I think the contours of the US stock market have changed dramatically since the early February correction from its recent peak on Jan. 26.

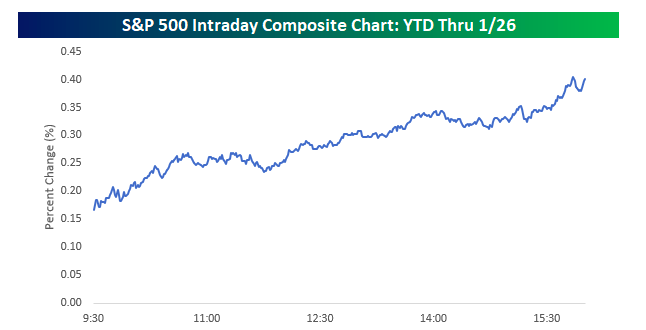

In the three weeks leading up to the January peak, volatility was low throughout each trading session, according to an analysis by Bespoke Investment Group.

Choppy Waters

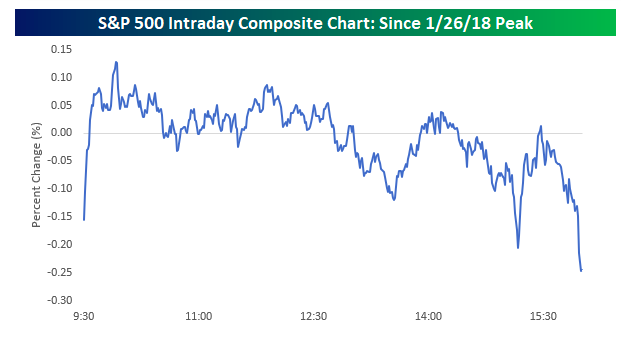

That’s all changed since the market sell-off that began in early February.

Intraday price swings have been far more dramatic. The next chart, as Bespoke describes it, “could just as well be the output of a cardiac device monitoring someone watching the intraday swings.”

Smart Money

In my view, another trend to watch is the market’s tendency to sell off late in the trading day.

Stock analysts have long noted that less sophisticated investors tend to trade early in the day, while the money pros tend to trade late in the day.

Bespoke calls in the Smart Money Indicator. If this trend of late-selling continues, it may be something for bulls to consider, according to Bespoke.

Takeaway

In my opinion, the market has been on sounder footing over the last two weeks.

In fact, the Dow Jones Industrial Average and S&P 500 Index are in the green, up more than 2%, respectively, as of Feb. 23.

The early February sell-off was not fun, but keep in mind the current bull market that started in early 2009 has experienced five technical corrections of more than 10%.

The stock rally, meanwhile, keeps moving along and has delivered gains of nearly 300% since March of 2009.

Photo Credit: 401 (k) 2012 via Flickr Creative Commons