Bitcoin’s success as a form of currency isn’t likely to have any direct impact on my business or my daily life. I expect that Wall Street will continue to operate largely untouched by Bitcoin.

Bitcoin isn’t the answer to a question that anyone on Wall Street has asked.

As for my daily life, I’m content to continue using credit and debit cards because of the issue of recourse. If my card is stolen, my liability is capped at a relatively modest amount.

Bitcoin, however, as a bearer instrument, offers no such recourse. If I had a Bitcoin wallet and it was stolen or compromised, then it’s no different than a street-corner hold-up. It’s gone, probably forever.

I am glad to see Bitcoin make strides as a competitive replacement for Visa, MasterCard and other forms of cashless payment, only because the competition will pressure the latter players to keep transaction fees low.

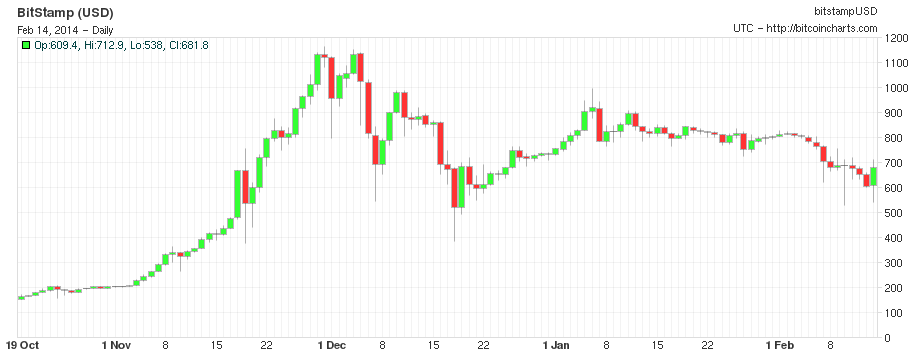

For the competitive reasons, local merchant acceptance can only help me, a potential customer. But for a local merchant to use Bitcoin, she or he opens themselves to certain forms of currency risk, made worse by Bitcoin’s volatility.

Source: BitcoinCharts.com

Source: BitcoinCharts.com

If the merchant buys a substantial amount of raw material priced in Bitcoin, and then Bitcoin loses value vis-a-vis, say, the U.S. dollar, the resulting sales revenue might suddenly be substantially less than the value of the raw material, resulting in an avoidable loss. So businesses will need to think about this risk before deciding how committed they might be to using Bitcoin.

One place that Bitcoin may find ready use will be in developing countries, where farmers and small merchants will be able to do transactions using Bitcoin, rather than using cash which might be more dangerous, or utilizing money transfer agents. Bitcoin’s cross-border functionality would come in very handy for small merchants unwilling or unable to make profitable transactions with customers and suppliers doing business in a different currency.

I think that Bitcoin will become more popular and more widely used. But I think it will be most useful as a store of value – a kind of ‘e-Gold’ – than as a functional currency for the reasons I have already mentioned. It will continue to have method-of-transfer uses (e.g. Chinese nationals moving wealth out of that country) but not widespread transaction usage. So long as the underlying encryption is not compromised, then there is probably a place for Bitcoin in the global economy.

Photo Credit: PerfectHue

Disclaimer: All investments involve risk and various investment strategies will not always be profitable. Past performance does not guarantee future results.