Stocks are looking weaker relative to gold prices — one potentially worrying sign that may point to a potential shift in market risk-taking.

As investment adviser and markets technician JC Parets notes in his latest analysis, the Dow Jones Industrial Average relative to the spot gold price is an important measure of the long-term market risk-taking trend. The ratio was 1 to 1 in 1980, and expanded to 44 to 1 over the next 20 years, as the stock market surged, eclipsing the popularity of gold — a historically defensive asset.

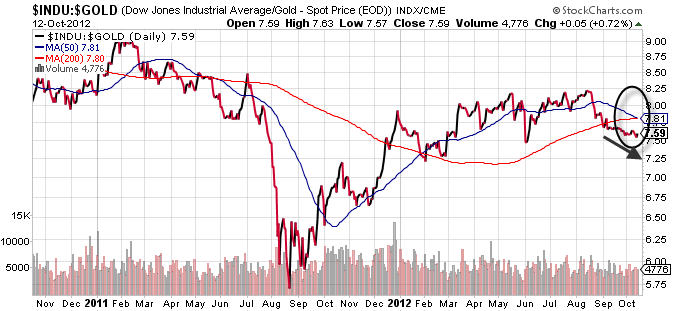

Then there was a massive trend change in 1999, when the ratio began dropping again, coming down all the way to 6 to 1 at its lowest point last year.

Source: Stockcharts.com

This year, the ratio reached a low of about 7.25 to 1 in February. The trend has been generally positive, marked by the ratio’s 50-day moving average crossing above the 200-day. What is interesting, however, is that to-day is just a tick away from falling below the 200-day once again, helping to signal a potential trend change.

That may be signaling a coming period where gold and perhaps stock investments tied to it once again begin to outperform the overall stock market.