John Ballard manages Covestor’s Mid-Cap Fundamentals portfolio, which focuses on long term investments in companies operating in under-capitalized sectors. This portfolio holds Rosetta Stone (RST), which has recently been making 52 week lows. We asked John whether this changes his investment thesis for RST, or whether he is taking this opportunity to increase the portfolio’s stake in RST. His response:

I am holding Rosetta Stone for the time being. Management is “re-engineering” marketing for their US business while worldwide institutional sales and international sales are booming. Sales of their latest product Version 4 Totale are growing subscription revenues. Subscription revenues make up only a minority of total revenue right now, but as Version 4 sales grow worldwide that portion should grow larger, which should stabilize cash flows. Subscriptions make for very cash flow positive business models.

I think in time Rosetta Stone will mainly serve the institutional and international markets. There may be too much competition, especially in the US, for the product to do well selling to individuals over the long term. I continue to hold RST because of the potential internationally and the fact that the language learning market is a multi-billion dollar industry, of which RST still only has a sliver of the pie.

Rosetta Stone chart from Google Finance:

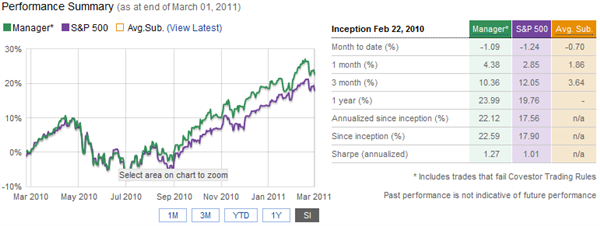

Here’s recent performance of the Covestor Mid-Cap Fundamentals Model:

* See important disclosures