The S&P 500 (SPX), the NASDAQ 100 (NDX) and all manner of tech stocks have had a very tough time in recent weeks. Not so Yahoo (YHOO), whose stock set a new 52-week high of $18.37 on Nov. 19th. Just look at the performance of Yahoo vs. those two indexes over the past 3 months:

YHOO data by YCharts

Yahoo’s new CEO, former Google executive Marissa Mayer, hasn’t yet proven that she’s directed the internet pioneer onto the road to redemption. However, Mayer seems to have growing street cred with investors and hedge funds. Two well known (and often imitated) hedge funds – Tiger Global Management and Greenlight Capital – recently disclosed stakes in Yahoo that they accumulated during the third quarter.

Everyone’s still wondering what exactly Mayer will do with the company. In public comments, Mayer has stressed that Yahoo needs to become a “site of habit,” where users go to check stock prices, sports scores and news. To get there, the company needs to pull off a “fundamental and massive platform shift” she says, away from PCs and towards mobile devices such as smartphones and tablets.

Mayer has said that she’s open to acquisitions, and the company now has a $2 billion-odd cash pile. Among the possibilities that could make a strategic difference for Yahoo: social network and search site Yelp (YELP), blog hosting platform Tumblr, stock analysis site Trefis, Quora, a question and answer website, or Automattic, owner of WordPress – ideas floated in this post today on Seeking Alpha.

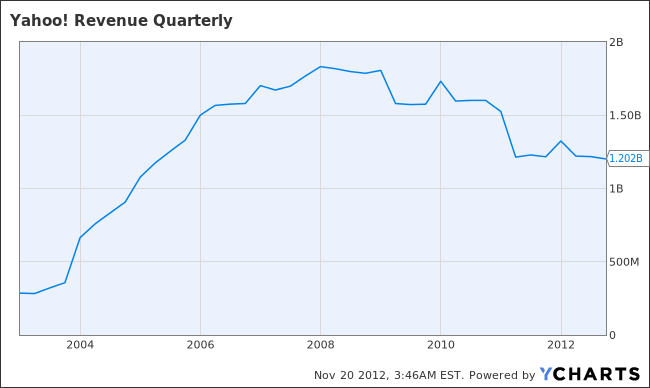

It’s very early in her tenure, but right now it’s pretty clear that Yahoo is enjoying something of a Mayer premium. To make that sustainable, though, Mayer will have to, among other things, turn this quarterly revenue chart back in the right direction:

YHOO Revenue Quarterly data by YCharts

The following Covestor portfolios hold Yahoo (as of EOD 11/16/12):

- Focus Growth by Analytic Investment

- Management Access by Douglas Estadt

- Prudent Value

Image: yvojoe

Disclosure: The investments discussed are held in client accounts as of 11/16/12. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.