By: Jose Torres, Interactive Brokers’ Senior Economist

Markets are returning from the extended weekend on the wrong foot, with hotter-than-expected economic data and weak corporate guidance from Home Depot and Walmart battering asset prices. This morning’s PMI data strengthened from last month’s release, with services reentering expansion territory and the pace of contraction in manufacturing slowing. While Wall Street expects resilient consumers following last week’s robust retail sales report, Home Depot and Walmart are much more cautious. This morning’s data offers more mixed signals concerning consumer demand, but during a traditionally weak seasonal trading period, investors are shifting toward a glass half-empty view against the backdrop of a year that’s featured the exact opposite so far, a glass half-full perspective.

This morning’s data offers more mixed signals concerning consumer demand, but during a traditionally weak seasonal trading period, investors are shifting toward a glass half-empty view against the backdrop of a year that’s featured the exact opposite so far, a glass half-full perspective.

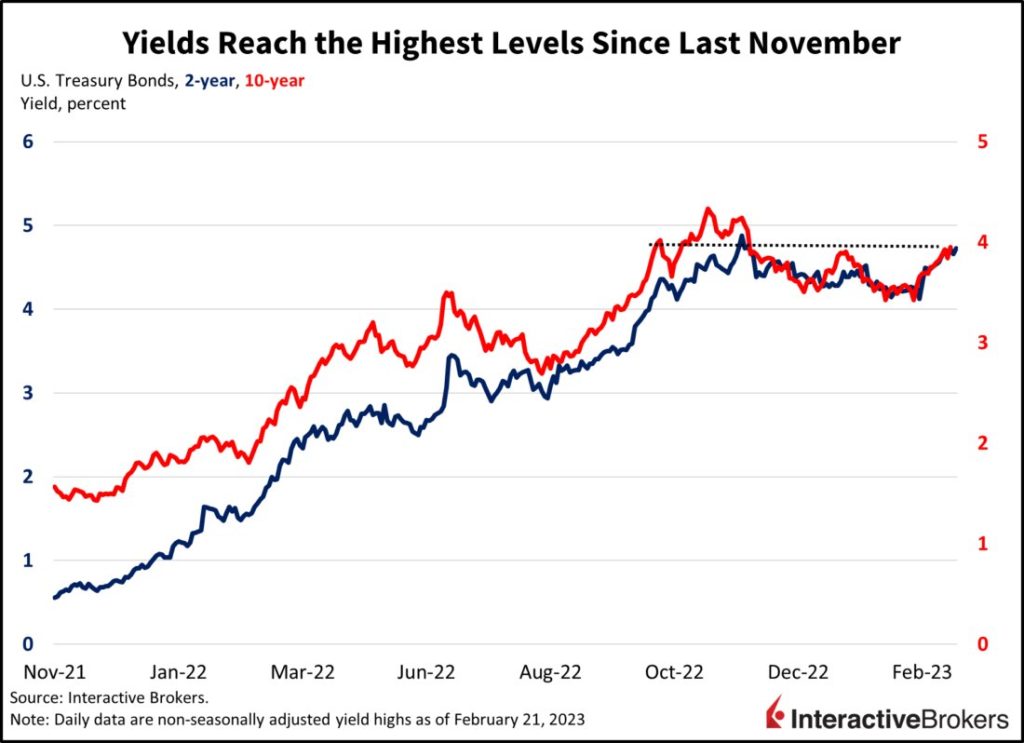

Asset prices are plunging this morning as weak guidance weighs on earnings prospects while upside risks to economic data remain, challenging the disinflationary outlook. Yields are the highlight this morning, with the inverted yield curve moving up significantly, led by the long end. The 2- and 10-year Treasuries are hitting fresh year-to-date highs as investors raise the probabilities of more Fed tightening and more inflation. The 2-year is up 8 basis points (bps) to 4.7% while the 10-year is up 9 bps to 3.92%, their highest levels since early November. Equities are responding negatively to higher yields which raise the cost of capital for businesses and also illustrate that investors increasingly believe the Fed’s rate hiking may be more aggressive than previously anticipated. The S&P 500 Index is down 1.5% while the tech-heavy Nasdaq Index is down 1.9%. The Dollar Index is up 0.16% while crude oil is down 0.3% to roughly $76 a barrel as recession fears offset optimism regarding the Chinese reopening.

