By Chelsea Rodstrom, Research Analyst, Global X ETFS

Early indications suggest that global growth is continuing to recover from mid-2020 lows thanks to historical fiscal and monetary stimulus, positive vaccine developments, rising commodity prices, strong demand from China, and a return towards consensus-based trade policies in the US.

In this piece, we delve into why these drivers are expected to uniquely benefit emerging markets in 2021, making them an attractive area in both debt and equity asset classes.

Key Takeaways:

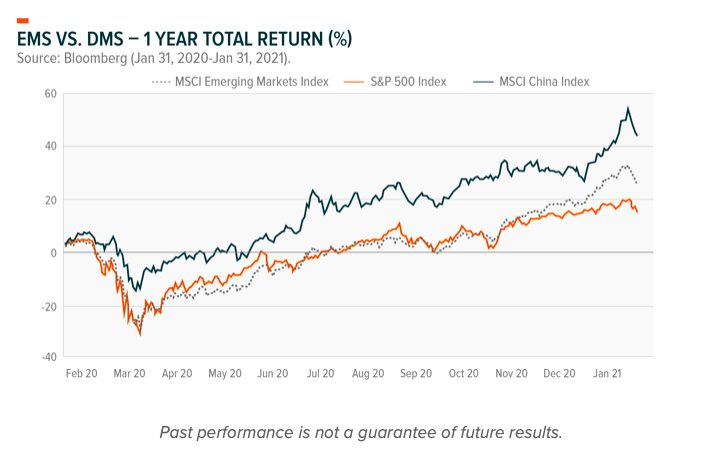

1. In reaction to the COVID-19 outbreak last March, emerging markets (EMs) initially sold off more sharply than developed markets (DMs), but saw a stronger recovery owed to higher commodity prices and robust demand from China.

2. Continued performance in EMs is likely to be driven by a weakening dollar, attractive valuations, and long term-growth fueled by consumption and digitalization.

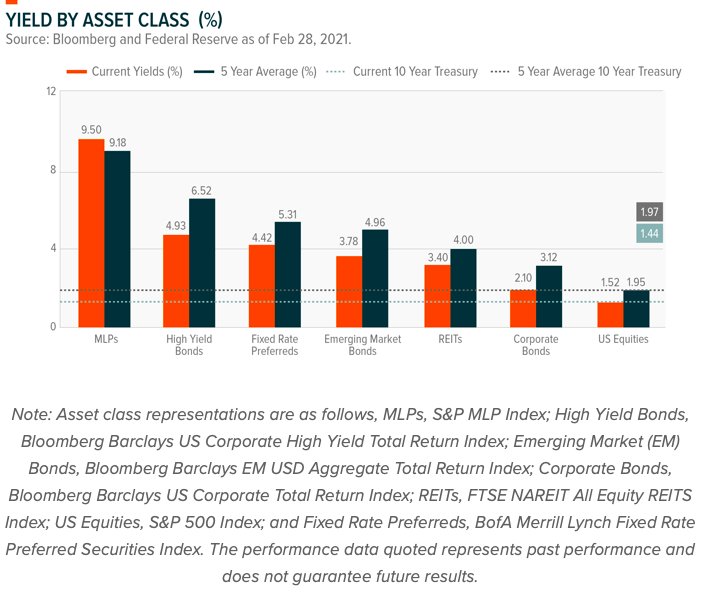

3. In equity markets, we see compelling opportunities for growth within Developing Asia, Latin America, and Europe. We additionally recognize the attractiveness of EM debt given low interest rates in developed markets and generally higher yields offered by EMs.

EMs Amid the Pandemic

Because of their higher dependence on commodities and exports, and greater sensitivity to market volatility, EMs initially fared worse than developed markets in the early part of the pandemic. EMs were hit particularly hard in March 2020 after oil prices collapsed amid plummeting demand because of COVID-19. Beyond that, less-developed health care systems struggled to contain the virus and treat those afflicted, resulting in harsh shutdowns and significant societal challenges. With a “flight to safety” amid the early days of the pandemic, many investors around the world reallocated to US assets, pushing up valuations on US stocks, bonds, and the dollar.

