The Island Light Sector Rotation portfolio was updated for the month of June as part of our regular rebalancing. The strategy, which employs an advanced algorithm for capturing market momentum in an optimized portfolio of US sectors, is the latest in a series of innovative dynamic portfolio models offered by Island Light.

For the month of August, we increased our exposure to the US consumer staples, energy, industrials, materials, and technology sectors, reduced exposure to financials, and eliminated investments in the utilities, healthcare and consumer discretionary sectors. We increased our overweight position to consumer staples relative to the S&P index weights.

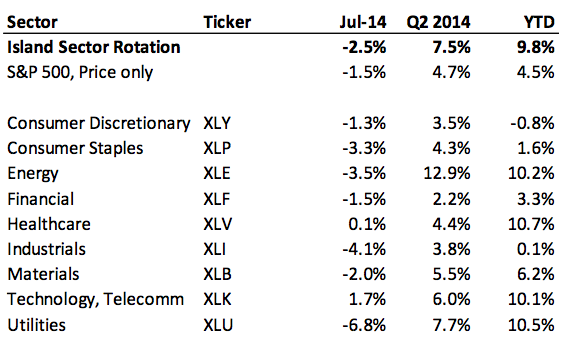

The following table reflects the performance of our strategy, the S&P 500 Index (SPX) and the 9 sector ETFs that comprise our investment universe, through July 31, 2014:

To learn more about investing with the portfolio managers on Covestor, contact our Client Advisers at clientservices@interactiveadvisors.com or 1.866.825.3005. Or you can try Covestor’s services with a free trial account.

DISCLAIMER: The investments discussed are held in client accounts as of July 31, 2013. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable. Past performance is no guarantee of future results.