Manager: Richard Moore

Manager: Richard Moore

Model: Market Comparables

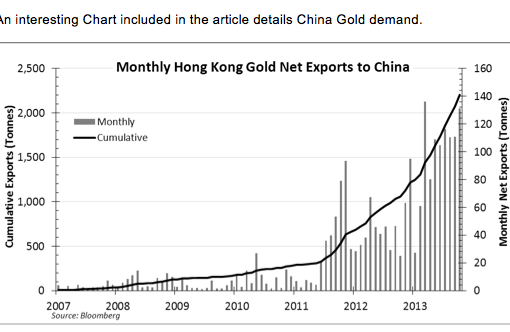

The stock market continued its winning ways in April. Fueled by easy money from the Federal Reserve, commodities led the way with gold and silver going parabolic.

I continue to be concerned and regard the stock market as a high risk investment at this time. While the market averages are clearly in an uptrend, my sentiment indicators are stubbornly stuck in a very negative position, indicating that small investors and speculators are extremely bullish. I remain in a fully hedged position, settling for a small return on my portfolio so far this year with what I consider to be a very low risk.

I have been in a hedged position for several months now and, while I am happy with the results I have achieved given the conditions, at some point I need to consider whether or not my sentiment indicators are adding value from a timing standpoint. Therefore, if the market does not get in line with my indicators in the next couple of months, I will elect to place less emphasis on these indicators.

In the meantime, I continue on my present course, recognizing the current conflict between stock price trends (up) and my sentiment indicator forecast (down).