By: Gerry Sparrow

Stocks were mixed last week as investors parsed market-moving news nearly every trading day—from an unsettling AI update to White House news to Q4 corporate reports.

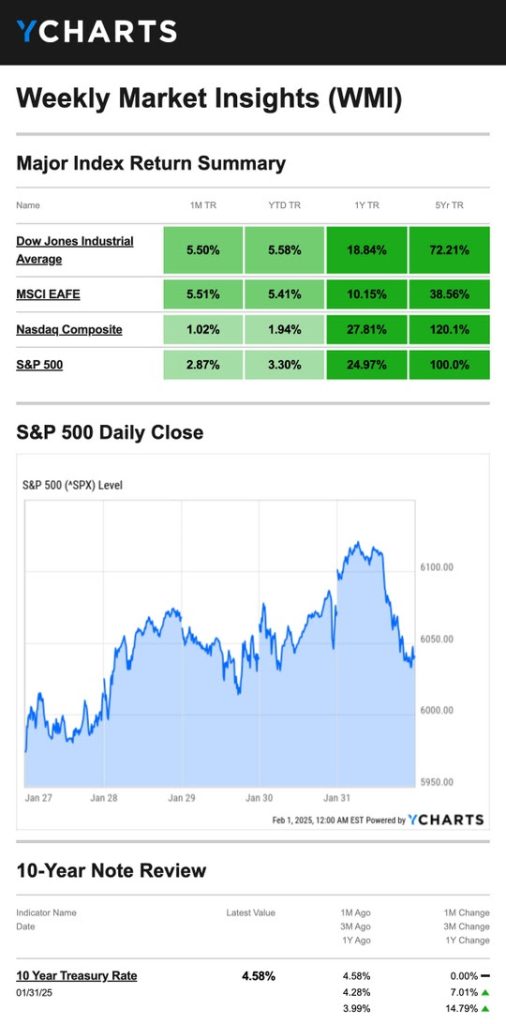

The Standard & Poor’s 500 Index fell 1.00 percent while the Nasdaq Composite Index slid 1.64 percent. Meanwhile, the Dow Jones Industrial Average rose, picking up 0.27 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, added 0.75 percent.1,2

A Choppy End to January

The week started on a down note with news that a Chinese artificial intelligence (AI) startup had made a breakthrough, which put pressure on a wide range of tech stocks. The tech-heavy Nasdaq fell 3 percent for the day, but the Dow Industrials ended the trading session slightly higher.3

Stocks were under pressure again mid-week as investors waited on news from the Federal Reserve. The Fed voted to hold firm on short-term interest rates. Even though the decision was widely expected, markets were under pressure again after the Wednesday afternoon announcement.4

Stocks rallied Thursday but reversed course Friday afternoon as traders adopted a more “risk-averse” position going into the weekend. There was a bit of anxiety knowing that the new administration’s tariffs on Mexico and Canada were scheduled to take effect on Saturday.

Interestingly, it was the Dow Industrial’s fourth-straight week outperforming both the S&P and the Nasdaq.5

Black Swan Event

It’s hard to overstate how much the markets were caught off guard by Monday’s news related to the success of a new AI startup based in China.6

What unsettled investors was the company’s claim that it developed a competitive AI model that performs as well as its Western counterparts at a fraction of the cost. As the week progressed, markets started to process the news and began to evaluate whether it was truly a “black swan” event or just another development in the fast-moving world of AI.6

This Week: Key Economic Data

Monday: ISM Manufacturing. Construction Spending.

Tuesday: Motor Vehicle Sales.

Wednesday: ADP Employment Report. Factory Orders. ISM Services Index. Beige Book.

Thursday: Jobless Claims. International Trade in Goods and Services. Productivity and Costs.

Friday: Employment Situation.

Source: Investors Business Daily – Econoday economic calendar; January 30, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

Originally posted on February 4, 2025

PHOTO CREDIT : https://www.shutterstock.com/g/airborne77

VIA SHUTTERSTOCK

Footnotes and Sources

1. The Wall Street Journal, January 31, 2025

2. Investing.com, January 31, 2025

3. CNBC.com, January 27, 2025

4. The Wall Street Journal, January 29, 2025

5. CNBC.com, January 30, 2025

6. CNBC.com, January 30, 2025

DISCLOSURES:

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.