Matthew J. Bartolini, CFA, Head of SPDR Americas Research

Studies have shown that there can be a considerable disconnect between investment allocations to one’s own country and the proportional representation of that country in a global portfolio.(1) But while favoring one’s home country may be a patriotic gesture, when it comes to investing, home-country bias can be detrimental to a portfolio.

Investors remain too close to home

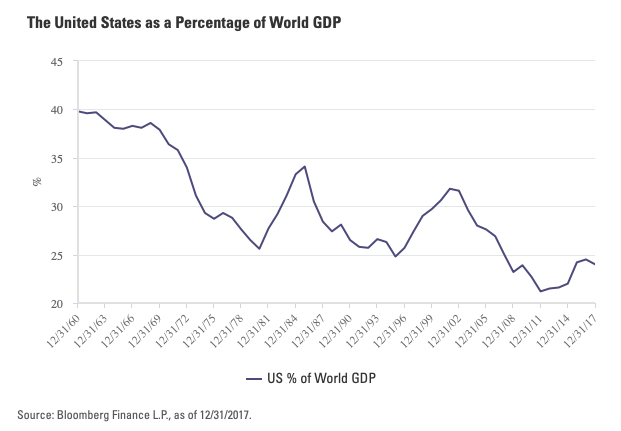

Home-country bias is a common phenomenon in which investors tend to allocate a large majority of their portfolio to investments in their home country. The result? Portfolios have a concentrated country exposure, limiting potential returns as well as diversification.Studies demonstrate that home-country bias is prevalent among US investors. According to the International Monetary Fund’s (IMF’s) Coordinated Portfolio Investment Survey, US investors allocate over 70% of their equity exposure to US securities.(2) However, measuring on the basis of market capitalization of equity, the US represents just 53% of the market cap weighted MSCI ACWI Index—a broad representation of 47 investable countries.(3)

Why does home-country bias matter?

Home-country bias wouldn’t be a concern if it didn’t have a material impact on portfolio outcomes. There are several reasons why correcting home-country bias can improve a portfolio’s risk/return profile, as well as higher income generation potential.

For more, please read the rest of the post originally published on the SPDR Blog on May 13.

Reference Shelf

(1)International Monetary Fund, “Coordinated Portfolio Investment Survey,” June 2016.

(2)International Monetary Fund, “Coordinated Portfolio Investment Survey,” June 2016.

(3)MSCI, as of 04/25/2019.

Photo Credit: Mike Mozart via Flickr Creative Commons

This material is from State Street Global Advisors and is being posted with State Street Global Advisors permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Advisors is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation to buy, sell or hold such security. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.