by Michael Tarsala

by Michael Tarsala

There already has been plenty of ink spilled — electronic ink mostly — on the pending Facebook IPO. It’s been slammed as a sucker’s bet and praised as the great hope for the next generation of investors.

Without picking sides, here are five things to think about as you weigh whether an investment in Facebook is worth the risk:

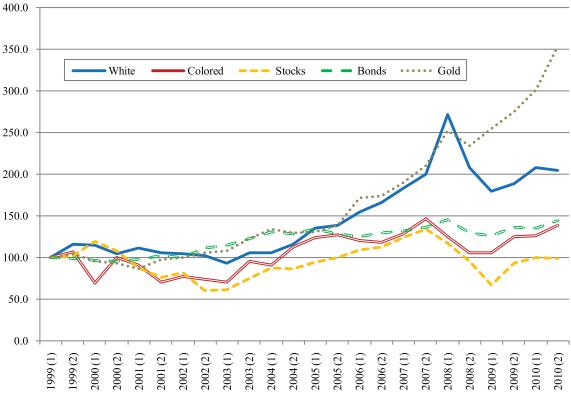

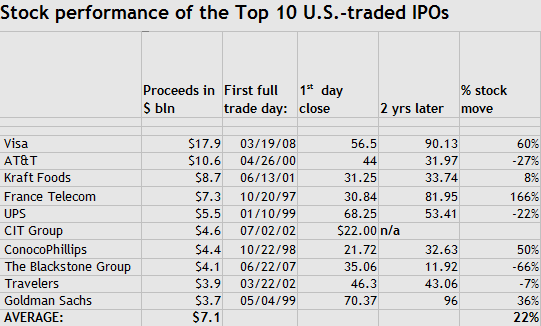

1) Performance of large IPOs:

Source: Company Reports, Yahoo charting

The past big U.S.-listed IPOs netted five winners and four losers from the close on the first day. That does not appear to point to an edge.

I purposely took into account an entry price that individual investors may have a good shot at getting, rather than the IPO price.

In the above table, CIT Group is “n/a” because it went bankrupt and was later refloated; the old price data is now very hard to find. And GM is down from its big IPO, although it hasn’t been trading as a refloated company for two years.

With those caveats, the average two-year performance (not a CAGR, and not adjusted for dividends) was in the double-digits.

2) The historic underpricing of IPOs

It’s important to know that many research papers over the years point to the tendency of IPOs to be underpriced. One of the most interesting ones of late is a paper by Richard Lowery of UT Austin and Ari Choi Kang at the University of North Dakota – primarily for what it suggests about possible collusion among underwriters. Yet the study also concludes that if you exclude the dot-com era, IPOs do tend to increase value.

3) We do not appear to be in a bubble. This is important in the context of Point #2: The price-to-earnings of some tech stocks are high, but on the whole they are down from where they were even a year ago, and not in asset bubble territory. And IPOs and takeovers are nowhere near records. Eric Jackson did a nice job of of summing these points in a story last week.

4) Some recent IPOS have seen extreme multiples. As Henry Blodget points out, you can expect to pay 3 to 8 times sales for the typical online media company, and as much as 10 times sales for the really hot ones. But if Yelp can garner nearly 20 times its revenue in an IPO, Facebook may garner a meaningfully higher multiple than that, considering it is the top social media brand. A Yelp-like multiple of 20 times last year’s revenue would place Facebook’s value at $74 billion, below the $100 billion being discussed by some news outlets.

5) The float may be small for such a large-cap stock. Tom Foremski, the SiliconValleyWatcher himself, has very good background on how small floats tend to increase IPO volatility and may push up prices for insiders as they wait to cash out their shares. A $10 billion should make the float significantly larger than Groupon’s. Still, $10 billion in proceeds is rather small-ish for such a high-profile offering. And Facebook as a result may be relatively volatile for such a big stock.

Photo: Guillaume Paumier