Yesterday, February 27, shares of the professional networking service LinkedIn (LNKD) shot up about 7% to a record $169 per share after two analysts released upbeat reports on the company’s growth and earnings prospects. (End of month fund manager ‘window dressing’ probably played a role too.)

Later in the day, deal site Groupon (GRPN) saw its shares plummet about 30% in after-hours trading after reporting a $81 million fourth-quarter loss that surprised analysts, and issuing disappointing revenue guidance. The Groupon report, simply stated, was a disaster.

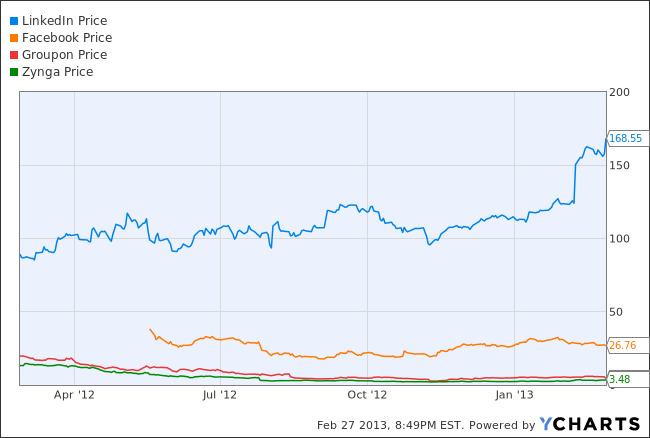

LNKD data by YCharts

The two online tech news developments triggered very different market reactions, and say a lot about the increasing market differentiation taking place among social media stocks and new trends such as shifts in social advertising and the rise of mobile start to unfold.

LinkedIn has a business model that works. It is both a consumer-oriented site that is free to join and sells marketing services to corporations. But the company also has a robust paid subscription service that’s popular with both job seekers and recruiters. The company’s three revenue lines – which it calls Talent Solutions, Marketing Solutions, and Premium Subscriptions – all enjoyed over 70% quarterly growth year over year for Q4 2012. It’s firing on all cylinders, aided by a strong developer and product team and ongoing market share gains in the lucrative corporate networking and job placement space.

LinkedIn isn’t really a social networking site per se – that element, as Jonathan Marino points out, masks its real business:

LinkedIn is about as far as a company gets from social media… it is making the transition from mere profiles and connections to in-house monetization. Its social media aspect is a front to consumers, who operate neat little profiles and have increasingly been sucked into verticals like premium subscriptions, advertising and LinkedIn’s hiring offerings.

LinkedIn’s subscription revenues have steadily risen. You can barely squeeze a nickel out of the average Facebook, Twitter or Pinterest user for the mere privilege of being on the site. The company is making good money on advertising, but that’s not LinkedIn’s only source of revenue—nor the most important.

And as Sarah Lacy recently pointed out, LinkedIn is now reaping the rewards of staying focused on its vertical a few years ago, even as Facebook was surging in new user gains:

[LinkedIn founder Reid] Hoffman stubbornly believed something very few others believed: That work and play should be separate in the social world. He actively fought against things that would make LinkedIn too viral.

The most dramatic was resisting adding pictures to the site for so long, given that photos were the thing driving Facebook’s growth. He did not want LinkedIn to become a meat market. Similarly, for a long time you had to have someone’s email to connect with them, not simply their name. He refused to make his site look more like Facebook as Facebook surged. That takes incredible discipline when the bulk of the world is saying a new social player is lapping you. As a result, LinkedIn remained a premium environment for job seekers and recruiters and employers. It remained something distinct in a Facebook-takes-all-world.

Bloomberg reports that Blake Harper at Wunderlich Securities just initiated coverage of LinkedIn with a buy rating and $195 per share price target. Ken Sena at Evercore Partners thinks the stock is will hit $200.

Groupon? It lacks the kind of sticky, recurring revenue that LinkedIn enjoys and there’s nothing proprietary or particularly focused about offering deals on teeth whitening and weekend trips to Vermont – a point I outlined in a post late last year.

There’s lots of talk now of Groupon CEO Andrew Mason being replaced by the board. The company’s revenue base has collapsed and some observers speculate the deal site may not survive in its current form or could even end up in bankruptcy court.

LinkedIn, whose market cap has tripled since going public, has that kind of financial strength. Groupon and Zynga (ZNGA), both trading below their IPO levels, don’t.

Neither does Facebook (FB) at the moment, though its prospects are far rosier given its billion-plus user base and ad revenue growth. Before its recent slump, the stock had been performing well earlier in the year.

A year ago, investors went were excessively bullish about the prospects for the entire sector. Now, they seem be wising up and becoming far more discriminating.

Photo: Coletivo Mambembe

The investments discussed are held in client accounts as of February 28. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.