By George Milling-Stanley Chief Gold Strategist with State Street Global Advisors

2021 was a period of recalibration for gold — reverting toward longer-term trend levels among demand sectors, with the price seeking to consolidate at a higher base. Nearly three months into 2022, there are several reasons to remain optimistic about gold’s outlook.

Markets remain volatile as we grapple with ongoing effects of the pandemic and the Russia-Ukraine War, which continues to have devastating human impact. With so much uncertainty and non-linear market moves, gold remains top of mind as investors consider how to mitigate these risks. However, looking beyond some of the headlines, fundamentals for gold in 2022 remain robust. In this blog, we leverage some of the recent research from the World Gold Council to look at gold supply and demand trends in 2021 to see if those trends may continue into 2022 or, perhaps, improve.

In particular, I want to look at where there might be room for improvement on last year’s performance compared with the most recent period that might fairly be regarded as “typical”, the five years from 2015 through 2019, immediately preceding the onset of the COVID-19 pandemic. Let’s start with the demand side of the gold equation.

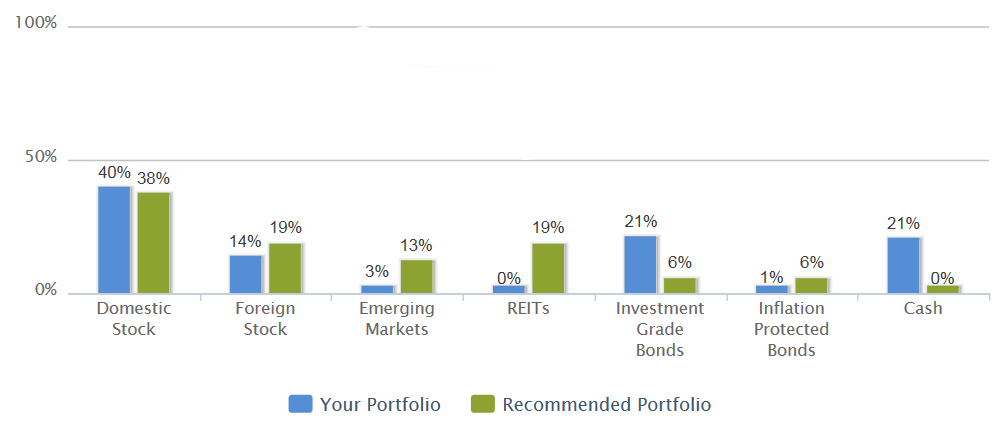

Global Gold Demand by Sector (Metric Tons)

We break gold demand down into four main categories: jewelry, investment, technology and central bank net purchases. Here, we’ll take a look at each of the categories, 2021 performance, and factors that may come into play in 2022.

Jewelry Demand Recovers

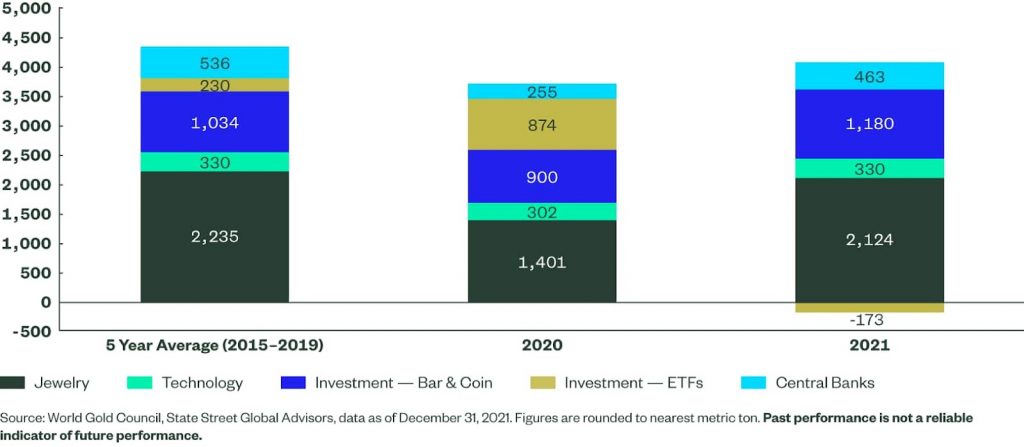

The pandemic hit the demand for gold jewelry very hard, the total for the full year 2020 falling about 50% in the face of widespread lockdowns and social distancing restrictions. Well over half of global jewelry demand is attributable to emerging market (EM) countries, the same countries that were hit early on by the pandemic and also applied the strictest lockdowns and social distancing rules. Small signs of an early recovery in jewelry demand became apparent in Q4 2020, and the rebound was confirmed in full-year 2021 statistics.

