Kevin Flanagan, Head of Fixed Income Strategy

One of the more unexpected developments this year is that a recession has yet to rear its ugly head. Here we are, approaching three-quarters of the way into 2023, and the totality of economic data arguably continues to confound what was perhaps the most widely anticipated economic downturn on record. With 525 basis points worth of cumulative Federal Reserve rate hikes in the books, the U.S. economy may still not be completely out of the woods, but signs are pointing to another positive performance for third-quarter real gross domestic product (GDP) as well (more on that later).

U.S. Economic Activity Measures

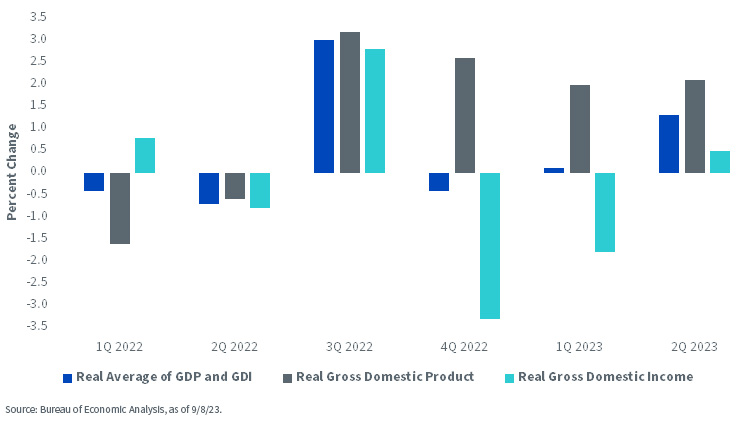

Notably, if you go back to last year, economists were fighting the complete reverse battle. Indeed, real GDP had printed two consecutive negative performances during Q1 and Q2 of 2022, but it seemed as if the narrative was trying to dismiss these readings as not being indicative of a recession, especially because of the solid labor market data setting (sound familiar?).

Back then, we were being told that we should look at an alternate measure of economic growth, gross domestic income (GDI). I blogged on this exact topic in early October of last year and thought it would be intriguing to look at how things have changed almost a year later.

As a refresher, according to the Bureau of Economic Analysis (BEA), GDI is defined as a measure of the incomes earned and the costs incurred in the production of GDP and is another way of measuring economic activity. For the record, GDP measures the value of the final goods and services produced in the U.S. To sum up, GDP calculates economic activity by expenditures, while GDI focuses on the incomes generated during the process. Interestingly, the BEA states that both are “conceptually equal.” While each series can produce different short-term results, they tend to come together over the longer haul.

The above table underscores how the “2023 experience” has essentially been the opposite of last year’s. While real GDP has been enjoying growth of around 2%, GDI has either been negative or just barely positive. However, another way of looking at economic activity is to average real GDP and GDI together, a component the BEA produces as well. Thus far in 2023, this average has produced basically no growth in Q1 (+0.1%) and a more modest 1.3% reading for Q2.

Conclusion

So will the real economy “please stand up?” That brings us to where Q3 activity is. According to consensus forecasts, real GDP for the July–September period is expected to post another 2% performance, but the Atlanta Fed’s GDPNOW gauge has growth surging to 5.6%, as of this writing. Either way, it would appear the recession may have to wait yet again, with all eyes turning to how this year ends and 2024 begins.

This post first appeared on September 13th, 2023 on the WisdomTree blog

PHOTO CREDIT: https://www.shutterstock.com/g/eamesBot

Via SHUTTERSTOCK

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see the prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.