Jon Maier; Shannon Ahern, CFA

The intersection of financial services and technology, or fintech, is where many people now go to spend, lend, borrow, invest, and trade. And they do so like its second nature. Fintech makes financial services more efficient and adaptable, and more personal and inclusive. Whether buying a coffee with a credit card stored on a mobile device or splitting a dinner bill with Venmo, fintech applications transform how businesses and consumers interact with their finances.

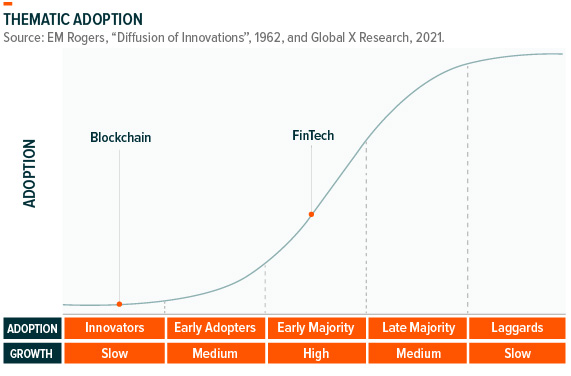

We expect that as technologies like these mature and their adoption increases, the Fintech mega theme’s prominence in investment portfolios should rise, and with good cause. Compelling opportunities continue to emerge as Fintech, including the Blockchain theme, increasingly overlaps with emerging themes like the Internet of Things (IoT), Cloud Computing, and Video Games.

Key Takeaways

- We expect the digital transformation to bring financial services, including mobile payments, online banking, and alternative lending platforms to previously unbanked and underserved populations.

- The pandemic put fintech’s adoption into overdrive, with digital payments moving into mass adoption. Key avenues for future growth include buy now, pay later (BNPL), cloud banking, and blockchain-based segments.

- Traditional financial services companies continue to invest significantly in fintech as consumer demand for the ease and convenience of these technologies increases.

Fintech Adoption Gaining Momentum, Becoming the Norm

Fintech adoption has increased dramatically in recent years, and we expect innovation in the space will continue to increase access to the global financial ecosystem. Global investment activity in fintech, including through venture capital, private equity, and M&A accelerated from $148.6 billion in 2019 and $124.9 billion in 2020 to $210 billion in 2021.1

For consumers, the ease and convenience of buying goods or services by tapping a device on a point-of-sale makes digital payments Fintech’s most recognizable segment. For companies, beyond the upfront costs of developing the program and infrastructure to conduct transactions, mobile payment technology is a consumer-friendly way to keep ongoing and variable costs low. With consumers more adept and willing to shop online, more integrated shopping ecosystems are developing. The success of Fintech’s fastest-growing segment, BNPL, is a result of continued growth in online shopping.

Overall, U.S. consumers using Fintech grew from 58% to 88% between 2020 and 2021.2 For comparison, it took the refrigerator 20 years to achieve a similar rate of adoption, while the computer took 10 years and the smartphone 5 years.3 Notably, adoption is increasing across user demographics. Millennials lead with 95% overall adoption, but Baby Boomers are the fastest-growing group, with their use doubling from 39% to 79%.4 For certain demographics, fintech use approached and even surpassed traditional banking use in 2021.

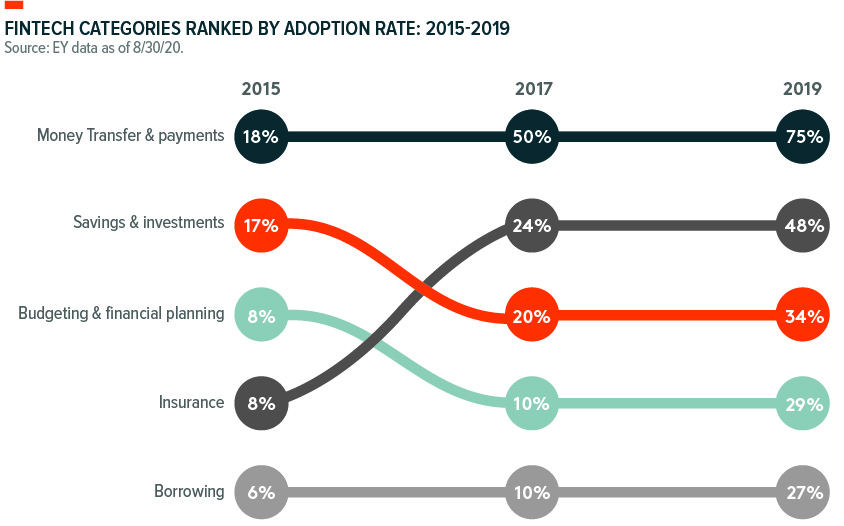

Based on available data, global adoption rate of fintech solutions reached 64% in 2019.5 Innovations in mobile payments, online banking, and alternative lending platforms can bring financial services to previously unbanked and underserved populations in developing and emerging markets. Without existing infrastructure in place, like traditional bank branches and credit cards, these markets can integrate the latest technology without forcing an old business model into obsolescence. Among emerging markets, China and India have the widest adoption thus far, reaching 87% in 2019.6

The chart shows the trend in fintech adoption globally across different traditional financial services prior to the pandemic. And it’s reasonable to assume that since the pandemic, adoption has increased across categories.

