As we head into the second quarter of 2013, let’s take a step back and note the macro trends reshaping the contours of the global economy and therefore investment decisions. Here are five trends worthy of notice:

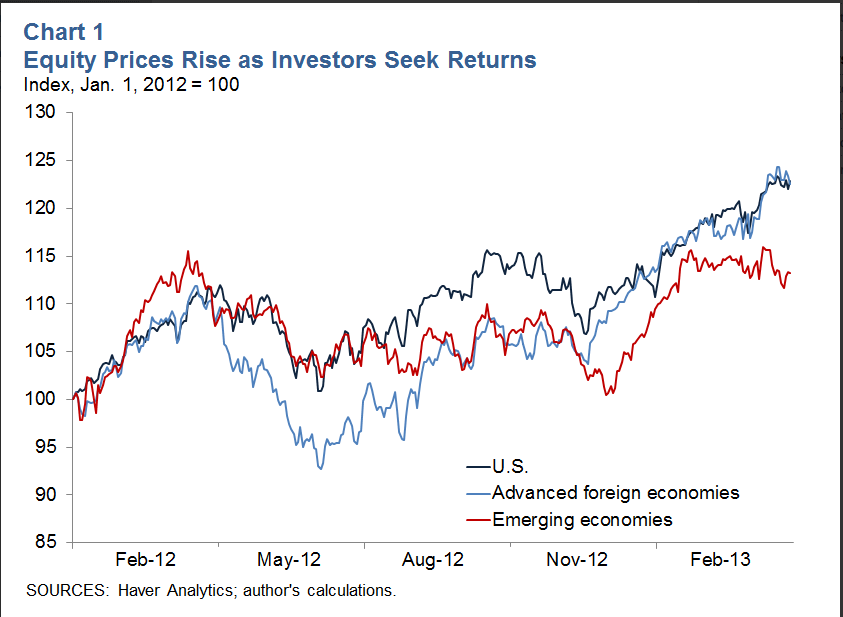

1) Global Bull Market: This has been a great year for stocks so far, particularly in Japan, where the benchmark Nikkei 225 Index (JP: NIK) is up nearly 27% year-to-date through April 8. Is this the real deal? Skeptics aplenty (see here and here) argue the worldwide stock rally is just a giant sugar buzz thanks to ultra-loose monetary policy in the U.S., EU, and Japan. (More on Japan in a minute.)

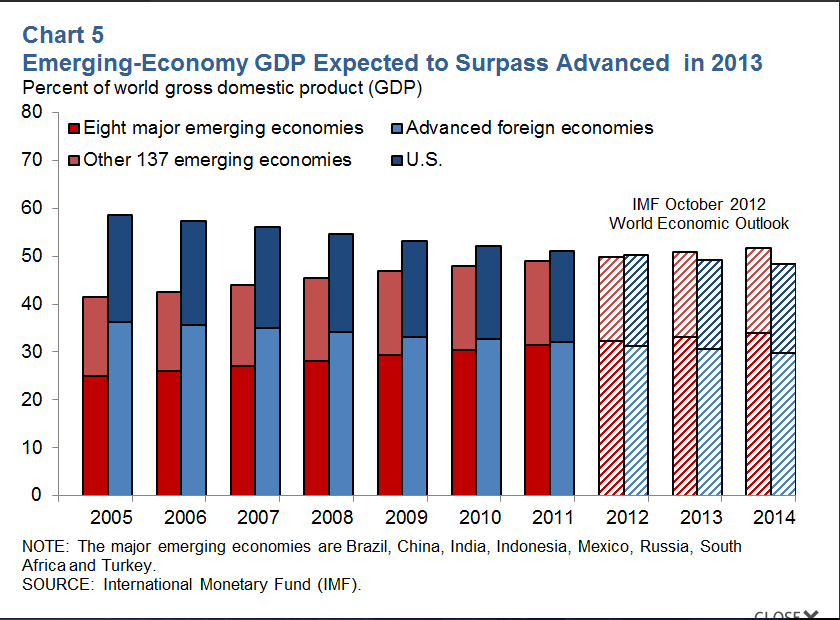

2) Emerging Economies Rise: With advanced economies in the U.S., Europe and Japan dealing with gargantuan debt loads, developing economies are picking up the slack. Brazil, Russia, India, China and South Africa alone have been responsible for 55% of global growth since the end of 2009, the Economist points out.

On top of that, Turkey, Indonesia, Mexico and other emerging economies growing at a fast pace. This year, the culmulative GDP of the emerging markets counted in this paper by the US Federal Reserve Bank of Dallas will overtake that of advanced nations’ economic output.