But towards the end of 2020, EM’s began to turn a corner. EMs recovered their losses and started outperforming developed markets by October, fueled by rising commodity prices, a weakening dollar, cheaper valuations, falling infection rates and overall economic robustness.

China Defied the Global Contraction in 2020

Within EMs, China demonstrated unique economic robustness in 2020. The world’s second largest economy and the largest EM only experienced an economic contraction in Q1, before effectively containing the spread of COVID-19 and becoming the only major economy to post positive growth for the year. In Q4 2020, China’s economy continued to show strong resilience with economic activity further strengthening after two quarters of expansion. Consumption, industrial output, and investment grew as more factories came back online throughout the year and consumers accelerated spending alongside broader reopening. Industrial production recovered early in 2020, but continued to rise throughout the year, and by November reached its highest level in over two years. Fixed asset investment improved throughout Q4, while the urban jobless rate also fell for the fourth straight month in November, suggesting a protracted recovery across the Chinese economy heading into 2021.

Looking Past the Virus Towards Higher Long-Term Growth

Despite lingering uncertainties about the global reopening process, vaccine distribution and virus containment measures have elevated global growth expectations for 2021. After a contraction of -3.5% in 2020, the global economy is forecasted to grow 5.5% in 2021.1 While developed markets are anticipated to achieve 4.3% growth in 2021, EMs on average are forecasted to achieve 6.3% growth in 2021, as accelerated global trade and higher commodity prices boost EM current account balances, while general economic activity boosts domestic consumption.2 While EMs are uniquely positioned to benefit from a global recovery, considering how sharply these markets were hit in 2020, we believe their economic resilience to crisis, long-term structural and demographic shifts supporting consumption growth, and the economic impact of technology and digitalization make them especially compelling over the longer term.

- Post-Crisis Resilience: Following a year full of volatility for commodities in which oil fell below zero and choked supply chains forced farmers to dump their goods, commodity prices across the board are bouncing back with a vengeance. Oil is now above $60 a barrel, while metals prices have continued to climb because of shorter term supply constraints, accelerating demand, and inflation and infrastructure projects looming on the horizon.

- Consumption: Chinese demand is a major driving force for the current commodity rally, including renewed demand for metals as factories reopen and an ever-growing need for agricultural products as China contends with scarcity in its own food supply. With China’s economy months ahead of the West in terms of its recovery, demand for consumer goods has extended from staples to discretionary goods – including domestic travel and luxury retail.

EMs are home to the greatest number of consumers, and make the highest contributions to global consumption, but many investors continue to have a myopic focus on US technology stocks when it comes to targeting growth. With rising purchasing power and internet-connected populations unrivaled by more advanced developed markets, EMs present attractive growth opportunities for investors looking to gain exposure to the booming internet and e-commerce theme.

Behind this rapid growth is the fact that EMs are increasingly dynamic – transitioning away from a dependency on commodity exports and low-cost manufacturing towards economies driven by high tech, services, and consumption-driven growth. Between 2000 and 2015, EM populations grew by 21%, while retail sales per capita were nearly 3x higher, rising from $525 to $1,490.5 Meanwhile, EM’s share of total global retail sales rose from 32% in 2000 to 51% in 2015, and EM retail sales growth outpaced DMs with a Compound Annual Growth Rate (CAGR) of 11.4% between 2000-2008 versus 5.7% for DMs during the same time period.3

- Technology & Digitalization: The COVID-19 pandemic accelerated e-commerce adoption not just in China, but globally. While countries like China and the US have the world’s largest e-commerce markets, growth is highest within Chinese and EM e-commerce segments thanks to growing internet penetration, smartphone adoption, and technology leapfrogging.

