One of the biggest warning signals for both the stock market and the economy is starting to look a little less threatening.

The signal I’m talking about is the transportation stocks and how they are moving relative to the rest of the market. The transports still don’t look great, but they continue to hang in there.

In an ideal world, you would want to see transportation stocks moving higher in lockstep with the stock market’s uptrend. That goes back to Dow Theory. Stocks of companies that ship goods should be moving higher along with those that make goods. When they are not, it can help mark a rally’s end point. That is still not happening over the long-term, and it still bears watching.

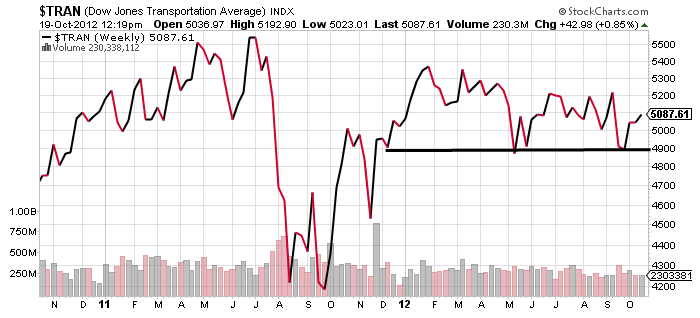

Source: Stockcharts.com

But here’s the picture right now: Transports may eventually go lower, but not just yet. We’ve seen the Dow Transportation Index rally in recent weeks from the September lows. Had that key index broken down in the chart above, that would have been a far stronger warning about the stock market’s recent move to five-year highs.

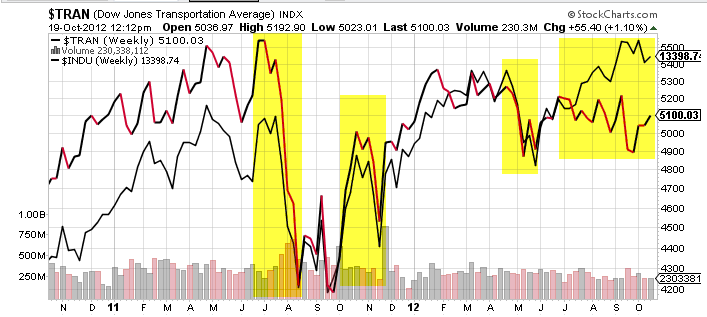

Source: Stockcharts.com

What also is encouraging is that the transports (in red and black above) are starting to move higher again with the Dow Jones Industrials (in solid black). The transports had done very poorly relative to the Dow since July, and now that relationship may be starting to change for the better. In the past, declines in the transports have been associated with market drops (see the chart above) and in some cases provided an early warning.

Transportation stocks also matter to the economy. The amount of stuff shipped — and the profits derived from it — gives us important insights into the economy’s strength. Coupled with recently improving news about housing, consumer confidence and retail sales, the recent uptick in the transports may be helping to paint a more positive picture overall.