Pandora Media (P), the hugely popular internet radio service, has been taking a beating from the tech press and investors. While users love its mobile app and deep reservoir of musical genres, analysts have cast doubt over whether the company has a sustainable business model. Hence the 17% drop in Pandora’s stock this year:

P data by YCharts

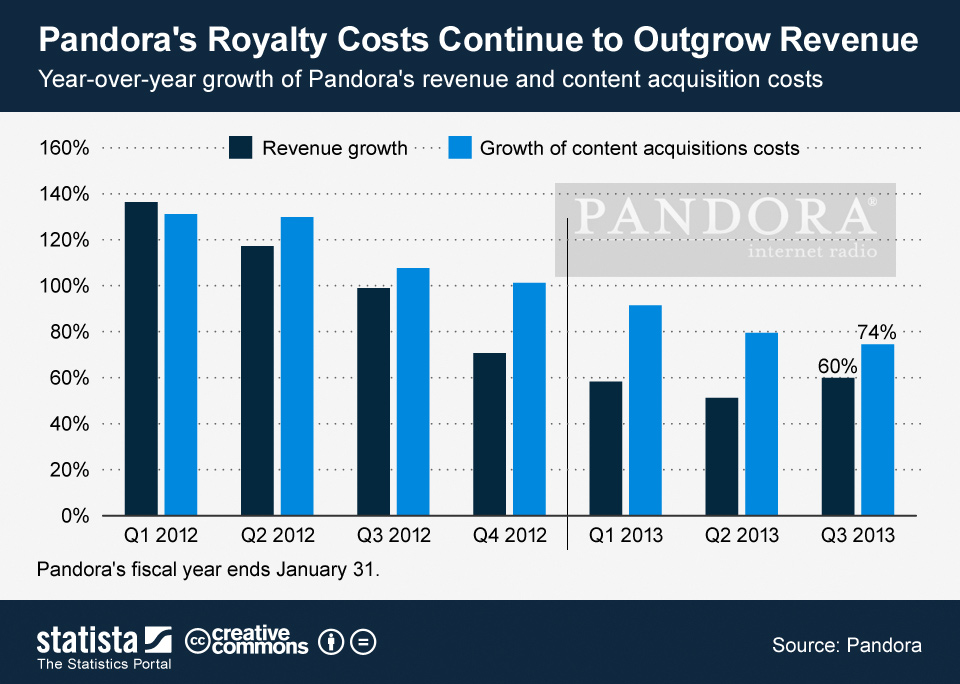

Pandora gets its revenue from online and mobile advertising as well as a premium subscription service that lets users listen to music without ads. However, the company faces two big strategic challenges: runaway royalty costs, and Apple (AAPL).

First off, there’s the expensive content agreement that Pandora has with SoundExchange, an industry group representing recording artists and music publishers that runs through 2015. Every time a Pandora user streams a song on his or her desktop or smartphone, the company must pay a royalty fee.

Pandora negotiated the agreement back in 2009 when it was a start-up. Now, it has nearly 60 million registered users and its royalty fees during its latest quarter hit $65.7 million, or about 55% of Pandora’s revenue.

Pandora CEO Joe Kennedy has been in Washington recently, trying to round up Congressional support for the Internet Radio Fairness Act. The legislation aims to rectify the situation whereby internet music streaming services like Pandora pay more than cable and satellite radio services. “The result is dramatically different royalty rates: satellite pays about 7.5% of revenues and cable pays about 15%, while Pandora pays more than 50% of revenue in royalties,” Pandora points out on its website. However, an army of music industry groups are expected to put up a fierce fight to kill the bill.

Aside from royalties, Pandora has another, actually far bigger concern: Bloomberg reports that Apple is in advanced talks with recording labels to acquire rights for an ad-supported streaming radio service that may launch in 2013. “Apple sees the service as a way to grow its iAd mobile advertising platform,” reported Bloomberg, “and is exploring ways to integrate iAd with iTunes to steer customers back to iTunes.”

Pandora probably doesn’t have the financial muscle to compete against Apple and should this occur, it would need a white knight suitor to stay in the game. Richard Saintvilus at TheStreet thinks Google (GOOG) or Facebook (FB) would be ideal acquirers. Until then, Pandora may be singing the blues.

Disclosures: Certain information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. The manager believes that such statements, information and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

Any investments discussed in this presentation are for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions made by model managers in the future will be profitable.