Shares of Apple (AAPL) had their worst day in nearly four years today as the stock dropped more than six percent and lost around $40 billion in market cap. The last time AAPL had a larger one-day decline was on 12/17/08. It has surely been a painful few days for AAPL longs.

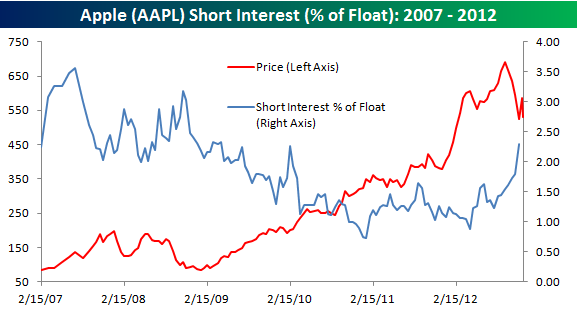

At the same time, there have been a growing number of people betting against AAPL that may finally feel vindicated after trying to call the top in the stock for the last four years. The chart below shows AAPL’s short interest as a percentage of float (blue line) going back to 2007 along with the stock’s share price (red line). As of the most recent reporting period (11/15), AAPL’s short interest as a percentage of float rose from 1.8% to 2.3%. This was the largest two-week increase since mid-February 2010, and it’s the highest short interest as a percent of float since April 2009. Since the middle of April when AAPL’s short interest as a percentage of float hit its lowest level of the year at 0.87%, negative bets on the stock have increased by 163% to 2.3% of float. While this is a large increase for AAPL, we would note that there are still 265 stocks in the S&P 500 that have a higher short interest as a percentage of float.

Data: Bespoke Investment Group