Blockchain Can Be an Entryway to Financial Inclusion

In its most basic sense, a blockchain is a type of database focused on recording and maintaining data. Its unique properties stem from its decentralized approach. Data is recorded in blocks on a digital ledger. Participants, called nodes, are the computers and devices connected to the network that distribute and validate the ledger on a peer-to-peer (P2P) network. While anyone can create data on public blockchains by creating a new block and chaining it to a previous block, the consensus-based approach to validation means nobody can edit or falsify the data after it’s received a sufficient number of block confirmations. The result is a structure that generates trust without the need for a third party.

Because participants don’t need to trust a government to back a currency or to manage the money supply, it’s conceivable that blockchain networks eventually become embedded in the financial ecosystem. This technology provides a mechanism for financial inclusion, particularly in countries that struggle with political instability, corruption, or severe inflation.

A February 2021 survey revealed that the top 10 countries with the highest frequency of cryptocurrency usage among their populace were all emerging market countries. Nigeria led the way with 32% of respondents indicating that they use bitcoin or cryptocurrency more broadly, followed by Vietnam at 21% and the Philippines at 20%.7 In the U.S., an estimated 16% of adults own cryptocurrency.8 We expect these number to rise over time, but investors must be cautious in the crypto space, as regulation remains light and illicit activity common. Consumer risk is likely a headwind to adoption. Scams, theft, and volatility are risks. In 2021, $7.8 billion in value was scammed and $3.2 billion worth of cryptocurrency was stolen.9,10

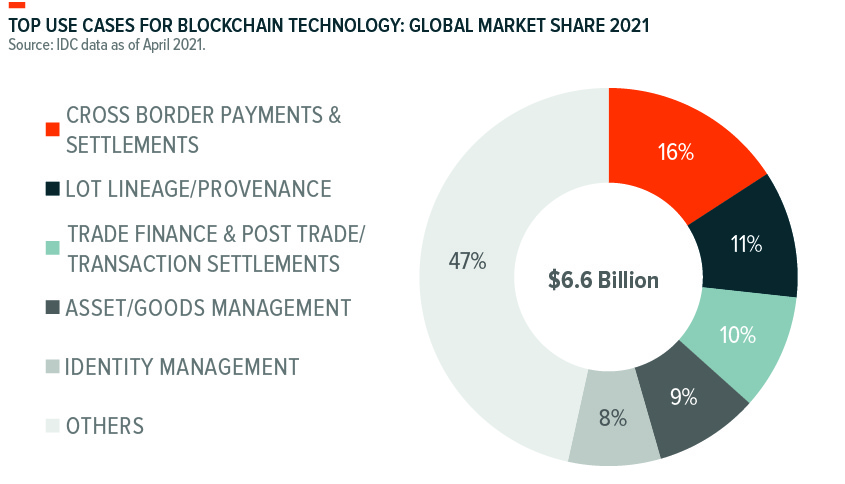

Beyond financial use cases, applications of blockchain technology are vast, touching supply chains, healthcare tracking, and smart contracts.

Fintech Is a Crossroad for Thematic Disruption

A key advantage for fintech platforms compared to their more traditional financial competitors is their ability and willingness to integrate new approaches at scale and shift their business models as new technologies emerge. The fusion of blockchain and fintech to form decentralized finance (DeFi) is a prime example. As a result, fintech is a natural crossroad for disruptive themes, including Internet of Things (IoT), Cloud Computing, and Video Games.

Fintech platforms paired with IoT technologies can transform everyday services. For example, insurance underwriters typically operate with incomplete information, which increases the cost of property and casualty insurance policies. But if they were able to use telematic sensors to track GPS and onboard diagnostic information, they could get more accurate information for the underwriters and conceivably lower costs and speed up resolutions.

Cloud technology can streamline previously cumbersome processes for banks, such as onboarding new clients, opening accounts, and managing regulatory compliance. Globally, banking industry IT cloud spending is forecast to increase at a CAGR of 16.2% between 2019 and 2024, increasing to roughly 25% of IT budgets.11

Another new frontier for Fintech is play-to-earn gaming with non-fungible tokens (NFTs). By one estimate, more than 1 million digital wallets connected to decentralized gaming apps per day in October 2021, representing 55% of the blockchain industry’s overall activity.12 These blockchain games allow ownership of playable items, and therefore the ability to sell, trade, use, and lend these tokens.