Gold Demand Trends to Watch in 2022

Jewelry fabrication demand rose 67% in 2021, with most of the growth occurring in emerging markets, including Thailand, Turkey, Indonesia, and Vietnam. But the largest year-over-year increases stemmed from China and India, up 63% and 93% respectively. The more than 60% growth in jewelry fabrication demand brought jewelry’s share of total global demand to 55%. This compares with an average share of total demand over the five years pre-COVID of 51%, suggesting that the recovery is pretty much complete.

Jewelry demand accounts for around half of the demand total, so continued good performance from jewelry demand will be crucial for the gold price going forward. Much will depend on the outlook for economic growth in the emerging world. China’s economic performance has run into some headwinds of late with trouble emanating from the real estate sector spilling over to the financial sector. This has clouded the economic outlook for the whole country. Whatever the resolution of the country’s economic difficulties, recent reports from China suggest that jewelry demand is continuing to run strong in 2022, after excellent performance last year,1 and the celebration of Chinese New Year.

India, another giant when it comes to EM jewelry demand, has so far seemed to weather the onslaught of COVID-19 much better than many commentators had expected, and its economy remains in good shape as we approach the end of the first quarter. Economic growth in the country is estimated at around 8% in 2021,2 with some small improvement predicted for the current year. If the growth in India continues, and China’s economic difficulties are resolved rapidly, emerging market jewelry demand should be set for another good year and could outperform if last year’s momentum is maintained.

Will Gold Investments Stage a Comeback in 2022?

As far as the other categories of demand are concerned, investment accounted for 25% of the total last year. While not far below the five-year average of 29%, these numbers suggest room for improvement in 2022. Digging a little deeper into the statistics, it is easy to see where that improvement might come from. Gold ETFs over the pre-COVID five-year period accounted on average for 5.27% of total demand, or 230 tons. In 2021, ETFs suffered net outflows of 173 tons. The gold ETF sector seemed to pause in 2021 after several strong years.

Global Gold-backed ETF Holdings

2022 has seen sustained buying across the whole spectrum of investors. This buying was triggered by the persistence of record high monthly inflation readings, with current levels reaching a 40-year high. Investors were initially slow to respond to increasing inflation, in part because Federal Reserve chair Jerome Powell and Treasury Secretary Janet Yellen both insisted for months that the high inflation reports were a transitory phenomenon, caused mainly by COVID-related disruptions to supply chains across many industries. Investor response to inflation, alongside market and geopolitical volatility, has kicked in and 2022 has seen strong inflows into gold ETFs, having already surpassed last year’s outflows.3 Any return to substantial net inflows can be expected to be helpful for the gold price.

Gold Demand in Tech Has Been Subdued

The demand for gold in Technology reached just over 8% of the total seen in 2021. While this is a little above the five-year average (7.6%), it is worth pointing out that demand in this sector had been subdued ever since the Great Financial Crisis of 2008. Perhaps a more normal level would be 10% or higher. If technology can more closely align with historical norms, that would also be helpful for the gold price.

Central Banks’ Gold Purchases Rebounded in 2021

Net purchases for official reserves by central banks have been a strong feature of the past 12 years, running at between 10% and 15% of the total. Purchases by the sector grew 82% in 2021, returning close to the average over the five years pre-COVID. If last year’s growth momentum is sustained in 2022, that could also bode well for prices. As noted during the past 12 years of strong net purchases by the official sector institutions, the buying has been largely on behalf of countries in the emerging markets. While the biggest buyers of recent years, China, Russia, and Turkey were largely absent from the market in 2021, the following countries all bought significant quantities of gold for their official reserves: Thailand, India, Brazil, Uzbekistan, Kazakhstan, Hungary, and Singapore.

