First came the slowdown, then a stock market rout and finally a surprise currency devaluation.

China has delivered plenty of shocks to the global financial system this year, especially emerging markets.

In Asia, China has been the giver of economic life.

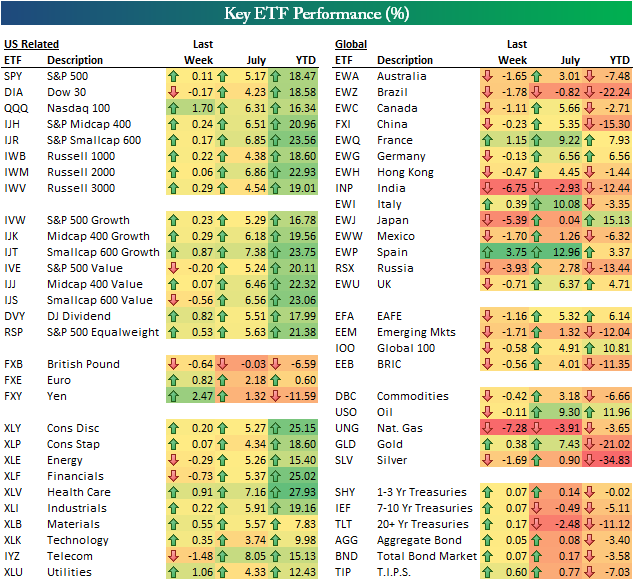

Export Dependency

Now, a Chinese economic slump from double-digit growth rates to about 7% is being keenly felt among the Asian giant’s trading partners in the region.

Taiwan, South Korea, Malaysia and Vietnam, whose own currencies are weakening, rely on exports to China for a sizable chunk of their total economic output.

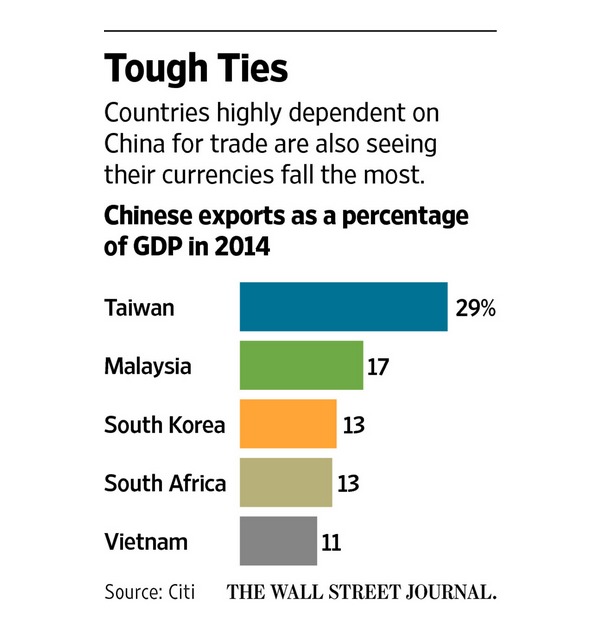

Race to Bottom

On top of that, there’s the prospect of competitive devaluations in Asia following China’s recent move to lower the value of its currency, the yuan, by about 3% versus the dollar.

In response, Taiwan lowered the rate it pays commercial banks for overnight deposits. That policy change resulted in its currency falling down 2% in two days.

Vietnam widened the band in which it allows the dong currency to trade, leading to a 1.2% loss over three days.

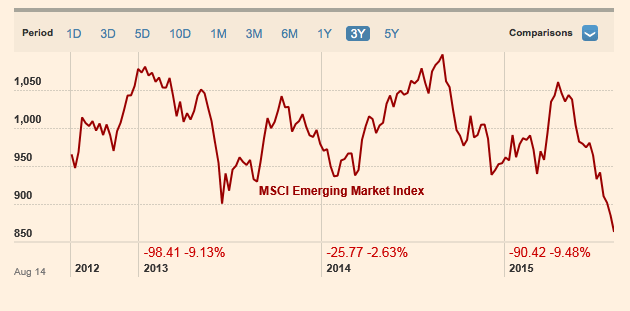

Bear Market

Emerging market stocks have been getting creamed for weeks.

As of August 14, the MSCI Emerging Markets Index was trading in bear market territory. It down more than 20% from its peak in September.

Takeaway

The prospect of a slower growing China is being felt around the world.

It poses a particular challenge to emerging markets, especially in Asia.

Taiwan, South Korea, Malaysia and Vietnam face some tough months ahead.

It all adds up to bad news for the entire world economy.

Photo Credit: Thangaraj Kumaravel via Flickr Creative Commons