Putting the Fintech and Blockchain Themes in a Portfolio Context

Fintech will continue to make financial services more digital and scalable. The transformation is readily apparent but also one that has significant room to run globally, as no single use case surpasses 70% penetration.13 Critically, as blockchain technology grows out of its infancy, we expect the scope of end-user and institutional applications to grow exponentially and potentially upend traditional finance.

In our view, thematic equity should be targeted, using screens to ensure that the underlying companies provide the desired exposure. This pure play focus minimizes overlap between themes while also differentiating the exposure provided by the theme relative to broad beta products.

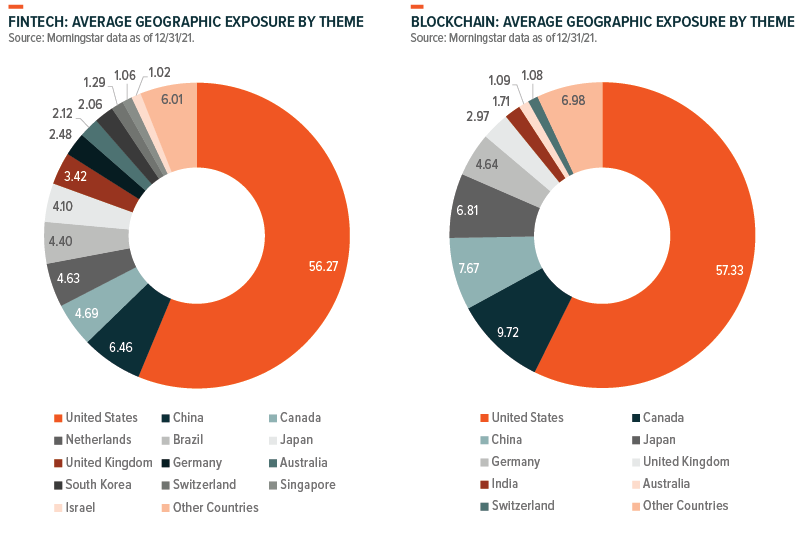

The companies operating in the fintech and blockchain spaces are global and positioned to benefit as thematic adoption increases across the world. We believe that there is ample innovation occurring outside of the U.S. and that limiting exposure to the U.S. will exclude key players, to the detriment of investors over the long term. The charts below break down the geographic exposure of the largest fintech and blockchain thematic ETF products.

Note: Includes the five broad Fintech ETFs and the largest five blockchain ETFs according to our thematic classification. All Thematic ETFs weighted the same.

Because blockchain remains in the innovation phase, the number of pure play blockchain companies is limited. Therefore, many ETFs include large semiconductor manufacturers that design and build crypto mining infrastructure. These companies are also included at a relatively high level in market cap weighted broad beta and technology sector ETFs. Over time, we expect overlap levels to decline as the space matures and the number of pure play companies grow.

Conclusion: Fintech Revolution Well Underway

Actual transfers of paper currency may be approaching relic status as fintech shifts how the world accesses and interacts with money. As the space advances and adoption increases, we believe that blockchain-based digital ledgers will likely become the dominant way people send, manage, invest, and lend. The rise of the digital payments segment to mass adoption levels illustrates consumer willingness to embrace these new technologies. Given the enormous growth potential for fintech applications, we believe a risk for investors is not having exposure to the Fintech mega theme and the numerous investment themes that it ties together.

Originally Posted September 15th, 2022, GlobalX

PHOTO CREDIT:https://www.shutterstock.com/g/Kirill+Wright

Via SHUTTERSTOCK

Disclosure

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

1. KPMG, Pulse of Fintech H2 2021 – Global: Global Fintech investment in H2’21 Recorded US$210 Billion Across 5,684 Deals, 2022

2. Plaid Blog, The FinTech Effect: Fintech’s Mass Adoption Moment, October 12, 2021

3. Ibid

4. Ibid

5. EY, Global FinTech Adoption Index 2019, August 31, 2020

6. EY, Global FinTech Adoption Index 2019, August 31, 2020

7. Statista Global Consumer Survey, as of February 28, 2022

8. Pew Research Center, 16% of Americans say they have ever invested in, traded or used cryptocurrency, November 11, 2021

9. Chain lysis, Crypto Crime Trends for 2022: Illicit Transaction Activity Reaches All-Time High in Value, All-Time Low in Share of All Cryptocurrency Activity, January 6, 2022

10. Chain lysis, Crypto Crime Trends for 2022: Illicit Transaction Activity Reaches All-Time High in Value, All-Time Low in Share of All Cryptocurrency Activity, January 6, 2022

11. IDC, Banking on the Cloud: Results from the 2021 Cloud Path Survey, August 2021

12. DappRadar, BGA Blockchain Game Report October 2021, November 11, 2021

13. Plaid Blog, The FinTech Effect: Fintech’s Mass Adoption Moment, October 12, 2021