Rapid consumption growth within EMs is tied to rapid technological progress and adoption. As consumers become more educated and wages rise, so does consumption. In EMs, the rapid expansion of the middle class is occurring alongside the digital age. Discretionary spending is increasing for EM consumers just as e-commerce and internet companies become the dominant providers of goods and services. As EM consumers form new spending habits, they are developing a preference for digital ones, with growing internet penetration and smartphone usage in EMs increasing usage of e-commerce and social media platforms, especially for younger and more educated populations.4 As an early adopter of smartphones, and an aggressive policy to expand internet access, China has become the largest and fastest-growing e-commerce market globally with a market worth $862.6 billion in 2019 and revenues expected to grow at a 12.5% CAGR versus 8.8% CAGR for the US over the next four years.5

With more people connected to the internet and adopting smartphones, the spillover effects of digitalization seem endless. Digitalization helps shape how we interact and can lead to a cross-pollination of several sub-segments of EM internet and e-commerce, including in the growth of internet software and streaming companies, payments platforms, as well as search engines that rival Google in terms of market dominance within local markets.

- Valuations: After a decades-long bull run, US and developed market equity indexes are at or approaching all-time highs and touching valuations not seen since 1999. Compared to the US, emerging markets are trading at a 32% discount based on price to earnings (PE). And when looking at single EM countries like China, that spread is even wider, with large cap Chinese equities trading at roughly a 39% discount to US markets.6

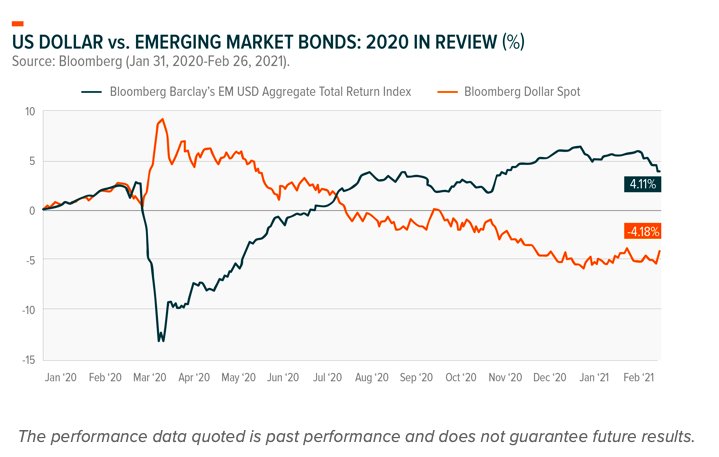

- Weakened US Dollar: Meanwhile, US economic weakness, ballooning federal and local deficits, and relatively low interest rates for the foreseeable future, have many investors anticipating the US Dollar will continue weakening beyond its 10% fall in 2020. A depreciating dollar coupled with an uptick in inflation could help raise prices of commodities and foreign exports, providing additional momentum for emerging markets. For many investors, these factors are sparking renewed interest in foreign equity markets, which could benefit from currency tailwinds.

EM Regions Poised for Growth in 2021

- Emerging Asia: Although EMs are expected to grow at a faster pace than DMs overall in 2021, Emerging Asia is forecast to grow faster than other EM regions. Leading Asia is India, which is expected to grow 11.5% in 2021; China, which is expected to grow 8.3%; and Southeast Asia, which is expected to grow 5.2%. With the signing of the Regional Comprehensive Economic Partnership (RCEP) in November, Asia is now home to the world’s largest trading bloc covering roughly a third of global GDP and the world’s population. RCEP is a huge step forward for countries like China, Japan, and Korea in improving trade ties, and introduces new benefits for countries like Vietnam and Thailand that rely heavily on demand from these regional leaders. Likewise, the Biden administration in the US, along with European allies, re-engaging with China and improving trade ties with other RCEP members, could benefit Emerging Asia with greater global trade in the coming years.

- Latin America: Perhaps more than any other region, the road to recovery is likely to be uneven in Latin America. While much of Latin America’s manufacturing has come back online and net exports have recovered to pre-crisis levels, consumption continues to lag.7 The commodities rally continues to help countries like Colombia, Brazil, and Mexico, which benefit from higher oil prices, while Chile and Argentina’s benefit from higher copper and lithium prices. Increased trade with China and the US may provide additional tailwinds for Latin American economies broadly. However, there are still several risks that could prolong a recovery. Aside from political risks, given major elections in Peru, Mexico, Ecuador, Argentina, and Chile this year, which could exacerbate any recovery challenges, Latin America must overcome higher unemployment levels and greater inequality resulting from COVID-19, the risk of a resurgence in infections, and the preemptive removal of fiscal support which would threaten to derail recovery efforts.

