By Brian Manby, Senior Analyst, Research

The summer months are upon us, and with the warmer weather comes a fresh reminder that the worst of the COVID-19 pandemic may be finally behind us.

Here in New York, the joy of a real summer is palpable as the U.S. economy recovers from last year’s recession.

Financial markets are also brimming with optimism, so now seems like a good time to take the pulse of U.S. small-cap valuations and prepare for the next phases of the economic cycle.

That Was Then, This Is Now

This year’s hot trade has been the “reopening” trade, as investors have grown bullish on the economic revival and gotten a piece of it any way they could, from cyclical sectors, to value, to small caps.

But as the run-up in equities persists into June, it’s prudent to examine how overvalued or undervalued markets are in a historical context.

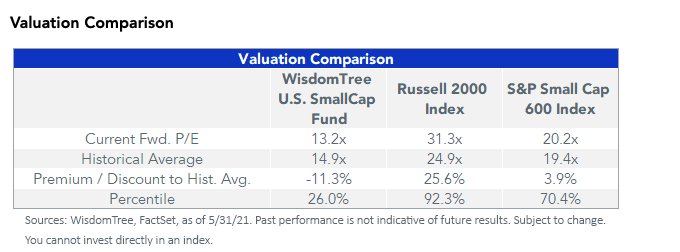

As of May, the Russell 2000 Index is trading higher than 30 times estimated earnings; that’s more than 25% higher than its monthly historical average dating back to early 2007. To provide a sense of how high that really is, its forward price-to-earnings (P/E) ratio is ranked in the 92nd percentile over that timeframe (where a higher percentile rank indicates a higher forward P/E value, with the 100th percentile as the highest on record).

The S&P SmallCap 600 Index is a bit more subdued, trading at a negligible 4% forward P/E premium compared to its historical average. But this modest premium remains in the 70th percentile over the same period, indicating it’s not exactly a bargain by historical standards, either.

The odd man out in the universe of supercharged small-cap valuations is the WisdomTree U.S. SmallCap Fund (EES).

It’s currently trading at an 11% discount to its historical average on a forward P/E basis since inception in February 2007. It also remains attractively priced by historical standards, ranking in the 26th percentile by the same measure.

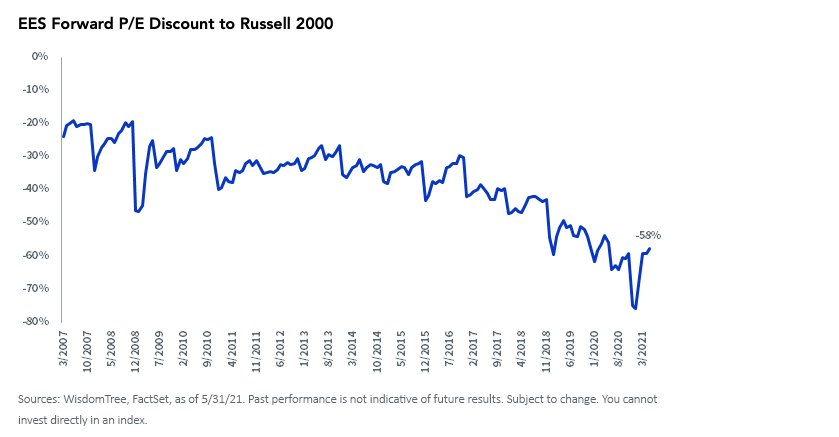

Similarly, EES is also trading at a historically deep discount to the Russell 2000. Its forward P/E is 58% less than that of the broader small-cap Index as of May.

Likewise, this discount is nearly as steep as it has ever been. Since inception, EES has always traded at a forward P/E discount by nature of its earnings-weighted strategy, but the current margin ranks in the top decile of discounts throughout its history.

We think this signals an important value opportunity for two reasons.

If markets continue to move higher as the economy recovery continues its improvement, then it seems intuitive that a small-cap fund predicated on positive earnings could potentially benefit from an earnings revival. We think this signals an important value opportunity for two reasons.

Likewise, small caps tend to operate in cyclical economic sectors versus larger market benchmarks such as the S&P 500 Index. Cyclicals have already started to enjoy the benefits of the reopening trade this year, and if they have more room to rally, then there’s reason to believe they may outperform.

On the other hand, if markets turn sour, there’s a possibility that the highly valued, overbought companies within the Index could be the first to suffer. Fortunately, since EES has been able to resist the valuations run-up thus far, it may potentially be more insulated from a reversal.

No Need to Sacrifice Quality

Let’s expand on that last scenario. After all, it’s fair to assume that many investors may still be traumatized by last year’s volatility.

Given their interlinkages within the domestic economy and importance as part of the global supply chain, small caps tend to disproportionately suffer during any sign of economic weakness. The U.S. has obviously been in pandemic recovery mode since the end of Q2 last year, which leaves us wondering when the next economic slowdown will materialize.

Whenever that may be, there’s no reason why a stereotypical, risky small-cap allocation needs to suffer as much as the broader asset class.

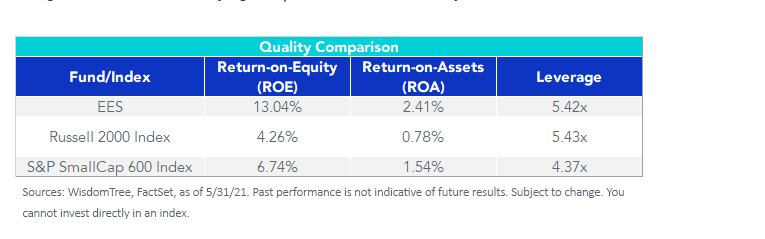

To help mitigate against major volatility, we introduced a new composite risk scoring mechanism in the creation of the WisdomTree U.S. SmallCap Index, which EES seeks to track. We introduced four quality factor measurements and a momentum factor component to help defend against the junkiest and most volatile companies.

The quality pickup in the portfolio is appealing, which signals to us that EES can potentially protect on the downside during a reversal if the underlying companies are fundamentally healthier.

For definitions of terms in the chart, please visit our glossary.

A Small-Cap Allocation for Any Market

Mapping the road ahead for any market environment is already hard enough, but it’s even more difficult this time as we finally exit the pandemic.

Whether you’re a bull or bear, there are direct implications for small-cap allocations.

No matter your economic forecast for the near future, we think the WisdomTree U.S. SmallCap Fund can be a part of it

This post first appeared on June 15 on the WisdomTree blog.

Photo Credit: Laura Wolf via Flickr Creative Commons

DISCLOSURE: Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.The securities of small-capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than larger capitalization stocks or the stock market as a whole. Small-capitalization companies may be particularly sensitive to adverse economic developments as well as changes in interest rates, government regulation, borrowing costs and earnings.

The Standard and Poor’s 500, or simply the S&P 500, is a free-float weighted measurement stock market index of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. The Russell 2000 Index is a small-cap stock market index of the smallest 2,000 stocks in the Russell 3000 Index. The S&P SmallCap 600 Index is a stock market index established by Standard & Poor’s. It covers roughly the small-cap range of American stocks, using a capitalization-weighted index. Investors cannot invest directly in indexes.