Economic data gained momentum in February, as the S&P Global Flash PMIs reflect that the services and manufacturing segments have reached recent highs, an eight-month high for the former and a 4-month high for the latter. The services-PMI came in at 50.5, hotter than expectations calling for 47.2 and launching back into economic expansion territory after last month’s dismal 46.8 reading. The manufacturing-PMI remained in contraction territory but came in at 47.8, above expectations of 47.1 while the pace of decline improved from last month’s 46.9.

While supply chain improvements have increased manufacturing efficiency, service sector inflation remains red hot, as price pressures rose at the fastest pace since October. Furthermore, employment growth accelerated to the fastest pace since last September while consumer pessimism faded. Today’s PMI report calls for the Fed to do more, as inflation is accelerating, not dropping or even staying flat. Particularly noteworthy is how quickly the short-term loosening of financial conditions alongside a kind and gentle Fed chairman is driving consumers to spend rapidly and investors to add risk. Unfortunately for Wall Street, investors are now taking notice, raising the odds of a 50-bps hike to 24% in March while odds of a 5.63% terminal rate in July have increased to 25%.

Dour quarterly reports from Home Depot and Walmart depict a challenging environment for retailers while also supporting the view that Americans are spending an increased portion of their disposable income on entertainment, traveling and other services. For the three-month period ended January 29, Home Depot’s revenues of $35.83 billion missed the Refinitiv analyst-consensus expectation of $35.97 billion while the company’s earnings per share of $3.30 beat the expectation by 2 cents. It was the first Home Depot revenue miss since November of 2019. Home Depot maintains that a drop in lumber prices contributed to the revenue miss, but the company also says consumers conserved cash for spending on activities during the 2022 holiday season. Home Depot issued a sluggish growth outlook, explaining results will be challenged by pressure upon the goods sector and flat consumer spending as Americans’ finances weaken.

Walmart, however, benefited from consumers increasingly seeking lower priced products. For the fourth quarter, the company generated $164.05 billion in revenue compared to the $159.72 billion expected by analysts. Its same-store sales excluding fuel climbed 8.3% year-over-year (y/y) and its Sam’s Club same-store sales excluding fuel increased 12.2%. Walmart says consumers are cutting back on purchasing discretionary items because shoppers are under pressure due to higher grocery prices. The company expects same-store sales excluding fuel to increase between 2% and 2.5% y/y in the current year, but analysts were expecting 3% growth.

While consumers are feeling the brunt of inflation and higher interest rates, geopolitical fears are growing, causing an increasingly muddled outlook for the economy and investor sentiment. In a show of support for Ukraine’s fight against the Russian invasion, President Biden recently made a surprise visit to the country and met with its leader, President Zelenskyy. Biden also announced providing additional military equipment to the country. Shortly afterward, Russia announced it was suspending its participation in the New START nuclear arms reduction treaty, which regulates the development of intercontinental ballistic missiles in the U.S. and Russia. China also surfaced once again as a geopolitical concern when a spokesman for the country denied U.S. allegations that the country is providing lethal military aid to Russia. The spokesman maintained that the U.S. is “not qualified to give orders to China.” The statements follow reports that Biden has warned China that there would be consequences in U.S.-China relations if China provides lethal military aid to Russia. China-U.S. relations are already strained due to trade practices and the U.S. downing of an alleged Chinese spy balloon.

Visit Traders’ Academy to Learn More about the PMI-Manufacturing, Corporate Earnings, Payroll Employment and Other Economic Indicators.

Originally Posted February 21st, 2023, IBKR Traders’ Insight

PHOTO CREDIT: https://www.shutterstock.com/g/Rudzhan

Via SHUTTERSTOCK

DISCLOSURE: INTERACTIVE BROKERS

Information posted on IBKR Campus that is provided by third-parties and not by Interactive Brokers does NOT constitute a recommendation by Interactive Brokers that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with permission from IBKR Macroeconomics. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and IBKR is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation to buy, sell or hold such security. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

In accordance with EU regulation: The statements in this document shall not be considered as an objective or independent explanation of the matters. Please note that this document (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and (b) is not subject to any prohibition on dealing ahead of the dissemination or publication of investment research.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.