by Michael Tarsala

Bill Gross at PIMCO, the world’s largest bond fund manager, says that 10-year Treasury yields will soon bottom out, which if true could impact dividend-paying stock prices.

“Even with QE3, Treasury yields have practical limits,” Gross tweeted in recent days. “(A) 1.5% 10 year is a good common sense bottom.”

The 10-year bond and dividend-paying stocks both attract yield-seekers, of course. Yet investors are more willing to buy the dividend-paying stocks when bond yields are extremely low. They are less attracted to dividend-paying stocks, however, when they can get more favorable bond yields.

The chart below shows the way that the Utilities Select Sector SPDR (XLU), made up of high dividend-paying utility stocks, tends to move in the opposite direction of Treasury yields.

Source: Stockcharts.com

So if Gross is right and if 1.5% is the Treasury yield bottom, that could help mark a shift away from utilities and other high dividend paying stocks that have run hard for much of the past two years.

But what if Gross is wrong?

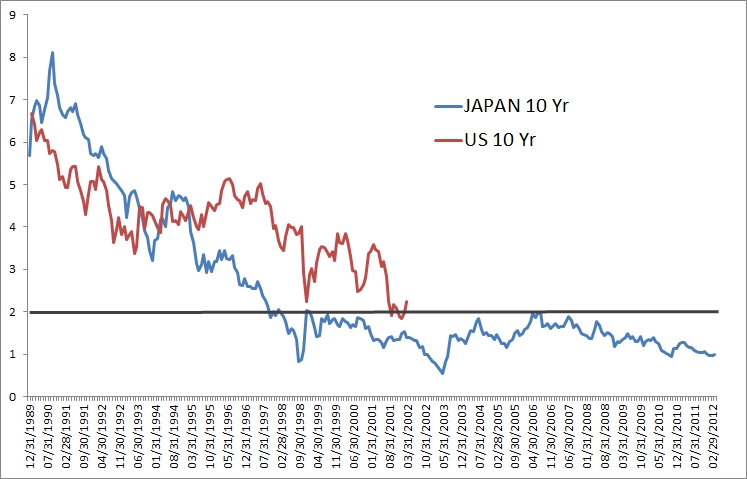

Portfolio manager and World Beta Blog author Mebane Faber suggested earlier this year that Japan may offer a comparison for what could happen to U.S. Treasury yields in the years ahead.

Source: World Beta Blog

Above is Faber’s chart of Japan’s 10-year Treasury, in blue. The red line is the U.S. Treasury yields plotted 10 years forward: That is, the U.S. series begins in 2000 when the Japanese series is at 1990.

Faber makes the case that 1.5% U.S. Treasury yields might not be a floor at all and that the yields may continue to collapse toward 0% over a full decade to come.

In Faber’s case, a long-term lull in bond yields may lead to a continued uptrend for utilities and other big dividend-payers.

If you would like to talk about the mix of dividend-paying stocks in your own investment portfolio, contact us at Covestor. We offer four different investment models with an indicative yield currently above 7%. That 7% figure is based on the last known dividend divided by the current price, and is shown as an annualized rate for all stocks in the investment model. It takes into account the cash held in the model, as well as long and short positions. For preferred shares, the yield to maturity is used. It’s not a measurement of the future yield, in other words.

For more information, give us a call at 866-825-3005 X 703. We are here in the New York office Monday to Friday from 9 to 5 Eastern time (usually later, but that’s when you are sure to reach us.)

We would welcome the chance to talk to you about our investment models and to help you decide if one or more of them might be right for you.