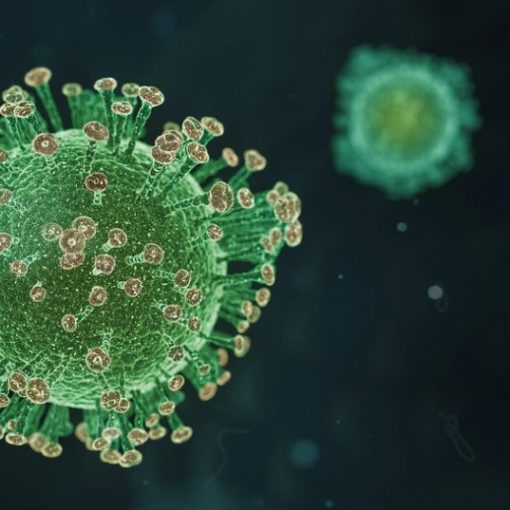

Unlike 2013, diversification worked in the first quarter of 2014. As revealed in our 2013 market commentary, U.S. stocks dominated with a 32% return while diversifying assets like commodities lost 10%. In my opinion, diversification didn’t work in 2013.

This year, diversification into real estate and commodities was handsomely rewarded in the first quarter.

Drilling deeper, there were also some reversals within U.S. and foreign stock markets, as described below. But momentum was not entirely dead. Some segments and styles continued the trends they manifested in 2013. There’s plenty in the first quarter for the momentum investor as well as the regression-to-the-mean investor.

Like 2013, smaller stocks, especially small growth companies, led the way in the quarter, with mid-caps earning 3%. By contrast, large growth and small core companies earned nothing.

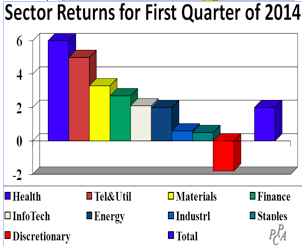

On the reversal front, large and mid-cap core were better performing styles in the quarter, whereas they lagged in 2013. On the sector front, health care and telephone-and-utility stocks fared best, earning 6% and 5% respectively. By contrast, consumer discretionary stocks lost 2% in the quarter, reversing 2013’s dominance, having earned 45%.

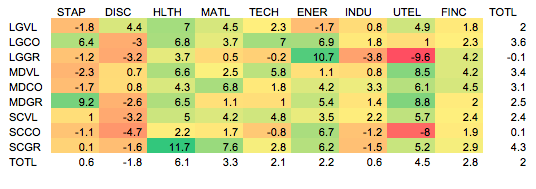

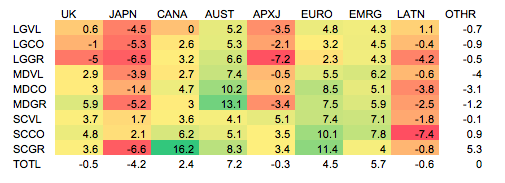

But the interesting details lie in the cross-sections of styles with sectors, as shown in the following heat map. A heat map shows shades of green for “good,” which in this case is good performance relative to the total market. By contrast, shades of red are bad, indicating underperformance. Yellow is neutral.

In the table below, we see that the best performing market segment was comprised of small-cap growth companies in the healthcare sector, earning 11.7%. And the worst performing segment was large cap growth in the utilities sector, losing 9.6%.

Many quantitative managers employ momentum in their models, buying the “green” and selling the “red.” Non-quants, also known as fundamental managers, use heat maps as clues to segments of the market that are worth exploring, for both momentum and reversal potential.

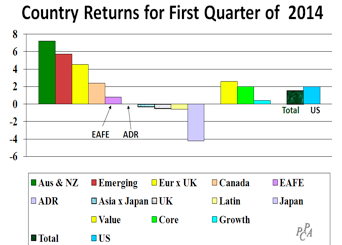

Looking outside the US, foreign markets earned 1.5%, lagging the U.S. stock market’s 2% return during the first quarter of 2014. Europe, Australasia, Far East (EAFE) lagged the total market with a 0.8% return because it is underweight the better performing regions of Australia-and-New-Zealand and Emerging Markets.

In another reversal, this quarter’s leaders were among last year’s laggards. Japan was the big story, losing 4%, reversing 2013’s outperformance of 40%. The Japanese stock market soared last year as the yen was purposely weakened against the dollar.

Like the U.S., further insights into market behavior are provided by heat maps, as shown in the following. As you can see, Latin America was red in almost all styles but actually had the best performing technology stocks, with a 13.4% return.

We all have outlooks on the economy and the stock market, and adjust our thinking as results roll in. I personally remain surprised and grateful that stocks have performed so well in the past 5 years.

As 2014 has unfolded so far, bargain hunting has won, and asset flow has lost. You can use the information above to test your personal outlooks, to see which are unfolding as you think they should and which are not, with the intention to clear the haze from those crystal balls.

On the sector front, health care and telephone-and-utility stocks fared best, earning 6% and 5% respectively. By contrast, consumer discretionary stocks lost 2% in the quarter, reversing 2013’s dominance, having earned 45%.

But the interesting details lie in the cross-sections of styles with sectors, as shown in the following heat map. A heat map shows shades of green for “good,” which in this case is good performance relative to the total market. By contrast, shades of red are bad, indicating underperformance. Yellow is neutral.

In the table below, we see that the best performing market segment was comprised of small-cap growth companies in the healthcare sector, earning 11.7%. And the worst performing segment was large cap growth in the utilities sector, losing 9.6%. Many quantitative managers employ momentum in their models, buying the “green” and selling the “red.” Non-quants, also known as fundamental managers, use heat maps as clues to segments of the market that are worth exploring, for both momentum and reversal potential.

DISCLAIMER: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. Past performance is no guarantee of future results.