Covestor model: Technical Swing

I was recently asked to explain my selling methodology. Let me highlight a couple of points on this topic.

First of all, I can’t fully discuss selling in a blog post since I could easily fill a book with that content. However, I can give you an idea about my methodology. In fact, it is not really my proprietary method. A lot of the aspects are taken from Alexander Elder‘s approach. I strongly recommend studying his work if you feel that the concept makes sense to you. I recently discussed how his ideas influenced my trading here.

I am basically a “channel trader” who uses EMA channels to determine exit points. The idea is to sell when everybody wants to buy, or vice versa in the case of a short trade. The concept makes so much sense to me since I believe that you can only make money in the stock market by buying low (which by definition is when everybody is selling) and selling high (which means selling when everybody is buying). In order to implement this concept with technical trading tools, you simply need a moving average and channels, which reflect a positive/negative increment to the current average price. So conceptually, I’m trying to buy close to the moving average and sell close to the upper channel boundary in the long case. In addition, I often scale out of positions, especially in strong markets in order to let profits run.

Here are two recent trading examples:

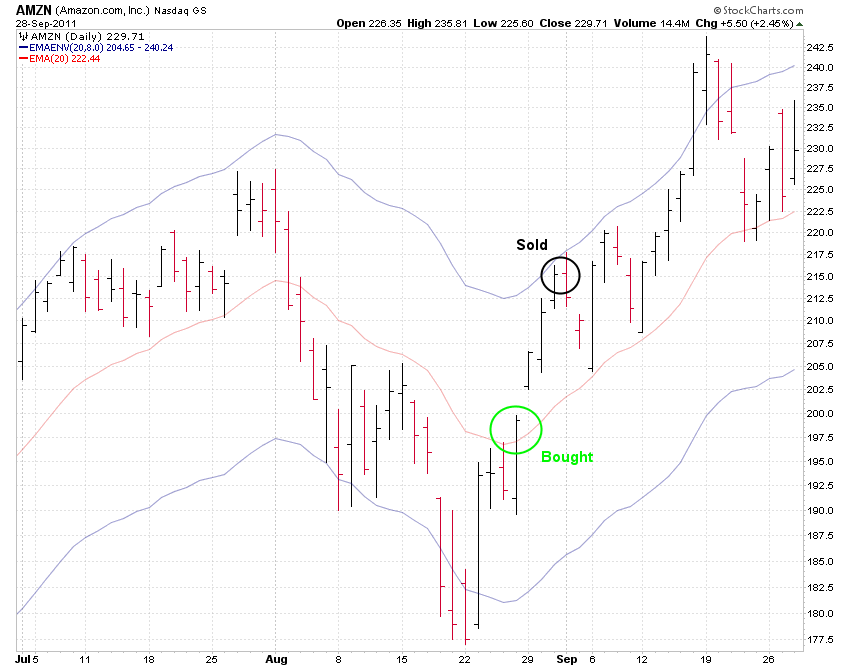

I bought Amazon (Nasdaq: AMZN) on August 26. The stock was trading close to its 20 day moving average. I sold the stock three trading days later when prices touched the upper channel line. As you can see, I took out only a portion of the entire move, but that’s ok. That’s swing trading. I’m not trying to sell at the absolute top.

Click to enlarge:

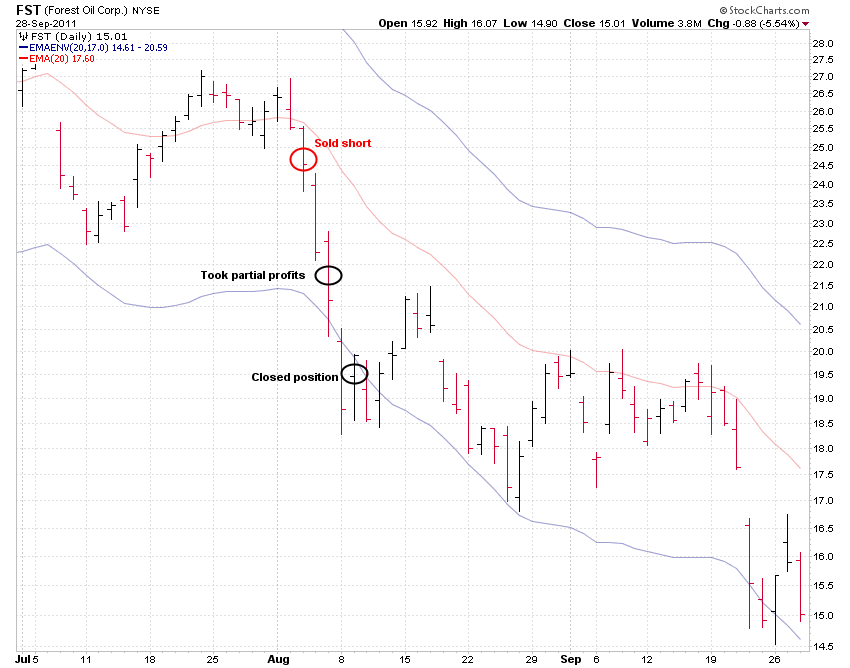

Another example on the short side: Forest Oil Corporation (NYSE: FST).

I shorted the stock on August 8, again, close to the moving average, the level of “normalcy” (Elder calls it “value”) if you will. FST moved down strongly and I reduced position size by half two days after I shorted the stock. I finally closed the trade two additional days later when downside momentum deteriorated. Click to enlarge:

As I mentioned before, there are a lot of nuts and bolts to this technique and I highly recommend reading Elder’s book The New Sell & Sell Short for more details.

Note that I was showing you two successful examples here. In reality of course, not every trade is successful. In fact, there is a lot of noise and randomness in the markets, so many trades will not work out and you have to sell with a loss. For example, during the very period of the two successful trades detailed above, I had losing trades in Apple (Nasdaq: AAPL) and McDonalds (NYSE: MCD).

Losing trades like these do not have to be a big deal if you have strong money management along the way, limiting your downside risk.