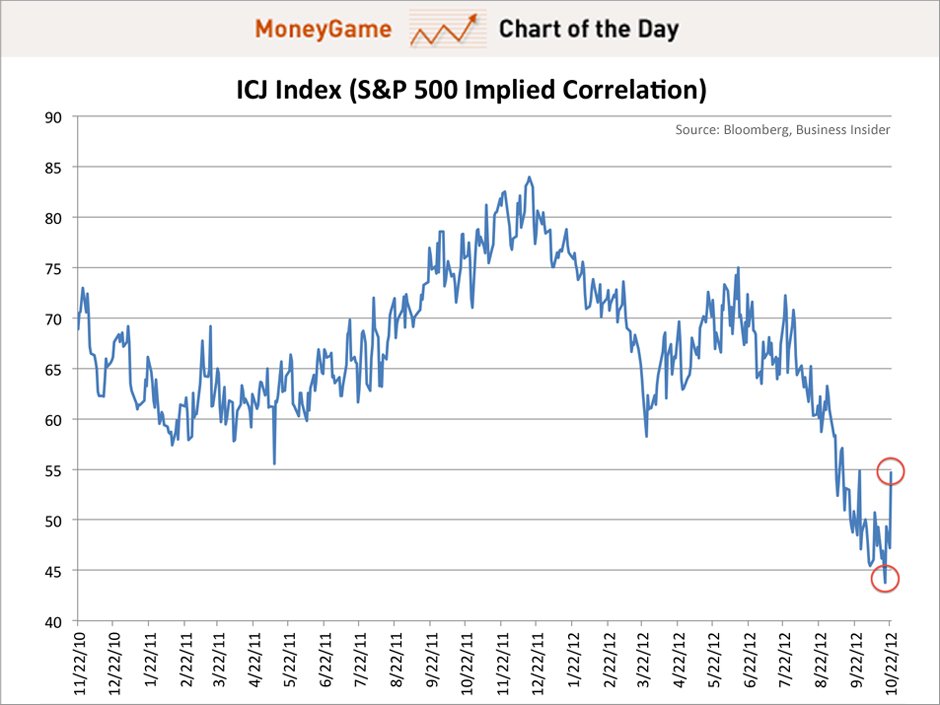

The market selloff on Tuesday significantly raised stock correlations that had been declining since June — a potentially worrying sign.

As Business Insider reports, it’s a reflection of a broad selloff, with many institutional investors fleeing the market at the same time. It’s a reason to keep an eye out for a shift to a more risk-averse trading environment and greater headline risk.

In other words, the implied correlations appear to be pointing to the risk of a broad stock selloff in the coming months.

The chart above was put together by Matthew Boesler at Business Insider. It measures the implied correlation of the S&P 500 Index. As you can see, Tuesday’s move was among the biggest one-day spikes in the index over the past two years.

Source: Business Insider, Bloomberg

It may be just a blip, or it could begin to reverse the four-month trend of lower correlations that corresponded with a stock rally, and arguably provided increased opportunities for individual stock-picking.

Here’s what it could mean specifically for market direction: Research by Boston College economist Hongtao Zhou suggests that weekly implied correlation changes can be used to improve the forecasting of short to mid-term S&P 500 direction.

Also, a market slump with a strengthened average correlation tends to follow its downward path for 7 to 10 months.

It’s too early to tell just how big of an impact a one-day selloff might have. Keep in mind, Zhou’s study looked at implied correlation changes on a weekly basis, and we’re now at midweek.

That said, the near-term shift in implied correlations is reason enough to watch the ICJ more closely in the coming days and weeks.