First-quarter 401(k) account statements will be arriving in mailboxes in a few short weeks. When they do, a lot of Americans will wonder why they even bothered contributing.

For all of the day-to-day noise, the market is going to finish the quarter pretty much where it started. And to think, the market hasn’t even crashed yet.

Running on a proverbial treadmill like that is frustrating, and I’d love to tell you to expect better returns for the rest of the year.

Tough Market

But, based on where stocks are priced today, I wouldn’t get your hopes up.

Looking at the cyclically-adjusted price/earnings (CAPE) ratio, the S&P 500 is priced to deliver annual returns of zero… over the next eight years.

You’ve no doubt heard the conventional wisdom that stocks “always” return 7%-10% over the long-term.

Well, that’s certainly been the case up until now… and will probably be the case going forward.

Lackluster Returns

But again, we’re talking over the long-term, which in the world of financial planning might mean 30 years. In the interim, the results can look a lot different.

From September 1996 to March 2009 – a period of more than 13 years – the S&P 500 went nowhere. And not to be outdone, old timers that survived the bear markets of the ‘70s might remember that the market went nowhere from 1968 to 1982.

And that’s before adjusting for inflation.

Adjusting for inflation, it would have been well into the 1990s before investors saw a positive return on their 1968 investments!

Time’s End

So again, while stocks “always” return 7%-10% over time, there can be long stretches when returns come nowhere close to that.

And based on today’s valuations, we may well be at the front end of one of those periods today.

So… what should you do with your savings?

Well, to start, you should max out your 401(k) plan at work.

Max Out

You might want to read that last sentence again. Yes, I am recommending (if I had the authority, I would say I was ordering) that you put every last penny you can afford to save into your company 401(k) plan.

And I say that fully expecting the returns on most mutual funds to be terrible in the years ahead.

Even with a bleak market outlook, your 401(k) plan is likely to be your best bet at earning a reasonable return.

Remember, investment returns are only part of your total “effective” returns. These can be broken down into:

- Investment returns

- Employer matching

- Tax benefits

Let’s say you keep your entire 401(k) balance in a money market or stable value fund earning a big fat zero in returns.

Well, guess what? The other two sources of return are looking pretty good.

Matching Power

Let’s start with matching. This will vary from employer to employer but usually falls into a range of 3%-6% of your salary.

If your employer is matching you dollar-for-dollar, your effective return on the portion they match is 100%. You’ve doubled your money as of day one.

The tax benefits are also nothing to take lightly. Every dollar you pay to the government in taxes is a dollar you no longer have.

Tax Savings

Frankly, I’d rather run my money through a paper shredder one dollar bill at a time than give it to the government.

But every dollar saved from taxes by stuffing it in a 401(k) plan is a real addition to your wealth. If you’re in the 25% tax bracket, then you’ve effectively “earned” 25% on the salary you defer into your 401(k) plan.

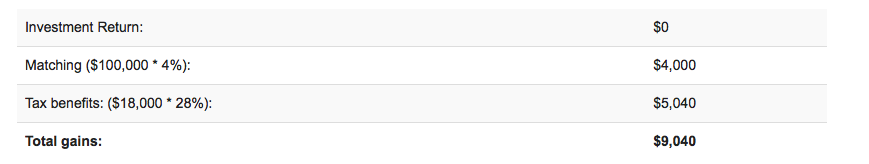

Let’s use real numbers. Say you earn an even $100,000 per year and that you’re in the 28% tax bracket. You’re disciplined and you manage to defer the full $18,000 per year… and you keep the funds in a money market fund earning effectively nothing.

Your employer is fairly generous and matches you at 4%. Here’s how the numbers shake out:

You just made a 50% “return” on your $18,000 contribution… without putting a dollar at risk in the stock market.

So I’ll repeat. The market may not offer much in the way of upside.

But it still makes all the sense in the world to stuff every dollar you can get your hands on into your company 401(k) plan.

Photo Credit: Ken Teegardin via Flickr Creative Commons