Lumber Liquidators (LL) represents one my Covestor “Growth and Momentum” models’ largest holdings. (This model was formerly called “Buy and Hold Value” but was renamed to reflect the underlying strategy more accurately.)

After a long period of weakness, the real estate market in America is starting to rebound and recent housing starts reports are encouraging. Companies that are involved in housing construction and renovation appear to be on a roll and these include stocks like Home Depot (HD) and Beacon Roofing (BECN) among others that have shown tremendous price strength. (I do not currently own shares of HD or BECN.)

On February 20, 2013, Lumber Liquidators announced earnings for the quarter ended December 31, 2012. As the Motley Fool site reported, the company reported revenue of $210.7 million, beating expectations of $197.4 million. These sales were up by 21% over the prior-year same quarter result of $174.5 million.

Earnings came in at $.50/share and were also easily ahead of expectations of $.43/share. The GAAP earnings of $.50 were also ahead of the prior year’s results of $.30/share by 67%. Certainly strong growth in financial results that are also ahead of what analysts are expecting are a good sign from my perspective for a stock that might be appreciating in price going forward to ‘adjust’ for the new financial results. And the stock did exactly that!

Reviewing the Morningstar.com ‘5-Yr Financials’ on Lumber Liquidators (LL), we can see that the company has been steadily growing revenue results from $482 million in 2008 to $813 million in 2012. Earnings during this period have grown nicely from $.82/share in 2008 to $1.68/share in 2012, although growth in earnings was relatively stagnant between 2009 and 2011.

Outstanding shares have been very stable with 27 million fully diluted shares according to Morningstar in 2008 and and increase to 28 million by 2012.

Looking briefly at the Morningstar-provided balance sheet reveals the company with $288 million in total current assets balanced against $101 of total current liabilities yielding a current ratio of 2.85. From my perspective a current ratio of over 1.0 is adequate and over 2.0 quite ‘healthy’ in terms of the ability to meet current cash needs to pay liabilities.

Morningstar reports that free cash flow has also been improving recently with $2 million reported in 2008, dipping to $(4) million in 2010 and then improving to $27 million in 2011 and $34 million in 2012.

Financially, the latest ‘good results’ reported in the latest quarter do not appear to be an unusual or exceptional development. The company has been doing a good job growing revenue and earnings, free cash flow, and maintaining a healthy balance sheet.

In terms of valuation, we can see from the Yahoo “Key Statistics” on Lumber Liquidators (LL) that with a market capitalization of $1.91 billion, this is a small cap stock. (For comparison, we can see that Home Depot (HD) has a market cap of $103.2 billion, more than 50x the size of Lumber Liquidators).

Lumber Liquidators (LL) has a trailing p/e that is certainly ‘rich’ at 41.80 and even with the rapid growth expected, the forward P/E (fye Dec 31, 2014) still comes in at 27.01. Thus the PEG works out to a fairly rich 2.18. (I generally prefer to pay up to a PEG of 1.5 for a stock.)

Yahoo reports that there are 27.16 million shares outstanding with 25.84 million that float. As of February 28, 2013, there were 4.17 million shares out short representing a short interest ratio of 5.4 days of average trading volume, ahead of my own ‘3 day rule’ for significance. A large short interest ratio may be a bullish indicator if the company actually reports an unexpected piece of good news forcing the short sellers to buy shares in a ‘squeeze‘.

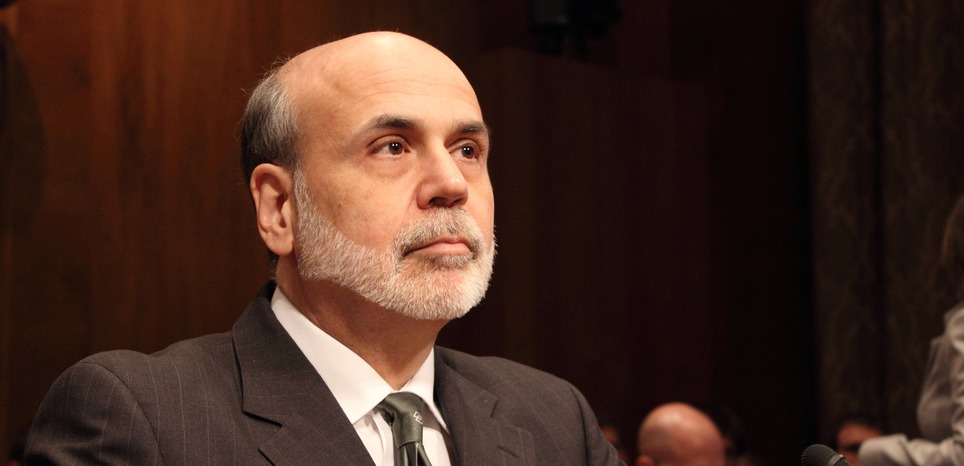

To summarize, the American economy has been in a ‘funk’ for several years since the financial crisis of 2008. With Congress in a stalemate unable to act to provide a fiscal stimulus, Ben Bernanke and the Federal Reserve have been utilizing quantitative easing and associated monetary policy to keep interest rates low and encourage economic activity.

With economic weakness and an accommodative Federal Reserve, rates have stayed low and one of the key beneficiaries of this policy has been the housing market which indeed is starting to come alive.

Lumber Liquidators (LL) is sitting in the middle of this rebound and is a company and a stock that has been helped by the real estate mini-boom developing.

The investments discussed are held in client accounts as of March 31, 2013. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.