Ultimately I believe that solutions will be found, compromises made, and the animal spirits of capitalism will overcome governmental ineffectiveness.

Dividend and Income Plus investment model manager Bill DeShurko is not deterred by McDonald’s earnings miss and still thinks it is a long-term value.

McDonald's (MCD) shares, held in 11 different Covstor models, are trading lower following the company's Q2 earnings miss. Here's the latest:

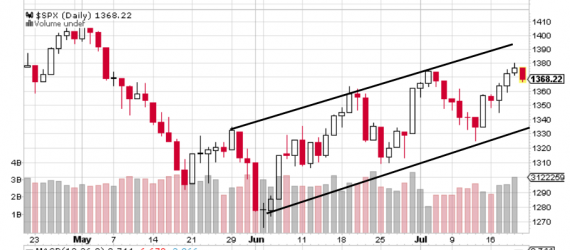

U.S. market volatility jumps to July highs amid new economic worries from Europe and China. What you need to know:

The fiscal cliff is arguably a bigger worry than corporate earnings or Europe's woes, and it could affect dividend stocks and retirees that hold them.

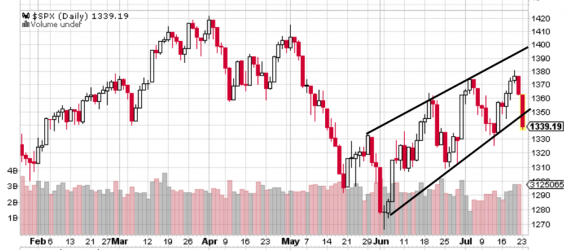

The top seven reasons U.S. stocks are up since early June despite lackluster earnings, higher jobless claims and more worrying signs from Europe.

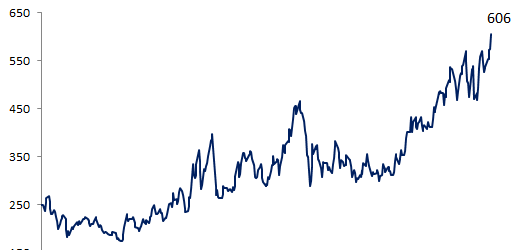

Annaly Capital has one of the highest dividend yields of all large-cap stocks, says Mark Holder of the Net Payout Yield model.

Rising jobless claims could threaten cyclical stock sectors. One contrary indicator, though, is that several Covestor managers recently bought retail stocks.