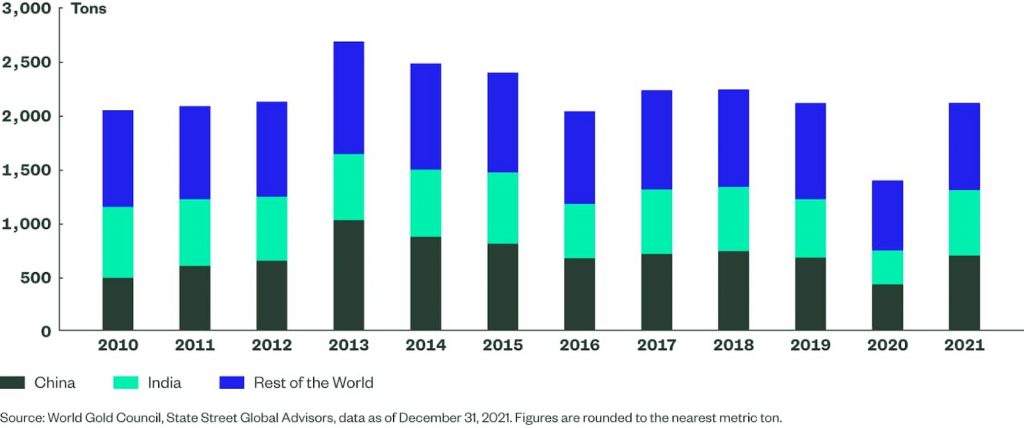

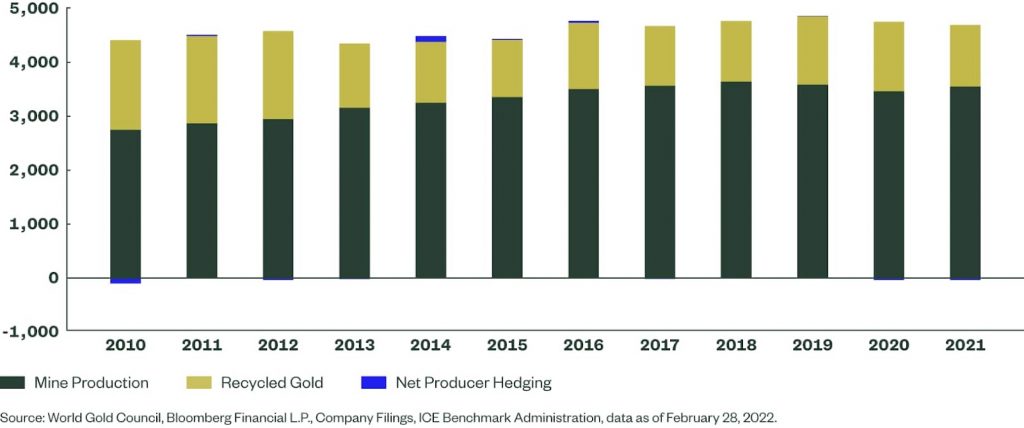

Supply Side Not Likely to See Much Change

Lastly, we turn briefly to the supply side. Mine production held steady last year — the total rising just 2% from the previous year — even though mines and refineries were working very hard to compensate for some shortfalls in 2020. There seems little prospect for any significant acceleration in the principal component of the supply side. Recycling, primarily of jewelry in emerging markets, fell 11% in 2021 and is expected to remain subdued this year without a major and sustained increase in the gold price. With supply likely to see little change, and some prospects for small improvements on the demand side, the stage seems set for some price increases this year after last year’s 2% rise.4

Mine Production Recovered Partially in 2021 but Remained Below Peak

Some Grounds for Optimism

2021 was a period of recalibration for gold — reverting toward longer-term trend levels among demand sectors, with the price seeking to consolidate at a higher base. Nearly three months into 2022, there are several reasons to remain optimistic about gold’s outlook. Uncertainties from monetary policy shifts, worsening geopolitical tensions following the Russian invasion of Ukraine, and heightened volatility may prove to be beneficial for gold as it looks to resume the current leg of the bull market which began at the start of the most recent Federal Reserve tightening cycle in December 2015.

This post first appeared on March 23rd 2022 on the State Street Global Advisors BLOG.

PHOTO CREDIT: https://www.shutterstock.com/g/macrowildlife Via SHUTTERSTOCK

DISCLOSURE

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.