By Liqian Ren, Director of Modern Alpha, and Aneeka Gupta, Associate Director, Research

Unlike the U.S., where the S&P 500 Index is the main gauge for broad equity exposure, China lacks consensus on a benchmark most widely accepted index.

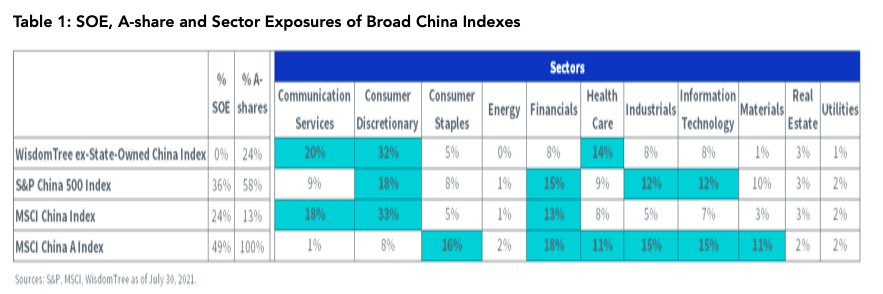

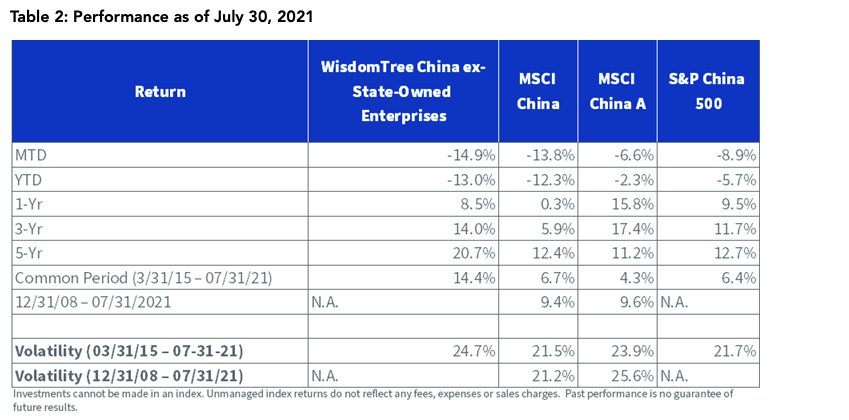

Broad China indexes differ according to how many state-owned companies and A-shares they include. As a result, the sector exposures of the indexes are widely different and their short-term performances can diverge significantly.

For example, the financial sector is dominated by state-owned banks, so the indexes that exclude state-owned enterprises are under-weight in financials but overweight in other sectors like health care, communication services and consumer discretionary.

To illustrate further, consider the state-owned exposure (SOE), A-shares exposure and various sector exposures of four leading China equity indexes: the WisdomTree China ex-State-Owned Enterprises Index (CHXSOE), the S&P China 500 Index—which takes the largest 500 Chinese companies regardless of listing place, the MSCI China Index and the MSCI China A Index.

Here are a few pointers for A-share exposure in a broad China equity portfolio:

1. We believe somewhere between 20% and 60% is a good reference point for A-share exposure in a broad Chinese portfolio. The MSCI China Index has finally increased its weight in A-shares, currently targeting 20%. It has been around 13% with more gradually being added.

When taking the S&P China 500 approach, A-shares are about 58% of the largest 500 Chinese companies regardless of listing location. Among SOEs, 76% are listed as A-shares. Among non-SOEs, 48% are A-shares.

With the political consequences of new U.S. delisting laws, we will likely see a trend of Chinese SOEs moving further toward A-shares, as shown by China Mobil’s recent listing approval. Non-SOEs generally prefer moving to the Hong Kong exchange from the U.S. if they can meet the stringent listing requirements, as listing offshore is still a positive signal for Chinese private businesses. Others may move to Shanghai’s NASDAQ-like STAR (Science and Technology Innovation) board or go private.

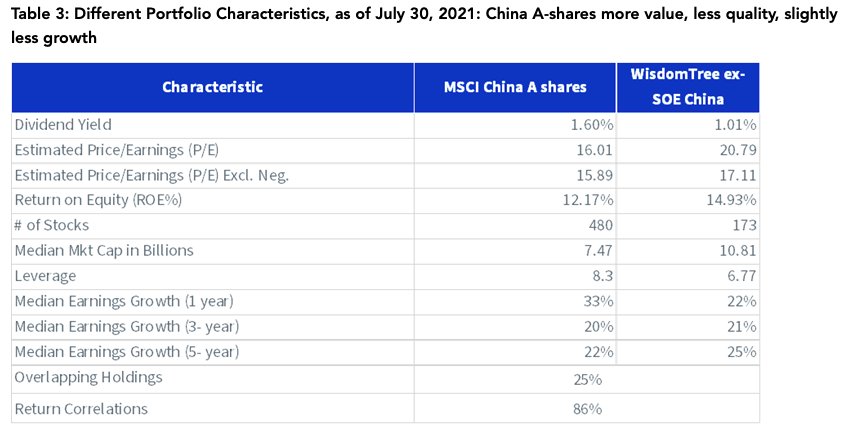

2. Mainland China A-shares and STAR board tend to offer diversification and exposure to more domestic industrial and consumer staples companies, and may have higher alpha potential for active strategies, but both come with their own nuances. That’s why we view it as an important part of broad China equity exposure for overseas investors. We recently discussed quantitative signals with Vivek Viswanathan, head of research for active alpha China strategy at Rayliant. Chinese A-shares are typical of emerging markets equities, and could provide good potential for alpha from non-traditional factors, like A-H share spread, or flow data of large clients versus small clients. Academic research found these kinds of friction-induced signals have worked better than traditional factors like value, momentum or size, according to research by WisdomTree. Historically alpha is also higher when the strategy was run within China where one could have full access to A-share stocks, according to research by WisdomTree. For clients based outside of China, there is a 30% hard cap on secondary market foreign ownership of any Chinese A-share stocks. The accounting standards are generally perceived to be better for offshore-listed Chinese equities than A-share stocks. However, if a company has dual A-H listings, it has less stigma for unreliable accounting data.

3. We believe A hybrid China A and H share could become the norm soon for many high-performing private Chinese companies. The case of health care company Wuxi Apptec would be an interesting case study for what’s to come. Its founder was educated both in China and the U.S. Its main operation is in China, but it also has U.S. operations. It was listed in the U.S., but the founder felt there was not enough U.S. investor interest and brand name recognition, and the company was undervalued as U.S. investors seemed to significantly favor Chinese tech companies. Wuxi Apptec then voluntarily delisted from the U.S., did a spin-off of Wuxi Biologics and listed in Hong Kong. The main Wuxi Apptec got dual-listed in Hong Kong and China A-shares. The WisdomTree China ex-State-Owned Enterprises Index owns all three listings. Through this A+H structure, the company can tap into mainland China investors through its high brand recognition in China and offshore capital.

In summary, A-shares and Shanghai STAR board stocks will likely become an even more important part of a portfolio’s China equity portfolio. We annually assess A-shares investment case and exposure in our own WisdomTree China ex-SOE Index, together with other risks such as delisting and VIE (variable interest entity) structure risks.

This post first appeared on September 7 on the WisdomTree blog.

Photo Credit: gaggs99 via Flickr Creative Commons

DISCLOSURE

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see the prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions.

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the United States. The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips. The MSCI China A Index captures large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges. WisdomTree China ex-State-Owned Enterprises Fund seeks to track the investment results of Chinese companies that are not state-owned enterprises, which is defined as government ownership of greater than 20%. Investors can’t invest directly in indexes.

This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)