Mark Hulbert, a 30-year market veteran, sees an increased chance of a correction. If that happens, long-short investments may be a way to play the downside.

Outlook

The CEO of the world's biggest bond manager, Pimco's Mohamed El-Erian, paints a dismal picture for the U.S. economy following the presidential election.

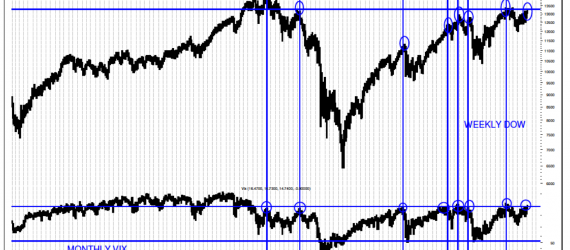

Legendary technical analyst Dick Arms makes a strong argument for a market pullback, suggesting it may be time to get more conservative with investments.

A board member's $1 million insider stock buy is good news for Facebook holders, but only if it was meant to increase his wealth, not just to suck in buyers.

The latest research suggests a high chance of QE3 already priced into the market -- one reason to think stocks might not rally hard on an announcement.

The U.S. presidential election has investors on edge. Here are the top 3 concerns, and some ways to think about dealing with them.

The U.S. economy is on the upswing – at least relative to expectations. Check out the latest Citigroup chart.

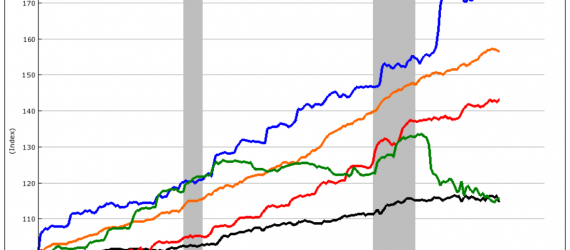

There is no denying that dividend stocks are becomine more of a crowded investment. Yet there's still little evidence of a bubble.

A single chart about beer prices can tell you what you need to know about the impact of the European economic crisis on real people.

If history is any guide, expect founder Richard Schulze's offer to buy out Best Buy to be a messy battle.

Here's a snapshot of the eight economic indicators watched by Goldman Sachs' rock star economist, Jim O'Neill.