Comedian and newspaper columnist Will Rogers had the stock market figured out a century ago: “If it don’t go up, don’t buy it.”

Alas, not every stock is a winner. Some are going to bomb on you, and knowing when to take a loss on stocks is a critically important part of investing.

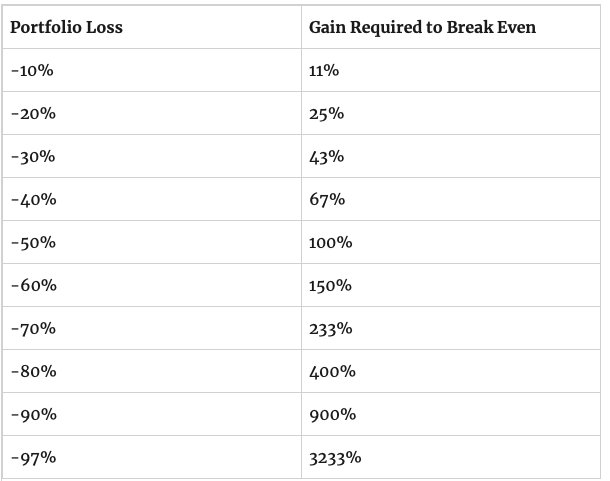

Take a look at the chart below. As you can see, gains and losses are not equal. After taking a loss on stocks, you have to gain back more in percentage terms in order to break even.

Closer Look

If you lose 10% to 20% in a trade, it’s not that hard to recover. It only takes 11% to 25% to get back to where you started.

But if you lose 50%, you need 100% returns to get back to break even. Or if you lose 97% — as you easily could in a risky trade gone wrong — you’d need a ridiculous 3,233% on your next trade just to get back to zero.

OK, we’ve established why knowing when to take a loss on stocks is important. You don’t want to dig yourself into a hole you can’t reasonably trade your way out of.

But how, exactly, do you do it? Let’s go over two ways.

Position SizingIn my opinion, probably the single most important tool in keeping your losses under control is position sizing. I could write for days about the “correct” way to size a position and never fully cover the topic.

But I can summarize it here in a few words: The riskier the position, the smaller it should be. The safer the position, the larger it should be.

It really is that simple.

Let’s say you put 1% of your net worth into a risky options play. If it blows up in your face, it’s not going to wreck your finances. But if you put half your net worth into it and it blows up… you just permanently reduced your net worth.

So always be smart about position sizing, and never overweight your position on a risky bet.

Stop Loss OrdersA stop loss is a rule to automatically sell if a stock you own drops below a certain point. For example, you could have a stop loss in Apple Inc. (Nasdaq: AAPL) at $350. If the stock price falls below that price, you walk away. You don’t hold out and hope for a recovery.

Brokerage apps like Robinhood let you put a stop loss sell order on all of your stocks. That way you don’t have to watch them closely if you don’t want to, or if you go on vacation or something.

Stop losses are controversial. As a general rule, I’m a fan because they prevent small losses from snowballing into larger ones.

Of course, the downside is that you won’t get to participate in any recovery. Let’s say Apple drops to $350 before immediately turning around and soaring to $400. Well, you just missed all that upside.

In my view, the decision to use a stop loss goes hand in hand with position sizing and knowing when to take a loss on stocks. If you keep your position sizes small, a stop loss

is far less important in my opinion. A small position isn’t going to blow up your portfolio if it goes south.

Takeaway

But in a larger position, I think a stop loss is a great idea. If a stock or fund makes up a large portion of your portfolio, you need to make sure you don’t take losses that you will never recover from.

There is a science to setting the perfect stop loss, and I’ll get into that more in a later piece. But, as a general rule, I think you should set your stops at points that are just below a “normal” trading range for that particular stock.

That’s the essence of knowing when and how best to take a loss on stocks. You should look to sell when something has fundamentally changed and get out before it’s too late.

Photo Credit: Zooey via Flickr Creative Commons

Charles Lewis Sizemore, CFA is the principal of Sizemore Capital Management, a registered investment adviser based in Dallas, Texas.

Disclosure: This publication may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially.

No statements in this publication are intended or should be construed as investment or tax advice. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.