U.S. investors kicked off their Fourth of July celebrations one day early as the Dow Jones Industrial Average hit 17,000 for the first time in history.

The Dow climbed to a fresh record after upbeat employment data showed the economy continues to slowly recover.

Also, monetary pyrotechnics from central banks have helped light a fire under financial markets.

Indeed, the market has been resilient as geopolitical instability around the world, from Ukraine and Thailand to Syria and Iraq, has hardly made a dent.

The Dow breaking through 17,000 signals ““continuation of a bull market,” said Gary Kaltbaum, president of Kaltbaum Capital Management, in a USA Today report. “I am not a big round number person, but I guess it has meaning.”

The SPDR Dow Jones Industrial Average ETF (DIA) is up about 4% so far this year even though the global economy is far from peak condition.

What explains the disconnect? One of the biggest reasons is that the world’s major central banks in the U.S., Europe and Japan continue to pump unprecedented amounts of liquidity into the global economy and markets.

While the U.S. Federal Reserve has consistently reduced its purchases of bonds, Fed chief Janet Yellen has made it clear that she and her colleagues aren’t in rush to raise interest rates. Nor is the European Central Bank, which is experimenting with negative interest rates on deposits, or the Bank of Japan.

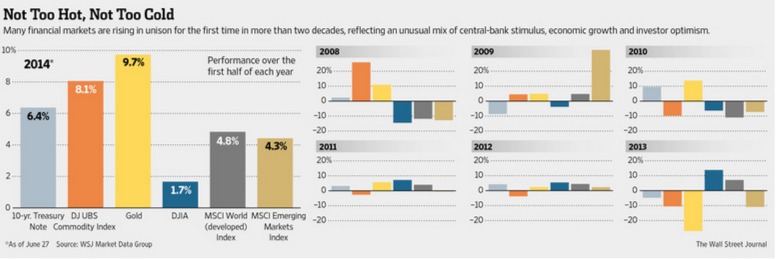

As a result, an impressive array of asset classes advanced in the first half of 2014, as the Wall Street Journal pointed out in the chart below. Through June 27, gold was up 9.7%, while the Commodity Index advanced 8.1%, the 10-year U.S. Treasury note 6.4%, the MSCI World Index of developed-world shares 4.8% and the MSCI Emerging Markets Index 4.3%.

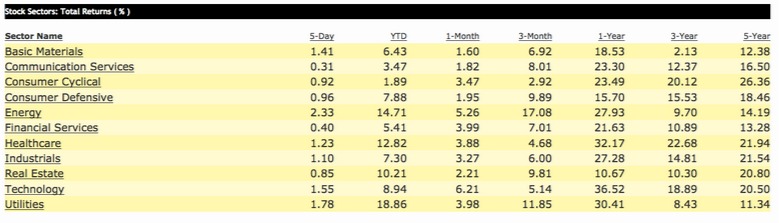

Within in the U.S. stock market, sectors such as energy, healthcare, real estate and utilities all registered double digit gains during the first half. Here’s a breakdown by Morningstar of best performing sectors as of June 27, 2014:

As for individual stocks, blue chip stocks such as Intel (INTC), Cisco Systems (CSCO), Caterpillar (CAT), Merck (MRK) and Walt Disney (DIS) are clocking in with double digit gains and outperforming broader market indices such as the Dow Jones Industrial Average by a wide margin.

Not everyone thinks the market rally is a sure thing going forward. For one thing, there is no statistically significant correlation between returns in the first and second half of the year.

And while a sudden shift toward monetary tightening is unlikely, there are worries about the strength of the U.S. economy even though employment data has been picking up. The U.S. economy contracted at an annualized 2.9% in the first quarter, the most since the depths of the last recession as consumer spending cooled. The International Monetary Fund recently cut its 2014 U.S. economic growth forecast to 2% from 2.8%.

At some point, investors may need to factor in whether a sluggish U.S. economy can grow fast enough to keep corporate profits expanding at a fast enough pace to justify current valuations. The trailing price-to-earnings ratio of S&P 500 is 19 and 22 for the Nasdaq, both up from last year.

For now, though, the global investors seem more focused on monetary stimulus than underlying fundamentals despite the risks ahead.

DISCLAIMER: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. All investments involve risk, the amount of which may vary significantly. Past performance is no guarantee of future results.