Allowing emotions to play a role in investing causes some of the classic investor mistakes, including buying high and selling low, chasing trends that are on the downswing in popularity and improper diversification. And, as Bryan Keller illustrates in his September 28, 2008 article for Seeking Alpha, The Cost of Emotional Investing, when one’s emotions take over, it can be impossible to implement a disciplined and systematic investment process. New Covestor model manager Tong Li, in his Quantum Opportunity Value model, uses computer models of both fundamental and technical analysis to ensure that human emotion doesn’t creep into any investment decisions.

Allowing emotions to play a role in investing causes some of the classic investor mistakes, including buying high and selling low, chasing trends that are on the downswing in popularity and improper diversification. And, as Bryan Keller illustrates in his September 28, 2008 article for Seeking Alpha, The Cost of Emotional Investing, when one’s emotions take over, it can be impossible to implement a disciplined and systematic investment process. New Covestor model manager Tong Li, in his Quantum Opportunity Value model, uses computer models of both fundamental and technical analysis to ensure that human emotion doesn’t creep into any investment decisions.

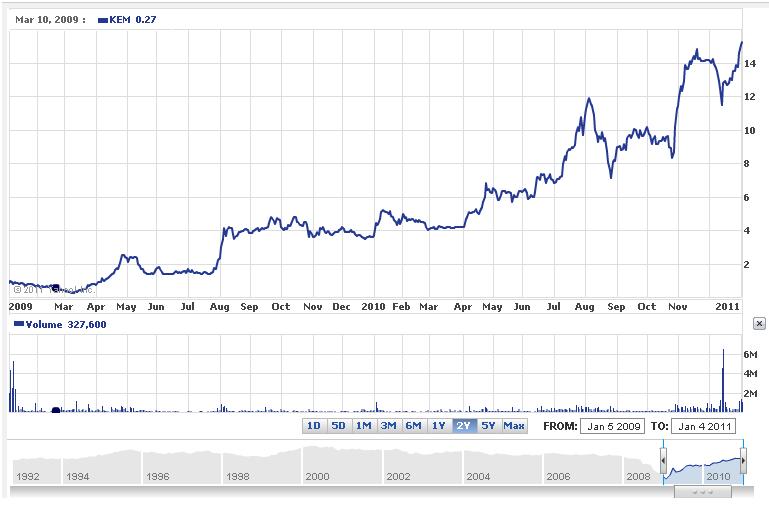

The top holding in the model is Kemet Corp (NYSE: KEM). During the past 9 day,s KEM has been upgraded once and initiated as a buy twice by analysts. As David Schrader noted in this September 1st article on SeekingAlpha.com, KEM has had some impressive growth since 2009—and that growth has continued since September.

While the price (after the stock split 1 for 3 on November 8th) has continued to rise, there have also been some pretty major dips in price that might have prompted an emotional investor to sell.

But a rise in stock price isn’t what’s behind the upgrades and initiations of analysts. Comments from Deutsche Bank state that their buy initiation is due in part to the fact that KEM had been trading at a discount to peers Avx Corp (NYSE: AVX) and Vishay Intertechnology Inc (NYSE: VSH) and in part due to the popularity of both ceramic and tantalum.

*Chart courtesy of Yahoo Finance.