By Chelsea Rodstrom, Research Analyst, Global X ETFs

The Global X Q2 China Sector Report can be viewed here. The report provides macro-level and sector-specific insights across the eleven major economic sectors in China’s equity markets.

In the second quarter of 2020, China’s economic activity began to gradually recover. As lockdown measures eased, many were able to return to reopened factories and other workplaces, while others adjusted to continued life at home. While at home, many became increasingly reliant on technology to communicate with coworkers and family, connect with doctors, order goods online, and consume entertainment.

China’s transition from a stay-at-home economy to one that is experiencing a restrained reopening, has been bumpy with intermittent spikes in cases across regions, resulting in the re-instatement of certain lockdown measures. But the reopening so far has exceeded expectations as Chinese consumers shift parts of their lives online and factories move towards greater capacity utilization.

By the end of the second quarter, China’s industrial capacity utilization rose 7.1 percentage points – up to 74.4% — and Beijing’s early efforts to spur a recovery started paying off. Transportation, industrial production, and consumption beat estimates, while China finished the quarter as the only major economy forecasted to have positive growth in 2020.

With the exception of the Energy sector, all of the Global Industry Classification Standard (GICS) sectors in China generated positive returns in Q2 2020. This is in stark contrast to Q1, when all 11 sectors had negative returns. The Health Care and Information Technology sectors were again the largest outperformers against the Broad China Index (MSCI China Index).1 In terms of contributions to overall returns in the MSCI China Index, the Consumer Discretionary sector played the greatest role as Chinese consumers resumed more normal consumption patterns.

Dispersion between China and US Sectors Normalizes

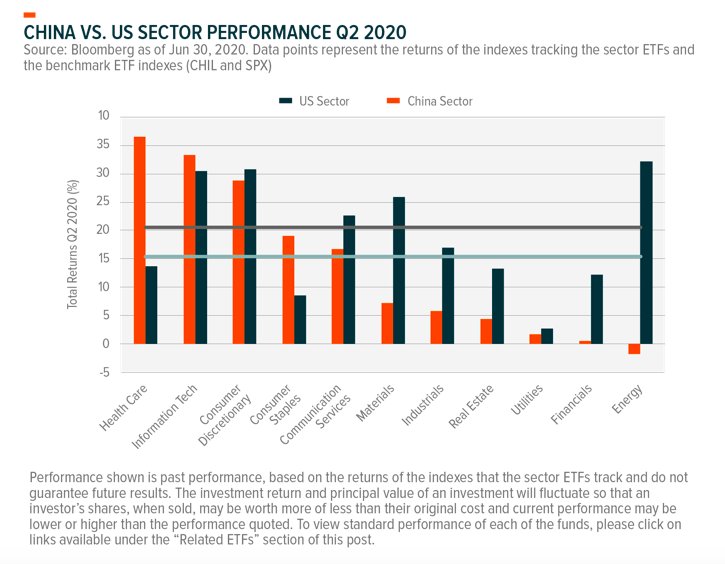

After contracting sharply in Q1, equity markets in the US and China rallied in Q2. In Q1, the MSCI China Large Cap Index and the S&P 500 Index benchmarks fell -11.5% and -19.6%. But in Q2, they generated positive returns of 15.3% and 20.5%, respectively. Some of the Q2 outperformance by the US may be attributable to the greater fall in Q1.

Sector dispersion, meaning the difference between the best and worst performing sector, had narrowed in Q1, as sectors sold off in unison amid the COVID-19 pandemic. As markets recovered in Q2, however, sectors fared unevenly. This is exhibited by the 38.11% return difference in Chinese sectors. In the US, sector dispersion was less dramatic, at 29.21%.

Comparing and Contrasting US and China Sector Performance

At the individual sector level, sector performance in the US and China was directionally similar but performance relative to the respective benchmarks was mixed.

In the chart below, we show performance of Global X ETFs that are designed to track China’s 11 GICS sectors relative to CHIL, a large-cap ETF tracking the 50 largest stocks in China, which were up 15.25% during the second quarter

.

China Sector Outperformers

During Q2, Info Tech, Consumer Discretionary, and Communication Services, outperformed the broader markets in both China and the US, as businesses became more dependent on technology to connect while at home, consumers began to come back online as a result of extensive stimulus measures and increased economic activity, and as communication became ever more important in keeping everyone engaged.

Unlike in the US, the best performing sector in China during Q2 was Health Care, a sector that underperformed in the US relative to the S&P 500. As the world’s second largest pharmaceuticals market, companies responsible for drug development and distribution have led the gains in this sector because of several companies’ efforts to develop a COVID-19 vaccine.

But longer-term tailwinds for the Chinese pharma industry accelerated during Q2, following the introduction of the revised Drug Registration Regulation on March 30, 2020. This revised regulation, implemented on July 1st , was a huge stepping stone for the industry.

It is the first major revision to China’s Drug Administration Law since 2007 and eases drug development and registration in China, encourages research and innovation within pharmaceutical with an emphasis on biologics, helps harmonize China’s system with international standards, eases the burden for domestic and foreign drug approvals, and accelerates the review and approval process for critical drugs targeting immediate need or severe illnesses.2

China’s Consumer Staples sector also outperformed the MSCI China Index, with Chinese consumers buying more Moutai – China’s national alcoholic beverage — and beer, as well as grocery store items and packaged foods while staying home and dining out in-person less. Higher commodity prices, the resumption of economic activity, and a slowdown in trade also contributed to higher relative returns in China’s Consumer Staples sector, owing the increase in prices for key imported inputs such as wheat corn, and soy.

China Sector Underperformers

Sectors that underperformed the broader markets in both the US and China include Financials and Real Estate, Industrials and Utilities. While China’s Real Estate sector began to pick up towards the tail end of Q2, it still underperformed the MSCI China Index after a sharp slump in Q1. Similarly, in the US, the Real Estate sector showed early signs of becoming a potential bright spot in the US as mortgage rates plunged, encouraging a buying spree among US households.

China’s Financials sector experienced slightly positive growth in Q2 but still underperformed the MSCI China Index given elevated concerns about the sector becoming overleveraged and because of fears of a resurgence of shadow banking. Likewise, in the US, the Financial sector reported better-than-expected earnings, allowing it to outperform the S&P 500.

In contrast to the US where Energy experienced a strong recovery, the sector underperformed in China. China is not a net oil exporter, which meant recovering oil prices were not a positive for the sector. As a result, China’s Energy sector was the only sector to have continued negative overall performance in Q2.

Conclusion

COVID-19 continues to shape the reopening of global economies, and performance across global markets, including major economies like the US and China. Individual sectors in China are impacted in distinct ways and over the past quarter, demonstrated a wide divergence. Policy stimulus, macroeconomic events, and economic integration can all affect sector divergence. But this year, the mixed responses to the COVID-19 pandemic and the resulting market bumps we see as a result, reaffirm the importance of monitoring and adjusting sector exposures in China.

FOOTNOTES

1. Bloomberg as of Jun 30, 2020.

2. Covington & Burling, “China Promulgates Revised Drug Registration Regulation,” Apr 29, 2020.

Photo Credit: François Philipp via Flickr Creative Commons