Bitcoin is a digital currency that has no central bank issuer and can be exchanged directly online, with no bank intermediary. The goal is to mitigate the instability of fiat currencies, including unpredictable inflation. Here’s how its creators present it:

Sounds interesting, and as Matthew Ingram notes, Bitcoin is gaining some traction as an e-currency. But before dropping any real dough on it, be sure to read through Adam Cohen’s opinion on the matter, which follows:

Is the cryptocurrency Bitcoin a good idea?

No. Bitcoin is a ludicrously bad idea. It is a scam. A Scam. It is not a currency. The economic assumptions underpinning the Bitcoin ecosystem are laughable, and ignore hundreds of years of accumulated understanding of how currencies work with each other.

Fortunately, it’s such an obviously flawed system that it will probably never grow to a point where it causes any ill-effects,or even impact, to world economies.

Still, I feel like it’s worth pointing this out.

Bitcoin, described most generously, is a system that makes digital transactions more like cash transactions. That’s…fine. The problem is it does this not by offering dollar-denominated digital cash-transfers, but by bootstrapping an entirely new currency. The question to ask is why this would be at all desirable. Maybe you hate the US government, or all governments. Maybe you want to avoid bank interchange fees, or perhaps avoid tracking altogether because your payment is for something illegal, or because you’re a particular private person. Or perhaps you just think that the world currency regime is going to collapse and you see Bitcoin as a technological salvation.

No matter what your reasoning, Bitcoin is a ridiculous idea that will not accomplish what you want.

Severe Problem Number 1: Seeding Initial Wealth

When the federal reserve “prints money”, it doesn’t just mail million-dollar checks to random Americans. It does one of two things. It either (a) purchases some other asset [generally us treasury bonds] on the free market, thereby injecting more cash into the system than there had been before, or (b), loans money to a bank, who will then loan it to other people who will then spend it.

Importantly, the people on the other end of those transactions did not just get free money. They either sold an asset for cash, or they borrowed cash that they will eventually repay (with interest).

Bitcoin does not have a central bank capable of printing and lending Bitcoin; it has an “algorithm” which through some convoluted mechanism allows Bitcoins to be “mined”. Essentially it randomly allocates Bitcoin to early adopters. This is a very good system for early adopters (free money!) It is a nonsensical system for a real currency, not to mention being obviously unscalable (what happens when everyone tries to mine Bitcoin all day long?). To solve this second problem, the supply of Bitcoin is algorithmically limited, which is again good for early adopters. But that brings us to…

Severe Problem Number 2: Built in Deflation.

Econ lesson time! Deflation is the phenomenon where cash grows in value relative to everything around it (i.e. prices go down). More specifically, deflation occurs when people expect the value of cash to grow in relatottive value to everything around it, and prices trend down consistently.

Question: if your money is getting predictably more valuable, why would you want to spend it? Answer: marginally speaking, you wouldn’t.