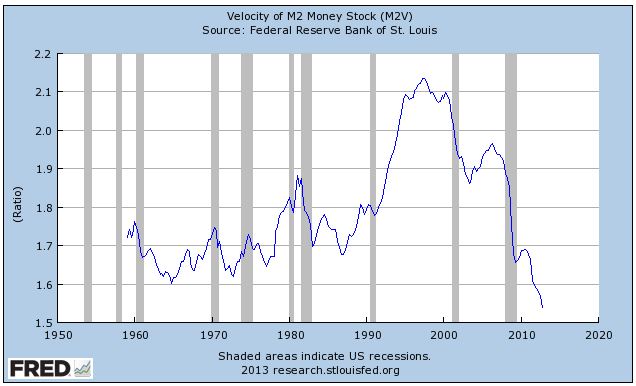

3) US Structural Employment: While the Dow Jones Industrial Average (INDU) and S&P 500 Index (SPX) have hit record highs this year, Americans are still struggling to find jobs. The latest read on U.S. employment was deflating. Barry Ritholtz at The Big Picture thinks that a structural unemployment gap has emerged in the U.S. economy. His take: “It appears that some people are making the decision that rather accept low paying jobs or doing “menial” labor, they prefer to not work at all. Hence, the declining labor pool.”

The impact on unemployed (or underemployed) individuals is clear. The systemic impact is that despite the Fed pumping huge amounts of money into the system, nobody’s spending it:

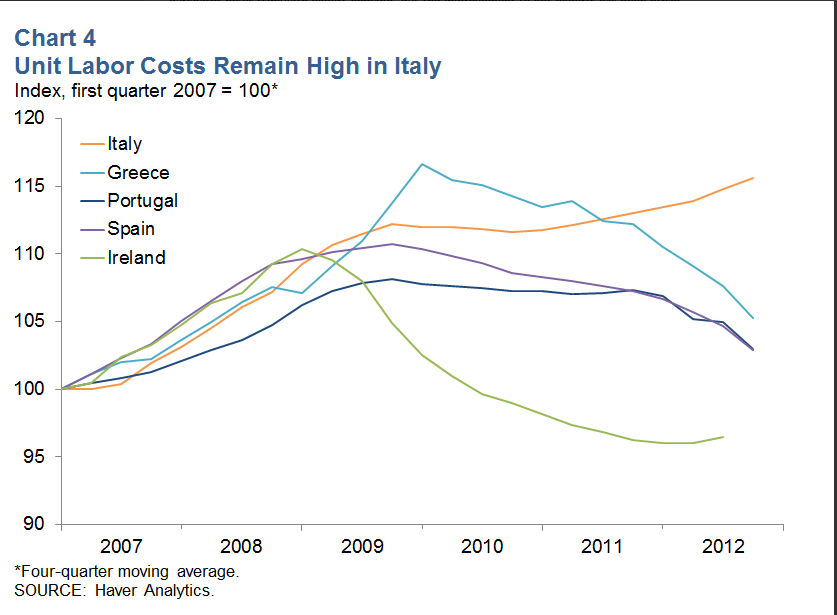

4) Southern Europe: A split decision in last month’s Italian elections sent bond yields soaring on worries government gridlock will prevent Italy from getting its debt burden down to manageable levels. Another worry: Italy’s high labor costs are totally out of line with other EU crisis countries.

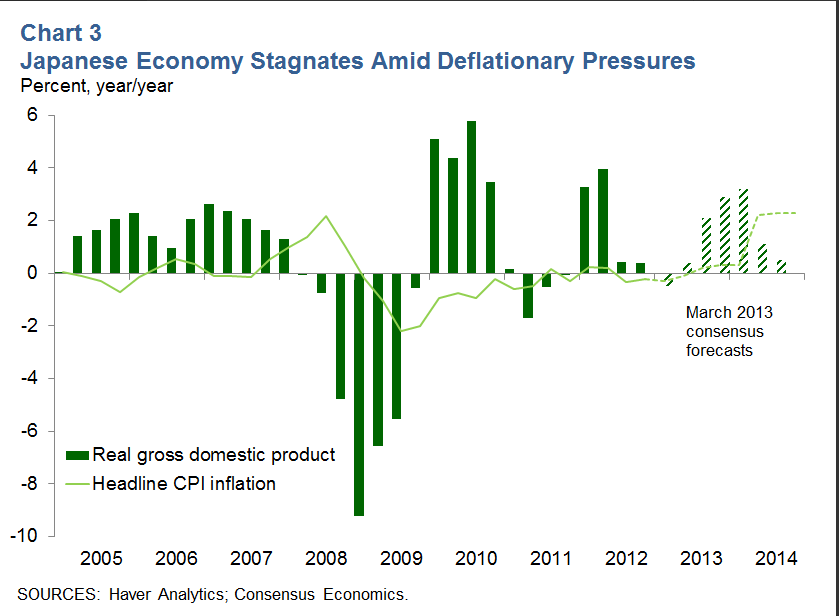

5) Japan: The Bank of Japan surprised global investors by announcing shock and awe monetary targets in a bid to boost the economy. The BOJ’s new governor, Haruhiko Kuroda, aims to double the country’s monetary base by 2014 through increased purchases of Japanese government bonds.

The planned ¥7.5 trillion ($75 billion) of monthly bond purchases would expand the bank’s balance sheet at a rate faster than that of the U.S. Federal Reserve, according to Masaaki Kanno, a former BOJ official and chief economist at JPMorgan Securities Japan (JPM). But to understand what the Japanese are up against, take a look at this chart.

Wall St. bull image: Herval