By Philip Lawlor, managing director, head of global markets research, FTSE Russell

Risk appetite has been swinging from concern about slowing global growth and profits to optimism that aggressive Fed easing was just around the corner. Optimism appears to have won the day, at least for now. Hints last week of the Fed’s readiness to cut rates sparked a global equity rally, with US stocks notching new highs.

The Fed’s latest dovish nod joined similar remarks from European Central Bank and the Bank of England, reinforcing the prevailing assumption that central banks will always be there when markets need them. But such confidence can also breed complacency.

In this environment, bad news is being viewed as good news as it is seen to be forcing the Fed’s hand. That makes it particularly important, in our view, to take a clear-eyed assessment of the potential risks that could catch equity markets off guard. Our latest review of global equity conditions highlighted several of them.

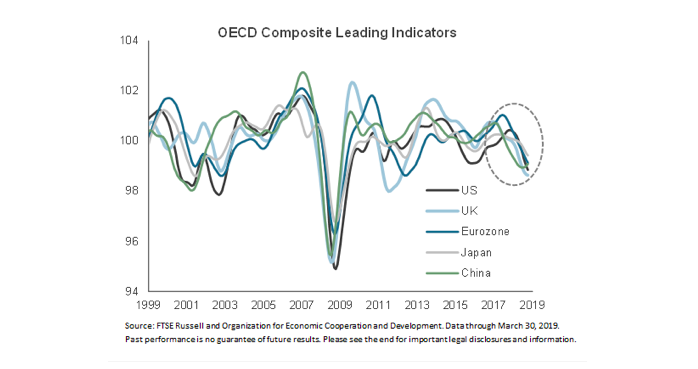

Risk #1: Deteriorating growth

Evidence that the global economy is slowing continues to mount. As the chart below shows, leading indicators from the Organization for Economic Cooperation and Development (OECD) are now at or near levels last seen at the height of the European debt crisis in 2012. A protracted trade war, a hard Brexit, an Italian debt crisis and/or a resumption of the US dollar rally top the list of additional threats to global growth.

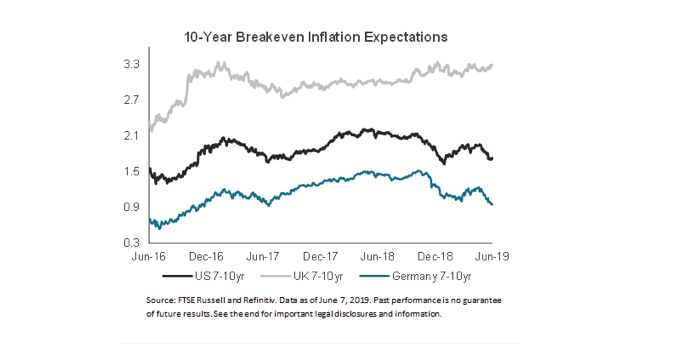

Market inflation expectations have declined significantly since April (see chart below), and dropped even more following the Fed’s June meeting, further confirming a more downbeat global growth outlook.

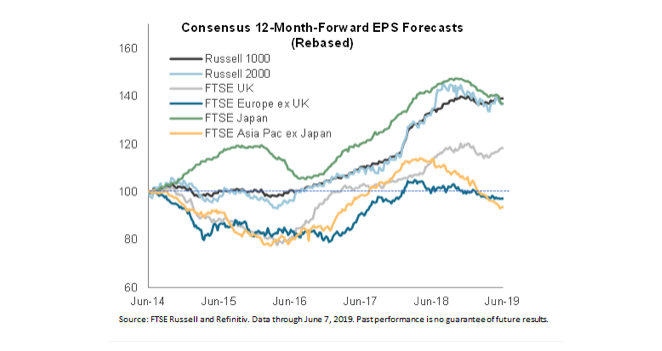

Risk #2: Dwindling earnings support

Falling economic growth and inflation expectations raise the risks to revenue and corporate earnings prospects. Indeed, as the chart below shows, earnings momentum has deteriorated in most markets since late 2018, with the uptrend in Russell 1000 and FTSE UK consensus 12-month-forward EPS forecasts leveling off while slumping elsewhere.

With their recovery from their May lows, forward 12-month price/earnings multiples for most major markets are now at or above their 10-year averages. Our analysis also showed that the rebound in 12-month-forward PEs since the December 2018 lows has come entirely from gains in the ‘P’, not ‘E’.

Risk #3: Disappointing Fed action

While supportive of equities, the Fed-driven drop in the 10-year US Treasury yield to multiyear lows and deeper negative yields on other safe-haven equivalents paints a grimmer picture.

The latest Fed messaging and futures-market rate expectations-–which are now pricing in steeper Fed rate cuts than those forecast by the central bank’s rate-setting committee-–indicate that the easing cycle is likely to start from a significantly lower base than in the prior two cycles.

One risk is that the Fed disappoints by not moving as quickly or aggressively as the market expects. But lowering rates now also leaves the central bank with far less crisis-fighting headroom. Add in the bond-market signals coming from the recent inversion of three-month/10-year US Treasury yields, which has occurred before every recession over the past 50 years.

As always, the prognosis for equity markets requires thorough consideration of current valuations and evolving macroeconomic conditions. At this juncture, that includes answering the question: what might turn bad news into bad news again?

Photo Credit: versageek via Flickr Creative Commons

This article first appeared on the FTSE Russell blog on June 24.

© 2019 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”) and (7) The Yield Book Inc (“YB”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell indexes or research or the fitness or suitability of the FTSE Russell indexes or research for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell indexes or research is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this blog or links to this blog or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained in this blog or accessible through FTSE Russell indexes or research, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This publication may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB, and/or their respective licensors.