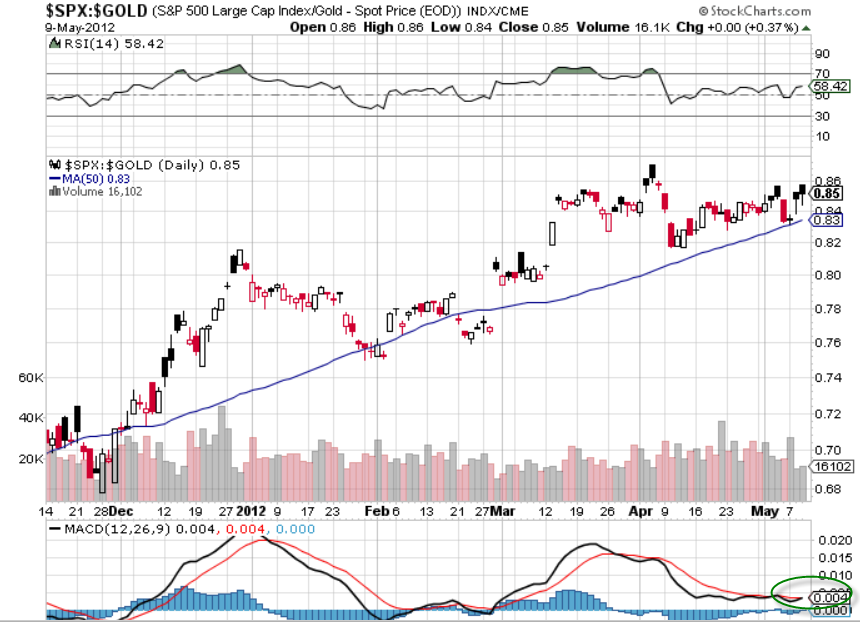

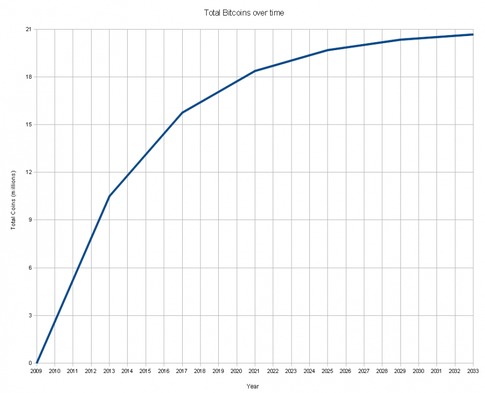

The supply of Bitcoin is programmed to grow at a known but decreasing rate over time, topping out relatively quickly at about 21M. The graph looks like this:

Known rate — ok, I’m with you, predictable inflation, not necessarily desirable from an economic standpoint, but I’ll go with it — but decreasing rate? If you were designing a currency that was going to topple the world order, wouldn’t you want it to look like this?

Or at least have constant in rate of growth? Yes, of course you would, because that’s the only way to actually accommodate more people using it.

But Bitcoin is not designed to be a functioning currency, it’s designed to enrich early adopters. Again, that is why it is a scam. Period.

As a quick thought experiment, let’s say demand for Bitcoin grew as more people found out about them. Well, you’d expect the price of Bitcoin in dollars to grow rapidly. Now assume I own one Bitcoin. I also have a dollar bill. I would like to purchase a Pepsi. Which one of those will I spend? Obviously the devaluing dollar gets spent before the skyrocketing Bitcoin.

In the best case scenario [the one where it becomes popular] the limited supply of Bitcoin will cause crippling deflation, drying up most Bitcoin-denominated commerce save whatever speculative buying and selling happens on exchanges. Some new world order. All that transparency and all those low interchange fees aren’t going to do you much good if you don’t ever want to spend these things and no one wants to give them to you anyway.

Severe Problem Number 3: Lack of Convertibility

There is a common misconception among people that there is such a thing as an inherent value of money. There is no such thing. Paper assets are literally only valuable to the extent they can be exchanged for other paper assets. A dollar is worth a certain number of euro cents. A euro is worth a certain number of Yen. A Yen is worth a certain number of dollars. A dollar can be put in a bank for a certificate of deposit, which can then be exchanged for a dollar. It can be turned into a cashier’s check or a personal check, and then converted back to cash or deposited. It can be converted to traveler’s checks which can then be converted to Yen on your vacation. Even if you spend your money and buy a sandwich, the sandwich stop only took that money because it was convertible to something else, such as his payroll check and then his bank account. Paper <–> Paper <–> Paper. All the same, all different. It’s a beautiful circular equilibrium. Envision a tee-pee. Paper assets are the poles; they fall over by themselves, but leaning against each other they form an edifice.

The critical point here is that exchange rates might change, but they never go away completely. The term in economics is “convertibility”. For Bitcoin to work as a currency, it would have to act as a predictable store of value, which means it needs to be easily convertible to all other stores of value depending on an individual’s needs or wants. It needs to be a part of that tee-pee. It isn’t.

The problem here is that because Bitcoin is completely decentralized, no one is completely invested in the long-term success of the system. No one is literally making the market, saying “no matter what happens, I’ll buy Bitcoins from you at some price”. I understand that there are “exchanges” floating around. Their commitment to this market is (in my opinion) not credible. Anyone and everyone can just pick up their ball and leave.

