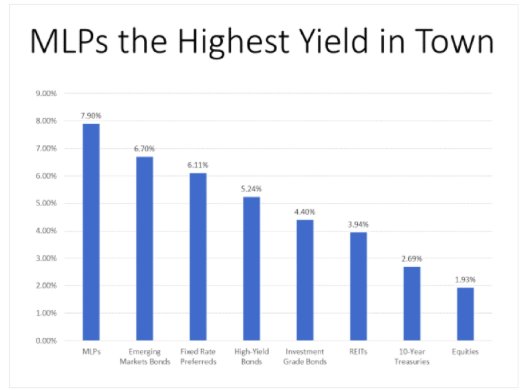

If you’re looking for income these days, your options are a little limited. The S&P 500 yields less than 2%, which is bordering on pitiful, and government bonds aren’t much better.

REITs, as a sector, are reasonably high yielders at 3.9%. But in order to get the yields I like to see, you really have to cherry pick in my opinion.

You’re not paying many bills with a 3.9% payout.

Few Options

Corporate bonds? Investment grade bonds yield 4.4%, and “high-yield” junk bonds yield only slightly better at 5.2%.

Sure, that’s better than Treasury yields. But hardly worth the risk. At the first whiff of an economic slowdown, junk bond default rates tend to jump.

Energy MLPs

Preferred stock still sports a respectable yield, but in my view, there’s only one asset class right now that sports what I would consider to be a truly impressive yield, and that is oil and gas master limited partnerships (MLPs).

The Alerian MLP index, which you can think of as “the S&P 500 of MLPs,” yields over 8%.

I know of no other sector where those kinds of yields are possible without taking substantially more risk.

Risk Factor

Business development companies, or BDCs, offer comparable or higher yields, but I consider them a little riskier at this stage of the business cycle.

Yields are high in part due to rising payouts over the past few years. But the far bigger reason is the total collapse in MLP share prices since late 2014. After years of gains, the sector hit a rough patch when the price of crude oil started to fall, and before the dust settled the Alerian MLP index has dropped by about 60%.The story on MLPs had always been that they were largely immune to energy price swings. MLPs own energy infrastructure, such as pipelines, and most of their revenues come from fixed fees.

Leverage Issues

The problem came down to leverage. Like much of the rest of corporate America, MLPs took advantage of the low interest rates of the past decade to absolutely gorge themselves on cheap debt. And their business model was dependent on it.

MLPs paid out substantially all of their cash flow from operations as distributions to investors. That meant that when they needed capital to expand their businesses, they had to get it from the capital markets via new debt or equity sales.

That model worked fine so long as stock prices were high and bond yields low. But when crude oil prices started tumbling in late 2014, MLPs had a big problem. Even if their business models were only minimally dependent on energy prices, they had no margin of safety.

Distributions

When share prices started falling, it became harder to sell shares to raise capital, and raising more via debt wasn’t an option because they were already overleveraged.

So, the MLPs raised cash the only way they could: by slashing their distributions.

It’s a case of once bitten twice shy. Investors that saw their payouts slashed back in 2015 and 2016 and lived through a 60% share-price collapse have been reluctant to come back to the sector.

Financial Comeback

But their timidity is an opportunity in my opinion.

After years of debt reduction and a focus on financing growth projects with retained profits like normal companies, MLPs as a group are in the best financial shape in recent memory.

In my view, if we have another energy-price rout, they’re in a much better position to ride it out.

Takeaway

A “sweet spot” for income investments tends to be moderate economic growth, benign inflation and a 10-year Treasury yield under the psychologically important level of 3%.

I think the Fed’s recent reversal of course shows that they’re worried about growth starting to cool, which usually means inflation expectations tend to cool with it. And the 10-year Treasury is hovering around 2.7%.

So, in my opinion, it’s looking good in income land.

Photo Credit: Angus MacRae via Flickr Creative Commons