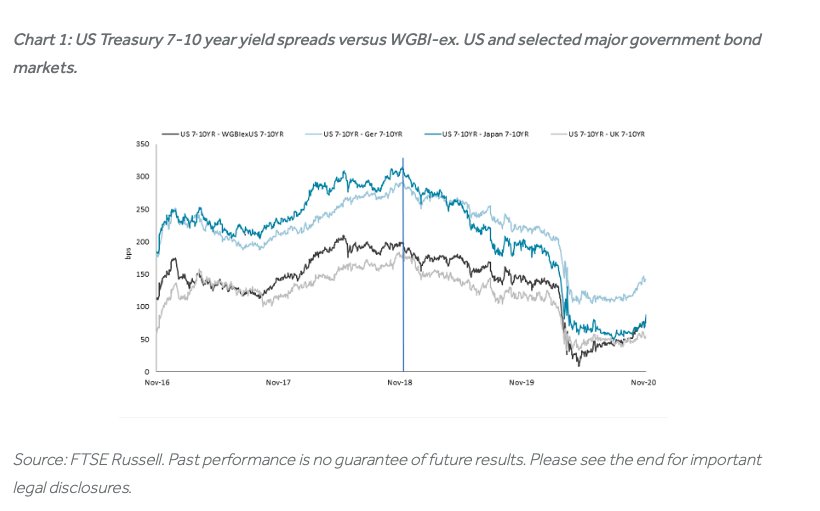

According to recent data from global index provider FTSE Russell, US Treasuries have become expensive compared to other major sovereign bond markets over the last four years, as measured by US yield spreads versus the FTSE World Government Bond Index excluding the US (WGBI ex. US). US yield spreads in 7 to 10 years have fallen from a peak of about 209 basis points in mid-2018 over the WGBI ex. US index to current levels of 79 basis points.

During times of economic turbulence and weak growth, US Treasury yields tend to fall faster compared with treasuries in other developed markets. Even with vaccines in the earliest days of availability, the US could face a resurgence of COVID-19 and another potential lockdown. Investors might be weighing US versus non-US government bonds and looking for opportunities in the broader international treasury market.

To illustrate, US Treasury yields fell more sharply than other major market debt obligations such as Japanese Government Bonds and German Bunds, between Q4 of 2018 and Q1 of 2020. During this period, the United States Federal Reserve cut policy interest rates by almost 300 basis points to near zero while policy rates in Japan and Germany were already below zero, so yields fell much less.

Robin Marshall, director of fixed income research, FTSE Russell:

In recent years we’ve seen a cyclical pattern, whereby US Treasury yields have risen faster during periods of economic expansion, relative to other major markets, as in 2017 and 2018, and fallen faster during periods of slower growth and inflation, like 2019 and 2020. What this tells us is that US Treasuries outperformed during periods of falling yields and tended to underperform during periods of rising yields.

If President-elect Biden is able to gain Congressional support for a substantial fiscal reflation package in 2021 in response to the economic impact of the pandemic, this cyclical pattern may be repeated, with US yields rising further than those in other markets, where deflationary pressures are still severe.

Karen Schenone, CFA, managing director, head of iShares fixed income strategy for BlackRock’s US wealth advisory business:

Investors have the option to diversify across global fixed income markets through ETFs that track the FTSE World Government Bond Index. ETFs provide investors easy and efficient ways to access bonds from international markets.

Photo Credit: U.S. Naval War College via Flickr Creative Commons

DISCLOSURE

© 2020 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”), (7) The Yield Book Inc (“YB”) and (8) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

Views expressed by Robin Marshall of FTSE Russell and Karen Schenone of BlackRock iShares are as of December 17 and subject to change. These views do not necessarily reflect the opinion of FTSE Russell or the LSE Group.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained in this document or accessible through FTSE Russell Indexes, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This publication may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and/or their respective licensors.