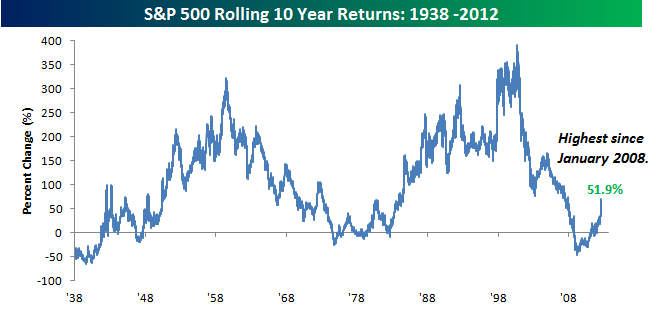

While the period from March 2000 through now has been classified as the dark ages for investing, the rolling ten year returns for the S&P 500 hit their highest levels since January 2008 this month. The chart below shows the historical rolling ten-year returns for the S&P 500 going back to 1938. As shown in the chart, the returns have been rebounding from multi-decade lows in the last couple of years and are now up to 51.9%. In other words, $100 invested in the S&P 500 ten years ago this month is worth $151.9 today.

Before we start calling it a golden age for equities, though, we would note that a big reason for the current positive level is the fact that this Summer also represents the 10-year anniversary of the end of the dot-com bear market that went from Spring 2000 through Summer 2002. Time sure flies when you’re having fun. Doesn’t it?

Data: Bespoke