by Michael Tarsala

Americans think gold is the best long-term investment — a reflection the very low opinion of the bond market, and perhaps an improving one for housing.

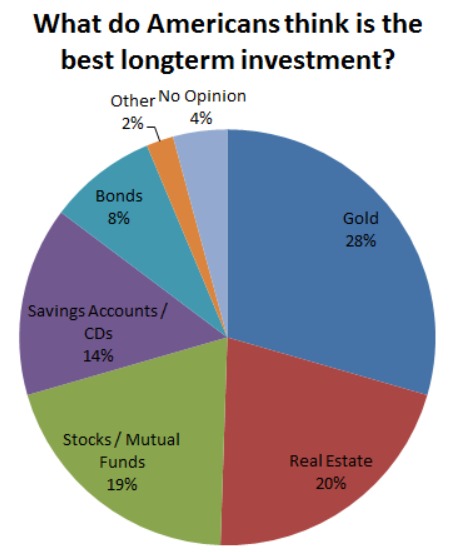

The Atlantic’s Jordan Weissman has a nice post on the latest Gallup poll that reveals the following (also see The Atlantic’s chart below):

— Gold is the favorite, with 28% of respondents saying it’s the best long-term investment.

— Gold is the favorite, with 28% of respondents saying it’s the best long-term investment.

— Gold and real estate are favored by nearly half the respondents.

— Savings accounts and CDs were favored by only 14% (that would be a scary sign of risk aversion if it were much higher!)

— Bonds, however were favored by only 8% of respondents.

If you ask me, the survey is saying three things:

1) Investors strongly believe in a continued gold uptrend. And from a contrarian’s perspective, I always find it worrying when a large percentage of the masses agree on any one conclusion. Gold is not threatened right now, mind you. But its continued bull trend is dependent in coming months on the direction of the dollar index, whether or not we get another round of quantitative easing, and a continuation higher out of the triangle pattern that reflects intermediate-term indecision about the overall trend. Read this for background, as gold may also have implications for equity markets.

2) Real estate as the second favorite is surprising. A lot of ink has been spilled in recent weeks about a rally in Home Depot (HD) shares signaling a housing rebound. That’s a coincident indicator. What’s more encouraging, though, is what a Merrill Index is saying about the oversold nature of houses — and what that might mean not only for homebuilders, but mREITS. Whether or not the group has truly bottomed remains to be seen. But there are more households being added right now than new housing units. Over time, that’s going to put a floor in for this group.

3) There is no love for bonds. And it’s hard to make an argument for Treasuries when you’re looking at a chart like the one at right. Japan’s 10-year Treasury is in blue. And in red are U.S. Treasury yields plotted 10 years forward. That is, the U.S. series begins in 2000 when the Japanese series is at 1990. It makes the case that it wouldn’t be unprecedented for yields continue to collapse toward 0% over a full decade to come.

Stocks, I believe, continue to have the edge over bonds for two reasons:

One, stock yields remain historically high versus bond yields.

And second, you might not get paid more to hold bonds in the future, either. Even in Japan, which has faced a deflationary environment, multiple global shocks, plus a tsunami and nuclear disaster, the Nikkei outperformed Japanese Treasuries over the past 10 years.

If you want to talk about asset allocations, strategy, contrarian ideas, leads on a pitcher to replace Mariano Rivera, or how our model managers can help you reach investment objectives, contact us.