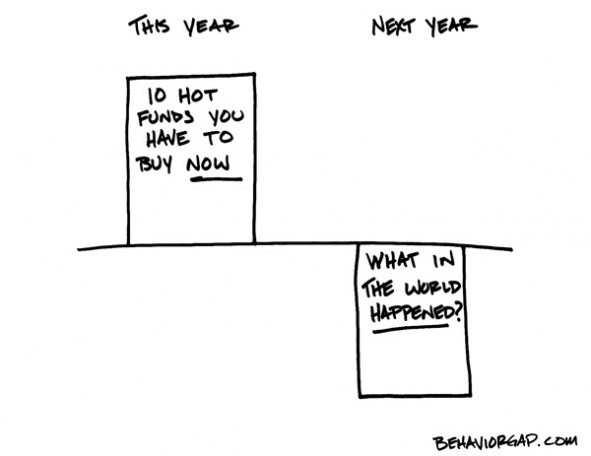

Carl Richards‘ latest sketch, on the hazards of chasing the hot funds:

In his newsletter, Richards recognizes why we’re susceptible to this error:

We’ve been told over and over by the traditional financial services industry to look for the best investment. In our search for the best we often use past performance. Doing so makes sense since we rely on past performance for other decisions.

For instance, if a university needs a new basketball coach they start by reviewing a coach’s track record. Does he win more than he loses? However, in a crazy paradox, selecting an investment manager using past performance may not be the best choice. But how is this possible?…

In the end, successful investing is more like planting an oak tree than hiring a basketball coach. You never plant a tree and then pull it out every time the wind blows just to check the roots. This simple, but not easy, approach reminds me of Warren Buffett who said that, “Benign neglect, bordering on sloth, remains the hallmark of our investment process.”

Based on many conversations I’ve had, this attitude feels wrong. It seems un-American, a contradiction to the Protestant work ethic. If something isn’t painful or hard it’s not worth doing. But when it comes to investing, we’re dealing with a different animal. Once we’ve made a decision based on our personal goals and plans, often the best thing we can do is practice benign neglect.

Our CEO Perry Blacher made a similar point – stressing the importance of finding the right investment vehicle not primarily based on past performance – in a recent post on Quora:

every investment firm has to specify as clearly as possible that ‘Past Performance is No Guide to Future Returns’, because it has definitively been proven not to be. Don’t believe in experts – no one is more expert than you. You really want to be asking ‘is this person’s strategy something I believe in, and does he or she have skin in the game?’ Look at the past performance as an example wherever you go, but be sure you understand what you are looking at.