“In these matters the only certainty is that nothing is certain.”– Pliny the Elder

Uncertainty paralyzes. When we don’t have certain knowledge, our inclination is to stand still, observe and do nothing. When we know more, we act.

In hindsight, everything is clear. Looking backward doesn’t tell us what will happen next, but past experience helps to frame our understanding of the future.

For example, the average market correction since December 1949 is -14% with the average correction lasting 120 days.

Perspective

The average gain following a market correction is 47% (median gain is 32%) lasting an average of 495 days.

From peak (July 20, 2015) to trough (Jan 20, 2016), the S&P 500 was off -7.9% on a total return basis. For the month of January, the S&P 500 was off 5.0%.

The year began poorly with market fears related to the continued drop in oil prices, slowing growth in China and the strong dollar.

Wild Cards

This created uncertainty in the short term which fed negative investor sentiment and poor equity market returns.

We expect continued uncertainty related to the US election, emerging market currencies, the direction of oil and the dollar and liquidity concerns in low-grade segments of the bond market.

However, in my opinion, a good earnings season, lower PE valuation ratios and the long-term positive impact of low oil prices may offset these fears in 2016, leading to low single-digit equity returns in 2016, albeit with a lot of volatility and uncertainty.

Global Equities

| Stock Indices | Jan 2016 | 2015 |

| Global, All Country (MSCI ACWI) | -6.0% | -2.4% |

| US Large Cap (S&P 500) | -5.0% | 1.4% |

| US Small Cap (Russell 2000) | -8.8% | -4.4% |

| Non-US Developed (MSCI EAFE) | -7.2% | -0.8% |

| Non-US Emerging (MSCI EMG) | -6.5% | -14.9% |

| Gold Bullion | 4.7% | -11.4% |

Source: Island Light Capital

China Syndrome

Global equity markets dropped sharply in January with the MSCI All Country World Index (MSCI ACWI) off -6.0% extending 2015 losses of -2.4%.

US large cap equity markets again outperformed other major equity classes; non-US developed and emerging markets lost more, smaller cap stocks were hard hit.

European and Pacific region indexes were hit hard by China fears, as cross-border trade is a relatively larger component of these economies than in the US. US Large Value modestly outperformed US Large Growth.

The only positive sectors in the S&P 500 were utilities (4.9%) and consumer staples (0.4%). The worst performing sectors were financial (off 8.9%) and materials (off 10.7%).

Domestic Fixed Income

| Barclays Bond Indices | Jan 2016 | 2015 |

| US Aggregate | 1.4% | 0.6% |

| US Treasury 20+ yr | 5.2% | -1.6% |

| US Treasury TIPS | 1.5% | -1.4% |

Source: Island Light Capital

Bonds

Fixed-income investors realized positive performance in January as interest rates dropped.

The 10-year US treasury plunged 30 basis points, 2.27% to 1.94%, moving longer duration bonds higher. We also observed widening credit spreads, which hurt high-yield and investment-credit bonds.

Inflation-protected bonds returned in line with the US aggregate bond index.

Macro View

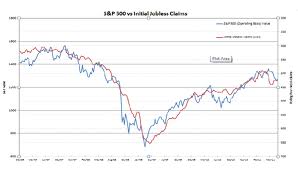

Market sentiment has gone decidedly negative since the beginning of the year. As oil prices plunged below $30 to the lowest level in twelve years, fears of contagion spread into the energy, materials and financial sectors.

Global deflationary fears returned in force leading to a drop in global interest rates. On the last day of the month, the Bank of Japan surprised markets by pursuing negative interest rates, joining a handful of European countries (Denmark, Switzerland and Sweden).

This divergence in foreign monetary policy from US policy is causing disruption in currency markets and a stronger dollar.

Add geopolitical uncertainty and, in my opinion, we get a flight from investment risk.

US Economy

The major drivers of global equity returns are the state of the global economy, the actions of the central banks, company fundamentals and valuations.

The US economy is still growing in the low 2% range annually, despite a slowdown in the fourth quarter. Ex-US central bank actions remain accommodative, which are net positive for stock appreciation and global liquidity.

Earnings weakened in the fourth quarter, particularly in the energy sector but most analysts still believe that earnings growth will be forthcoming and thus far in the quarter, company earnings have been at or above estimates.

This leaves us with valuation, or investor sentiment. At year end, forward PE was at 16.1 times earnings versus the 20 year average of 17.2 times earnings.

In my opinion, valuations are not stretched at this juncture, but on the other hand, equity risk seems to be increasing which might justify a lower PE.

Summary

Uncertainty paralyzes. While we are not certain of the current direction of markets, we do have confidence that our diversified portfolios should give us opportunity for gain while limiting exposure to losses.

There is a chance that January is the continuation of a long stretch of negative returns, beginning last August, such as we saw from 2001 to 2003.

However, we think there is a better chance that the US market recovers to low single-digit returns by year end. Given these two possible scenarios, we have moved equity exposure to our benchmark targets.

From these neutral diversified positions, we will remain cautiously optimistic and look for short term recovery.

Photo Credit: Vic via Flickr Creative Commons