Author: Atlas Capital

Author: Atlas Capital

Covestor model: Broad ETF

Disclosure: None

We are long term investors who frown on market timing strategies. We’re more interested in identifying value propositions available in the capital markets.

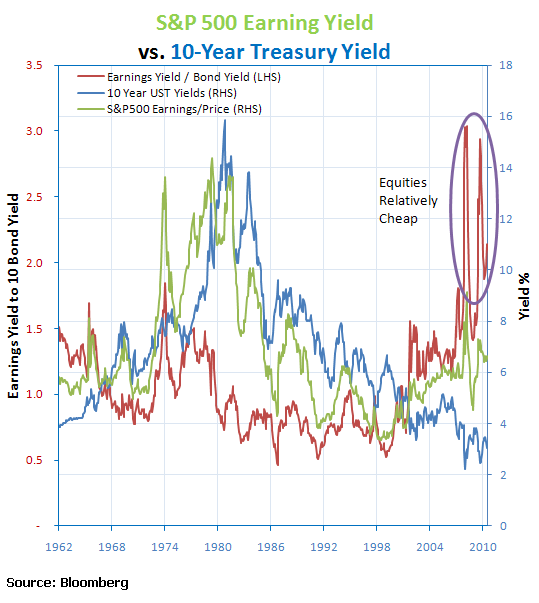

Equities currently remain attractive versus 10yr Treasuries.

Corporate earnings, as expressed in the S&P 500 earnings yield, are now (as of 6/11) yielding more than twice what can be earned investing in 10-year Treasury notes. Clearly this relationship is pronounced because of today’s low interest rate environment. More relative to the point, however, is that the Great Recession induced global risk aversion that has made the risk/reward tradeoff quite attractive for equities.

Additionally, global dividend yields are, on a historical basis, very close to bond yields; global equity investors thereby receive the upside potential of equity returns while earning the same income as a bond.

Quarter to quarter performance analysis is akin to noise, but we offer a review to give you a picture of current market activity. 2Q2011 activity showed mean-reversion. As market sentiment faded for strong global economic growth, commodities and most world stock markets showed negative returns, reversing trends seen for the previous two quarters. Couple this concern with a revisit to the Greece/EU saga and it’s not surprising that fixed income investments had a strong performance quarter. Municipal bonds also had a strong quarter after a period of poor performance tied to legitimate, but in our opinion over-exaggerated, state and local financial concerns.

TIP securities benefited from higher than expected year-over-year inflation increases. It remains to be seen if the current 3.6% inflation rate holds with the recent weakening in oil prices. TIPs prices imply the market doesn’t believe the current inflation rate is sustainable.

Sources:

BLS 6/15/11 release: http://www.bls.gov/news.release/cpi.nr0.htm