In most cultures, families grow up with a basic principle of reliance on one’s elders.

Each generation depends on the previous one to provide, instruct and guide.

In my view, a well-functioning society is composed of people, structures, and institutions that are dependable.

Trust

One thinks of the police, military, schools, hospitals, doctors, lawyers, and even the government.

When these entities wobble because of inconsistent behavior, people lose faith.

That’s why there is such a lack of trust in American institutions, in my opinion.

Reliability

From an investment point of view, a similar line of thinking applies to stock market performance, in my opinion.

When a company reports earnings every three months, if it meets or exceeds its guidance quarter after quarter, investors gain confidence in the management team and business.

Conversely, if every quarter smells like rotten eggs and there are unexpected shocks, you lose enthusiasm.

Utilities

From a portfolio structure point of view, this is why utilities are considered “widow and orphan” stocks.

Consumers general pay their electric bills.

All this reminds me of Warren Buffett’s old adage that if you don’t want to own a stock for 10 years, you probably shouldn’t for 10 minutes.

In other words, investors should think about buying stocks for the long haul.

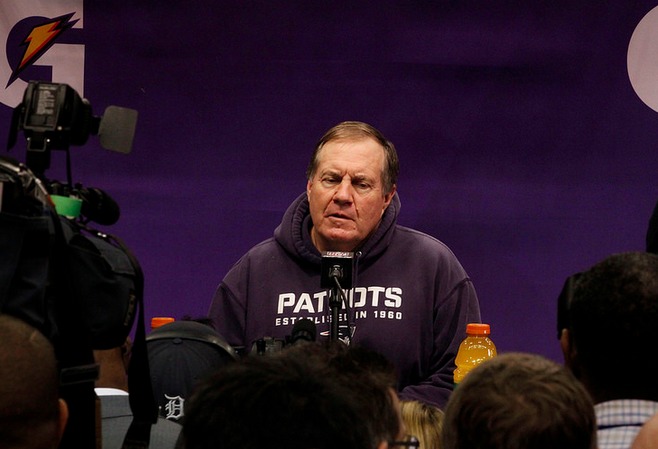

Belichick Speaks

Anyway, I bring this up because of a very useful video interview with Bill Belichick, the head coach of the New England Patriots, that appeared on CNBC.com.

He talked about the 5 attributes of leadership.

The biggest one? Reliability.

Photo Credit: WEBN-TV via Flickr Creative Commons