Author: Patrick McFadden, M2 Global

Author: Patrick McFadden, M2 Global

Covestor model: M2 Global

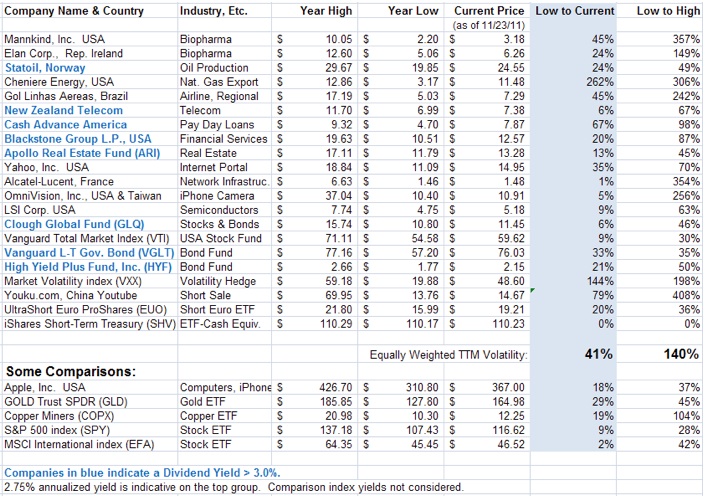

The list of stocks below represents securities that we have purchased or wished to purchase over the past year.

The great price swings for these securities are indicative of the volatility in global markets during this period, and show the potential benefit of purchasing assets at or near capitulation prices, whenever one manages to do so (pricing data via Yahoo Finance as of 11/23/11).

Patience is very important to a strategy that aims to buy stocks after large selloffs. The analogy would be that of an ambush, rather than a momentum chase. Therefore, we aim to perform due diligence well in advance of big price drops, and try to keep cash on hand at all times. We’ll follow a company for years priority to investment, along with global macro and credit markets.

Long-term investors looking for risk adjusted Alpha can take advantage of the recent and continuing volatility as they structure a diversified long-term portfolio over time. Asset class diversity, prudent hedging and retaining a strong opportunistic cash position may also enhance risk-adjusted portfolio returns.