As we began the year, many investors thought the seven-year stock rally had ended. Not so it turns out.

US stocks gained 1.4% in the first quarter, although foreign markets declined 3% as measured by the EAFE Index.

Continuing into the second quarter, the US market earned another 2.5%, bring the year-to-date return to 4% as of the end of the first half.

The markets have grown more volatile, following the surprise Brexit vote. I’m sticking with my forecast for a double-digit loss in the US stock market in the coming year.

Stay Diversified

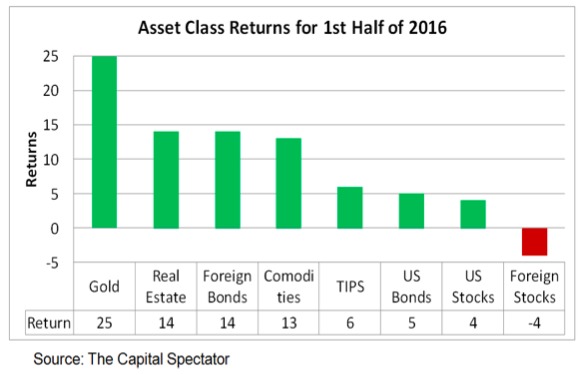

Interestingly, diversification worked in the first half, with gold, real estate, foreign bonds and commodities performing quite well, much better than stocks.

Looking at both US and foreign stock market performance, it’s clear that most market segments came through pretty well in a challenging environment.

U.S. Stocks

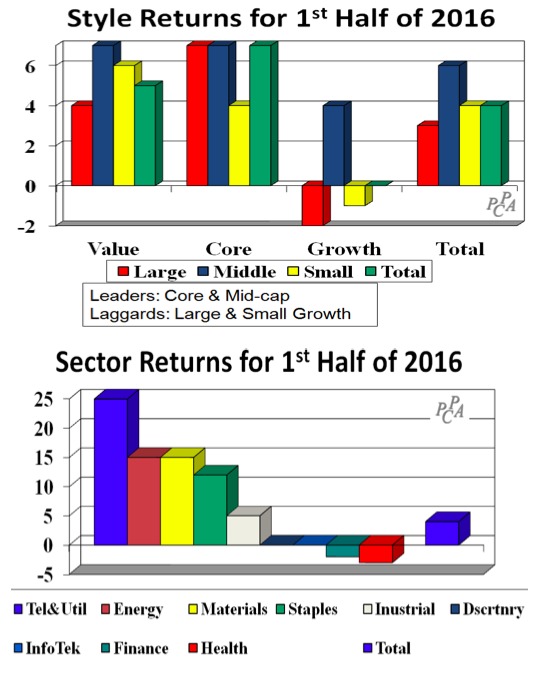

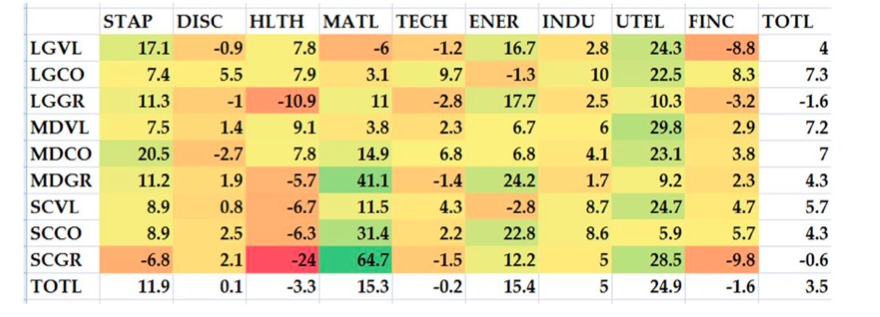

The stuff in the middle performed best in the first half of 2015 with mid-cap outperforming large and small-cap, and core outperforming value and growth.

Style performance ranged from a high of 7% for several styles to a low of -2% for large-cap growth.

The performance range across sectors was even larger. Telephone-and-utility companies earned a substantial 25% return, while healthcare firms lost 5%. That’s a 30% spread.

Foreign Stocks

Looking outside the US, foreign markets earned 1% in US dollar terms, lagging the US stock market’s 4% gain but exceeding EAFE’s 4% loss.

Unlike the US, where mid-cap companies have fared best, smaller companies have performed best outside the US, earning 4% while larger companies have been flat.

But like the US, core stocks have led with a 3% gain, while growth stocks have lost 3%.

Latin America and Canada have left the rest of the world in their dust, earning double digit returns of 18%, while the next best countries earned only 5%, albeit edging out the US.

Outlook

It just keeps getting better, until it doesn’t in my opinion.

After seven years of extraordinary growth, stock markets are showing signs of weakening. No one knows what lies ahead, but we all have outlooks on the economy and the stock market, and adjust our thinking as results roll in.

Photo Credit: Scrubhiker (USCdyer) via Flickr Creative Commons