It’s an article of faith among many investors that when interest rates rise, bond prices fall all things being equal.

So will bond investors duck for cover if the Federal Reserve Bank raises US interest rates at its December 16-17 policy board meeting, as widely forecast?

Not necessarily. Much depends on the type of bond and maturity as well as the overall economic climate heading into 2016.

Junky Returns

If you are an investor in junk bonds–as in high yield, below investment-grade bonds–there may be reason for concern.

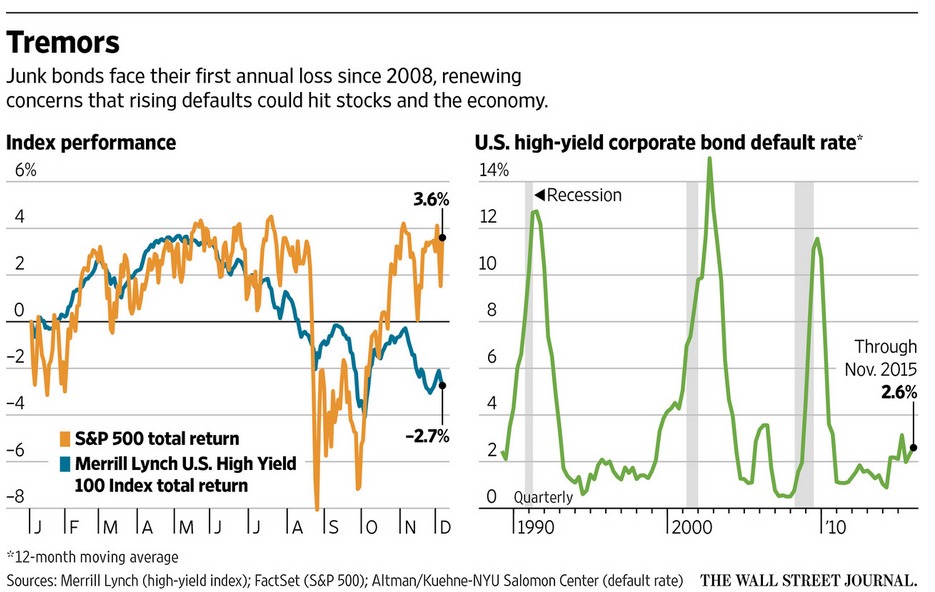

Junk bonds are already on track to post their first annual loss since 2008.

What’s more, corporate defaults are also on the rise. That’s not a welcome development for junk bond holders.

Spreading Pain

And the defaults aren’t just coming from the obvious suspects in the oil patch suffering from the energy price slump around the world.

As a recent Wall Street Journal article points out:

“The selling has spread beyond firms hit by the energy bust to encompass much of the lowest-rated debt across the market, potentially snarling some takeovers and making it difficult for all kinds of companies to borrow new funds.”

Don’t Panic

That said, if you have part of your portfolio in an investment-grade, medium- or long-term maturity bond fund, you probably shouldn’t panic.

First off, the Fed is likely to move glacially on rate increases in 2016 and 2017.

Remember, too, that interest rates are currently hovering at near-zero levels.

Second, while returns on some bond funds will suffer early on as interest rates start to rise, that won’t always be the case.

Portfolio Rotation

A smart bond fund portfolio manager is going to replace old bonds with new ones offering higher interest rates from the abnormally low levels of today.

Eventually, these newer, higher yielding bonds will reward investors.

Fund giant Vanguard worked up some projections looking at the returns of a hypothetical intermediate-term bond funds.

Rebounding Returns

Vanguard assumed the Fed will come forward with 0.25% rate increases every quarter through July 2019.

The result? The fund would lose a modest 0.15% in 2016 but then move into positive territory going forward.

The Vanguard figures are total returns including price change and income.

So if you have a time horizon that extends beyond a year or two, the Fed’s shift to a tighter monetary policy need not be a disaster for your bond portfolio.

Takeaway

Big swings in monetary policy can be a tricky time for bond investors.

Yet with the Fed ready to raise rates for the first time in roughly a decade, the impact on bonds will not be uniform.

Junk bonds are risky, but medium- and long-dated bond funds may still be worth a serious look.

Photo Credit: FutUndBeidl via Flickr Creative Commons