- Europe: During the Fall, Greece, alongside several peripheral European markets, including Spain, and Portugal, experienced an inflection point as the yields on their sovereign bonds turned negative for the first time in history. This was a significant moment for each of these countries, given their historical debt struggles. Greece, for example, only exited its IMF bailout program two years earlier. With the slow rollout of a vaccine across Europe, additional support from the ECB under its emergency bond-buying program (PEPP), and an upgrade to their sovereign credit from Moodys, Greek investors seemed bullish on the Greek economy’s potential to resume its COVID-19-interrupted recovery.

EM Debt Offering Higher Yields

While we believe there is still plenty of runway for EM equity markets, EM bond markets also deserve a closer look given that several of the trends mentioned in this piece should also provide tailwinds to EM debt. The trend of dollar weakness could be particularly helpful to EM debt as it tends to boost commodity prices, while also reducing the burden on USD-denominated debt issuers to service their debt. Many EMs depend on high commodity prices to fund government activities, so higher commodity prices could improve their credit profile. In addition, EMs often issue USD-denominated debt to access greater pools of capital and reduce interest costs.

EM debt markets ended 2020 strong as the global recovery gained traction with promising vaccine developments and strong inflows into the asset class as investors demanded higher-yielding assets. EM government bonds, for instance, yielded on average 4% more than their developed market (DMs) counterparts.8

We believe the dollar may continue to weaken after a nearly uninterrupted decade-long rise following the global financial crisis. Expanding local and federal deficits, relatively low interest rates, and the global economic recovery may continue to weigh on the dollar, providing further support for EM debt.

Conclusion

The global economic recovery looks drastically different between regions and countries. Despite the risks COVID-19 posed to EMs, which made them disproportionately vulnerable to a global slowdown in 2020, a global recovery is uncovering EM’s broad resilience to crisis – a trend that seems to repeat itself in recent history following the Global Financial Crisis of the 2000s, the Russian Banking Crisis, and the 1997 Asian Financial crisis. History again suggests that while EMs tend to experience sharper contractions during periods of global market stress, they tend to recover more quickly. With 2021 increasingly looking like a strong recovery year for the global economy, we believe EM equities and debt could experience strong near-term tailwinds in addition to the resumption of its long term growth trajectory.

This article first appeared on March 11 on the Global X ETF blog.

Photo Credit: philippe via Flickr Creative Commons

FOOTNOTES

1. IMF, “World Economic Outlook Update,” January 2021.

2. Ibid.

3. Kearney, “Emerging market retailing in 2030: future scenarios and the $5.5 trillion swing,” 2017.

4. Pew Research Center, “Smartphone Ownership is Growing Rapidly Around the World, but not Always Equally,” 2019.

5. Statista, “Statista Digital Market Outlook,” 2020.

6. ETF.com as of Mar 3, 2021. US refers to metrics related to the S&P 500 ETF (SPY), Emerging Markets refers to metrics related to the iShares MSCI Emerging Markets ETF (EEM), and China refers to metrics related to the Global X MSCI China Large-Cap ETF (CHIL). SPY and EEM represent the largest ETFs tracking the S&P 500 and MSCI Emerging Markets Indexes, respectively, and are used as proxies for the asset class. Information on funds other than Global X ETFs are for illustrative purposes only and should not be construed as an offer regarding the purchase or sale of those funds.

7. IMF, “Latin America and Caribbean’s Winding Road to Recovery,” Feb 8, 2021.

8. JP Morgan as of Oct 31, 2020.

DISCLOSURE

The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries*. With 1,381 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 698 constituents, the index covers about 85% of this China equity universe. The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. Investors can’t invest directly in indexes.