One encouraging sign for the U.S. is that consumers’ feelings about the economy are the most optimistic they have been in five years.

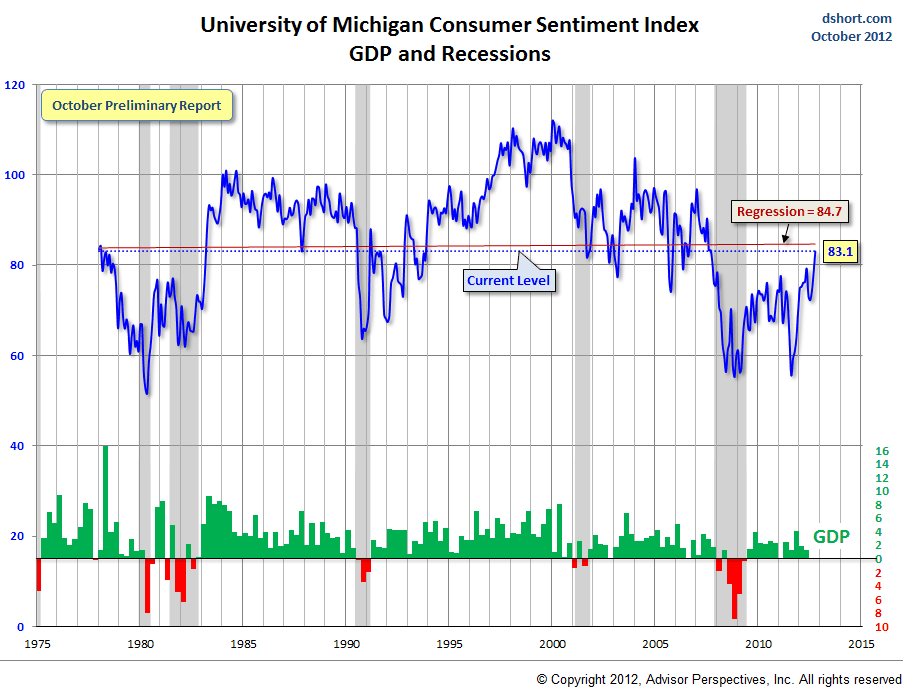

Source: Doug Short, AdvisorPerspectives.com

The Thomson-Reuters/University of Michigan Consumer Sentiment Index rose to 83.1 in early October, up nearly five points since September, and reaching a high not seen since September 2007. It also was well above economists’ expectations of a 78 reading, according to Reuters.

That rising confidence appears to be translating to actual spending, as well. Retail sales rose 1.1% in September, showing a third-straight month of gains. That is not a super-strong result. What is encouraging, however, is that the sales gains appear to be broad. Even without electronics sales — essentially adjusting for the iPhone 5 launch as well as gas station sales, retail sales rose 0.9% last month.

The figures cannot be taken as a sign that the economy is fully healthy, or that stocks will continue to move higher.

Then again, rarely, if ever, are you going to get an “all clear” sign from the markets that tells you it’s time to invest.

As hedge fund manager Whitney Tilson laid out recently, there are four factors that could still derail the U.S. economy:

1) A turn for the worse in Europe

2) A downturn for the U.S. housing market

3) The economic slowdown in China becomes a hard landing

4) A sovereign debt crisis in Japan

Yet long-term investors with a 10-year horizon are still better off buying dividend paying blue-chip stocks at reasonable multiples, he says, rather than low-yielding U.S. Treasuries — especially given the high level of U.S. sovereign debt.