As a result, my ability to turn a Bitcoin into a dollar or a euro or a yen is no greater than my ability to sell my laptop on Ebay. I can probably do it, but that doesn’t mean I’m going to start measuring my bank account in macbook pros, because one day I might not be able to find a buyer, and then what?

Because of this, Bitcoin is not really a currency, it’s an asset [and a particularly useless one at that]. It is being marketed as a currency to appeal to people who are crazy, idealistic, or afraid, and it is a scam.

Severe Problem Number 4: When Something Goes Wrong, It Will Die

In the early days of the great depression, some Americans started to worry that if their bank closed, they would lose all of their money. They then tried to take money out of banks all at the same time, which actually caused some banks to fail. That made even more people nervous, which caused even more banks to fail. That’s called a bank run, and for obvious reasons we want to avoid them.

After that happened, the US government started explicitly guaranteeing savings deposits (as well as implicitly guaranteeing other forms of financing, see Bush, Obama et all, “Bailouts”, 2008). Despite everyone’s frustration with this state of affairs, it turns out to be vastly preferable to a complete collapse of our banking system, so it continues on.

Now, fast forward five years. The Bitcoin economy is roaring! Everybody owns these things. Life is great. But then…something goes wrong. Maybe it’s a slight hardware glitch. Maybe there’s a rogue node somewhere in the system that causes transaction delays. Maybe some people were storing their Bitcoin on AWS and they lost it when it crashed again. It doesn’t really matter what: something will eventually go wrong, and Bitcoin will be tested.

Will it pass this test? People will get nervous. Some will panic. Few will run for the exits. The exchange rates will dip. Others will get nervous. Some will realize they never really had faith in the system to begin with. That will make them really nervous. Who is going to step in to backstop this system?

More importantly, is there anyone that even CAN do that? When a bank collapses, the federal reserve can honor deposits by quite literally printing money and giving people their cash back if need be. That slight increase in expected inflation (maybe) is a small price to pay for avoiding a financial meltdown. In the bitcoin economy, that’s literally impossible. It’s decentralized; it’s a published algorithm. No one can change it, and even if they could, it’s no one’s job to do so. Anyone with a large stake in Bitcoin will be too busy trying to get their own money out to worry about systemic risk.

Bitcoin (and really, any e-currency) is inherently unstable. And with currency, stability is everything.

In Conclusion

So, do I think Bitcoin is a good idea? The cryptography system seems to have technical merit although I’m not a cryptologist. If it were thoughtfully integrated into a legitimate banking product it might be a good idea. But this is not a good idea, this is a scam. Someone out there is trying to become very rich off of this system, and anyone who participates will be playing hot-potato until the inevitable collapse.

Do. Not. Buy. These.

Sources:

Bitcoin video: YouTube – “What is Bitcoin?” https://www.youtube.com/watch?v=Um63OQz3bjo&feature=player_embedded

“How BitCoin Wants to Make Money Even More Virtual” Matthew Ingram, GigaOm 5/16/11 http://gigaom.com/2011/05/16/how-bitcoin-wants-to-make-money-even-more-virtual/

“Is the cryptocurrency Bitcoin a good idea?” Quora, Response of Adam Cohen, 5/17/11 http://www.quora.com/Bitcoin/Is-the-cryptocurrency-Bitcoin-a-good-idea/answer/Adam-Cohen-2

Bitcoin graph: Bitcoin wiki – https://en.bitcoin.it/wiki/File:Total_bitcoins_over_time_graph.png

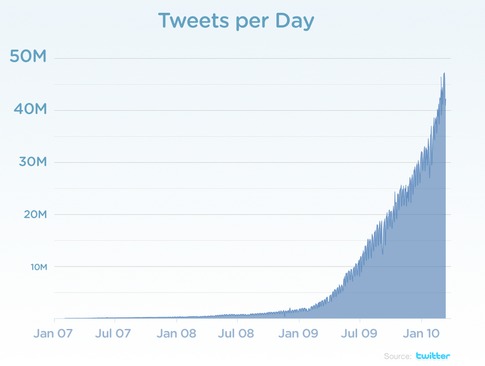

Twitter graph: “Measuring Tweets”, Twitter blog, 2/22/10 https://blog.twitter.com/official/en_us/a/2010/measuring-tweets.html