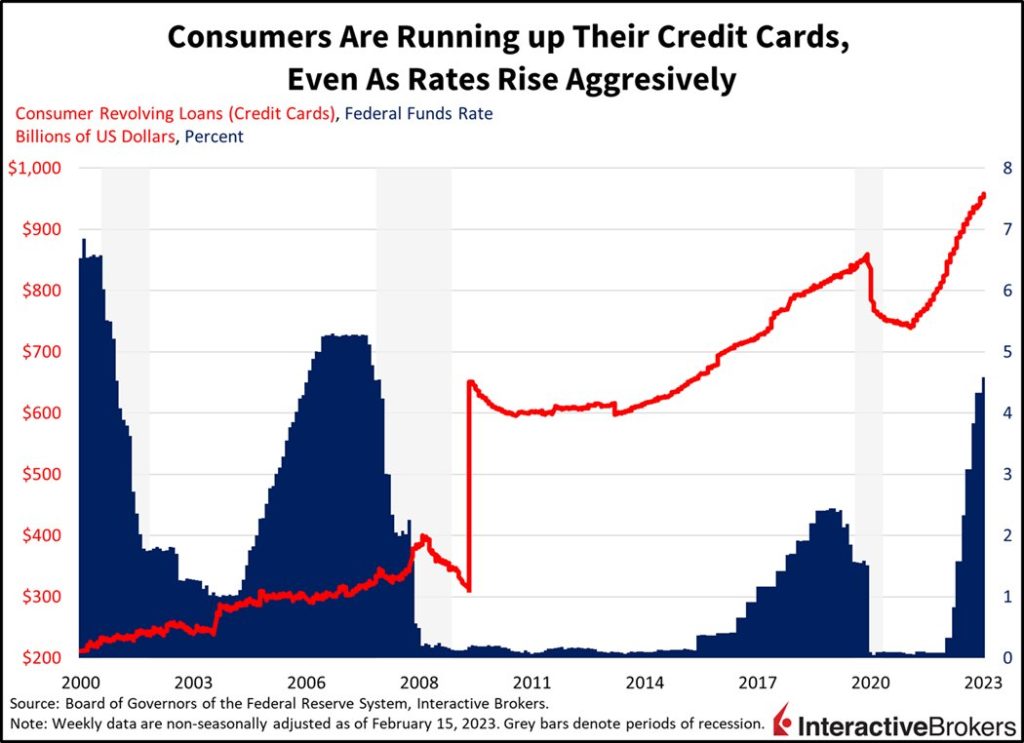

With growing fears about a resurgence in inflation, investors face a challenging start to March. Upcoming job market data on Friday, March 10th and results for the next Consumer Price Index are like to be too strong for the Fed and market sentiment may hinge, in part, on the potential for tight labor conditions to fuel wage pressures and the ability of consumers to continue spending as they burn through COVID-19 stimulus payments and increasingly use credit cards to finance their expenditures. How consumers manage their rising variable rate debt burdens, the delayed effect of Fed rate hikes, the impact of future rate increases and persistent inflationary pressures will determine the path of economic performance and asset valuations in 2023.

Visit Traders’ Academy to Learn More about Consumer Confidence, Home Prices, Gross Domestic Product and Other Economic Indicators

Originally Posted February 28th, 2023 IBKR Traders’ Insight

PHOTO CREDIT:https://www.shutterstock.com/g/k_nopparat

Via SHUTTERSTOCK

DISCLOSURE: INTERACTIVE BROKERS

Information posted on IBKR Campus that is provided by third-parties and not by Interactive Brokers does NOT constitute a recommendation by Interactive Brokers that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with permission from IBKR Macroeconomics. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and IBKR is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation to buy, sell or hold such security. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

In accordance with EU regulation: The statements in this document shall not be considered as an objective or independent explanation of the matters. Please note that this document (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and (b) is not subject to any prohibition on dealing ahead of the dissemination or publication of investment research.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.